What Robos Do Well: 5 Lessons for Financial Advisors

by Commonwealth Financial Network

As I discussed in yesterday’s post on robo-advisors vs. traditional advisors, my personal belief is that human advisors are indispensable. But in today’s post, I’m going to switch gears a bit to talk about the things that robos do quite well—including what they do better than many human advisors.

As I discussed in yesterday’s post on robo-advisors vs. traditional advisors, my personal belief is that human advisors are indispensable. But in today’s post, I’m going to switch gears a bit to talk about the things that robos do quite well—including what they do better than many human advisors.

Keeping in mind that there are many differences between digital and human advice, I hope these lessons for financial advisors will provide a fresh perspective on the robo phenomenon and help you better compete against these low-cost providers.

You don’t earn the robo moniker without effectively automating tedious tasks that have long been an irritant for both advisors and clients. With robos, account opening, money movement to and from bank accounts, tax loss harvesting, and portfolio rebalancing are all reduced to just a few clicks. This streamlining is their core competency and the foundation of all they do.

What steps can you take to automate your processes? Using model portfolios and developing rebalancing schedules can help. Here at Commonwealth, we've tried to simplify these processes for our advisors. Our Practice 360°® Models application allows advisors to build their own model portfolios or to use ours, and rebalancing can be done with a simple click.

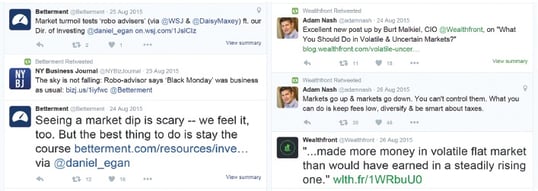

It’s true that robo platforms can’t offer a warm handshake and a cup of coffee while discussing the markets. But this doesn’t mean they’re not effective communicators. Although we have to qualify “effective” as via electronic medium, the fact remains that they’re really good at it.

They are able to deliver missives on a daily basis through multiple channels, including e-mail, blog posts, tweets, and a client-messaging system that allows them to “customize” messages to clients upon logging into their account. As an example of this, the figure below shows how Betterment and Wealthfront delivered messages to their clients during the market volatility of August 2015.

Source:Twitter

What are the most effective ways for you to communicate with your clients? You might be thinking that you can't keep up with robos in terms of how often you send messages to clients. But the lesson here is that you can and should be active on social media. This includes sharing quality content that speaks to your target audience, figuring out which platforms that audience is using (e.g., Facebook, Twitter, LinkedIn), and taking the time to build social media into your overall marketing plan.

The robos just mentioned—Betterment and Wealthfront—have another valuable tool at their disposal: an impressive array of academics. Betterment boasts an Investment Committee with the requisite CFA® and CFP® certifications but also leverages multiple PhDs from the faculty of Columbia University. Wealthfront counters with Burton Malkiel (enough said) and Meir Statman, who is widely recognized as one of the foremost experts on behavioral finance. Further, the content available from both firms is not only voluminous—covering topics across the personal finance spectrum—but also very high quality and likely on par with the content libraries of many established distribution giants.

Where can you find relevant content? Of course, you may not have access to faculty from an Ivy League institution. But you should still provide your clients with relevant content. Your broker/dealer likely has such content that you can customize for your clients. At Commonwealth, advisors have a wealth of resources available via our Four-Corner Marketing tool, including brochures, market commentary, and social media updates. You might also search the websites of well-known outlets to stay abreast of what’s happening in the industry and share relevant content with your clients and other followers. (For example, have you checked out The Independent Market Observer?)

So, who is the target audience for this great content so effectively delivered by robos? Specifically, robos have created an anti-financial services community by catering primarily to a niche of tech-oriented professionals. These folks often have a strong predisposition to believe that a technology-driven solution will offer a superior outcome by minimizing the influence of traditional financial services providers.

How do you appeal to the counterculture community? As an advisor who is part of the independent channel (or one who is thinking of moving there), you have a real advantage over other retail financial advisors that should be promoted. Specifically, since you're not required to hit sales quotas or sell proprietary products, you are able to focus on what matters the most: the individual financial goals of your clients.

Still another lesson here is that although technology is great (and an effective selling point), it’s just part of the equation. Your clients and prospects want technological innovation, to be sure, but they also want a great advisor. They need the wisdom and experience that go beyond an algorithm-based methodology. They want the personal connection, someone who recognizes that financial lives are not data points but real-life situations requiring nuanced interpretation.

The robo strategy also suggests that despite their high fees, human advisors have no answer for market volatility. This logic, deeply rooted in index-based portfolio construction, goes something like this: The best possible investor outcomes will essentially mirror the selected asset class returns, so clients should seek to minimize advisor fees wherever possible. In fact, without any face-to-face human counsel and with few ancillary services to offer, many robo providers are marketing low cost as the most important driver of investment success.

An example of just this strategy came during the market turmoil this past August. Betterment suggested that its clients add money, reduce equity exposure, and revisit their goals. Nothing is inherently wrong with these ideas, except for the fact that the robo has no real idea how those suggestions apply to a specific client situation. Wouldn’t it be great if clients had a trusted advisor with intimate knowledge of their specific financial situation with whom they could have this conversation in person, eye to eye?

So, what can you do if you can't compete on price? You can provide comprehensive financial planning, not just investment management. As a trusted advisor, you offer value in ways a technology solution cannot. You can:

- Use experience and intuition when risk profiling

- Have face-to-face meetings and account-specific reviews

- Effectively manage your clients’ emotions as you guide them through market cycles

- Provide holistic financial planning, meeting an array of needs across the financial planning spectrum

Simply put, in terms of service and personalization, robos just don’t compete.

The goal of robos is to have consumers believe that investing and even saving for retirement are so simple they can be completely automated. In fact, robo-advisors can be a fine solution. But let’s be clear about what type of solution this is: a DIY solution. Their content is decidedly devoid of personalized advice.

There is no question in my mind that robo advice will find a niche and capably support a specific segment of investors. I think many would agree, however, that the cost of failure when saving for retirement is simply too high to trust entirely to a low-cost provider that is primarily focused on disruption rather than client relationships.

Have you automated your processes through the use of model portfolios or rebalancing schedules? How do you compete with low-cost providers? Please share your thoughts with us below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network