by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

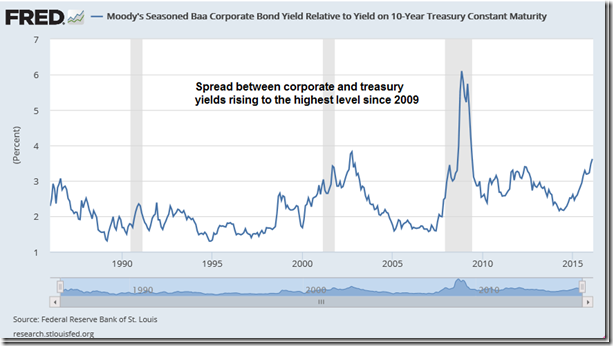

Spread between corporate and treasury yields hitting the highest level since 2009.

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $FOXA, $FOX, $OMC, $CL, $CCI, $CMA, $HUM, $BCR, $FISV, $YHOO, $FCX, $PPG. No breakdowns.

Editor’s Note: Another 8 stocks broke resistance after 10:15: ALLE, KO, LYB, MAC, PEG PHM, QCOM, TJX

Nice breakout by $SPY above $194.58 to complete a double bottom base building pattern.

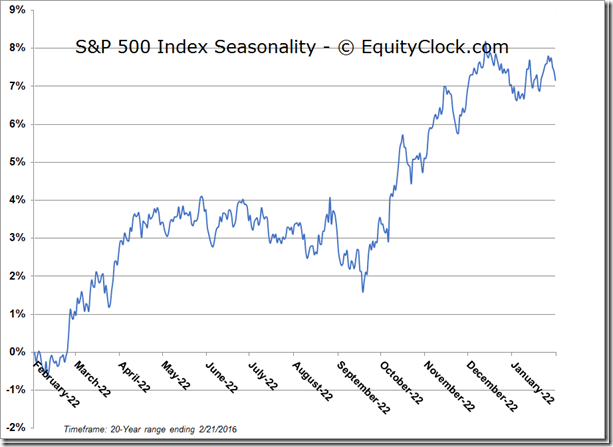

‘Tis the season for the S&P 500 Index to move higher until near the end of May.

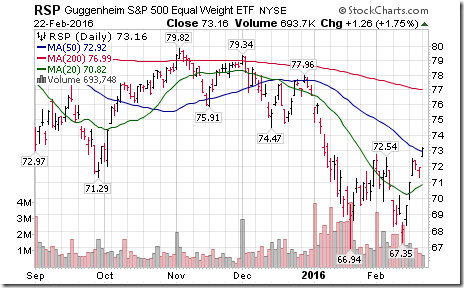

Nice breakout by the equally weighted S&P 500 ETF $RSP above $72.54 to complete a base building pattern.

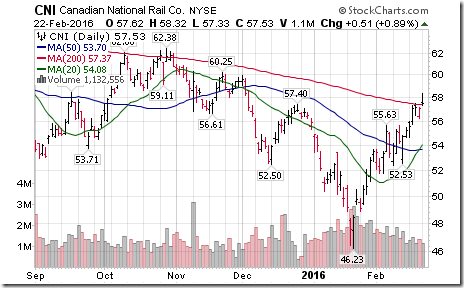

Nice breakout by Cdn. National Railways $CNI $CNR.CA above $57.40 to extend an intermediate uptrend.

‘Tis the season for $CNI to move higher to early May.

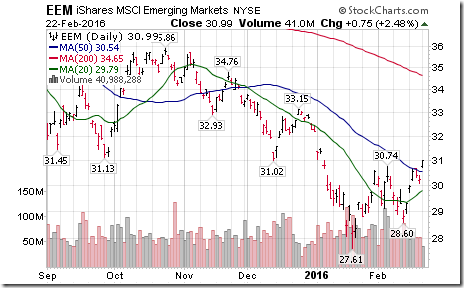

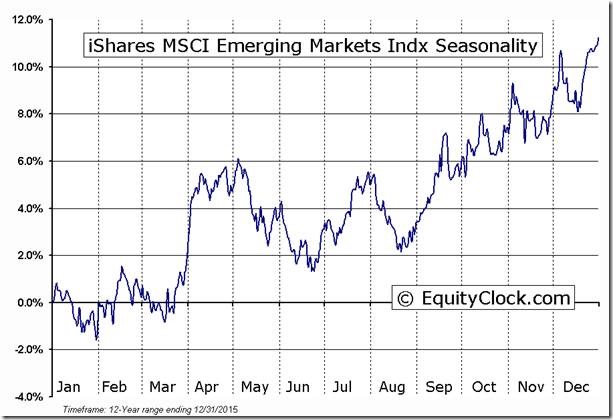

Nice breakout by iShares Emerging Markets $EEM above $30.74 to complete a base building pattern!

‘Tis the season for Emerging Markets to move higher to early May!

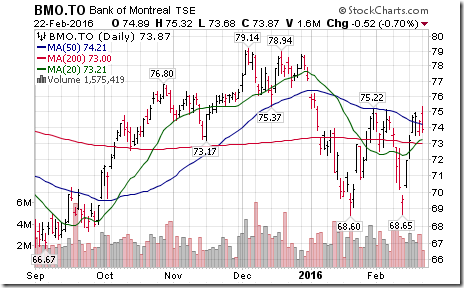

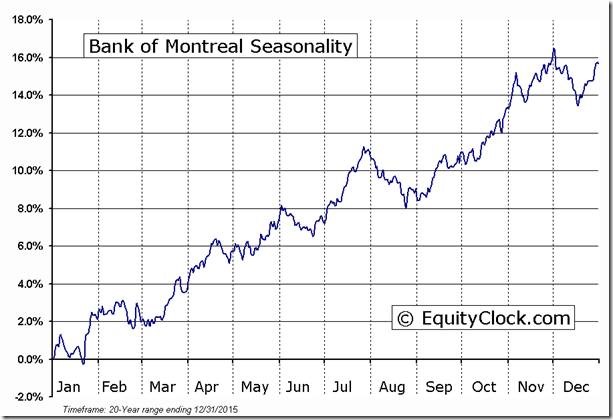

Encouraging breakout by $BMO.CA above $75.22 to complete base pattern prior to release of Q1 results tomorrow! $BMO

‘Tis the season for $BMO.CA $BMO to move higher until the end of May!

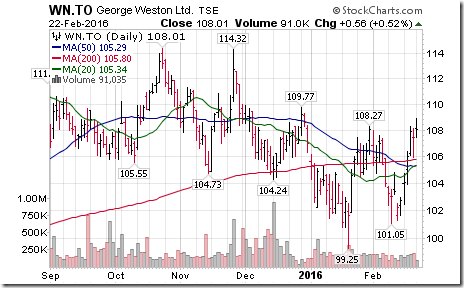

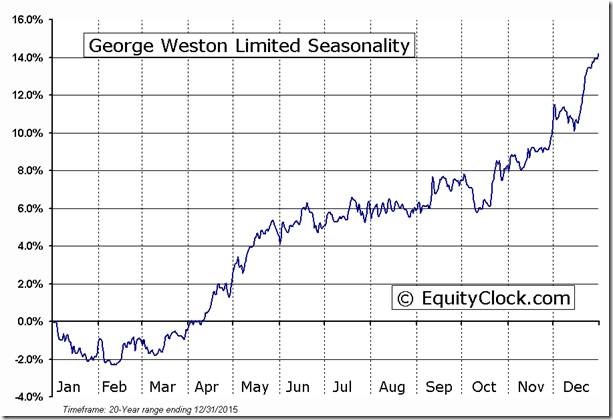

Nice breakout by George Weston $WN.CA above $108.27 to resume an intermediate uptrend!

‘Tis the season for George Weston to move higher until mid-June!

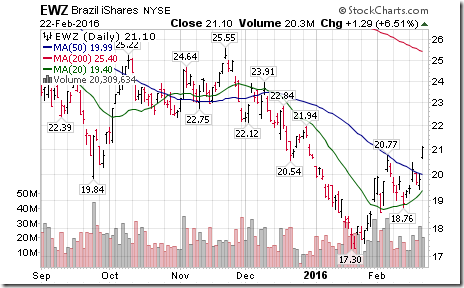

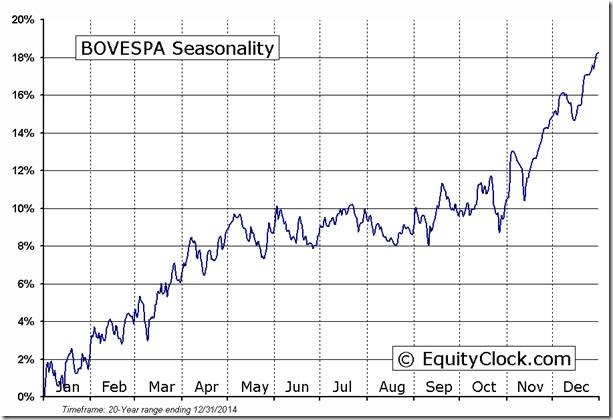

Nice breakout by Brazil iShares $EWZ above $20.77 to complete a base building pattern!

‘Tis the season for Brazil’s Bovespa to move higher to early May! Olympic game beneficiary?

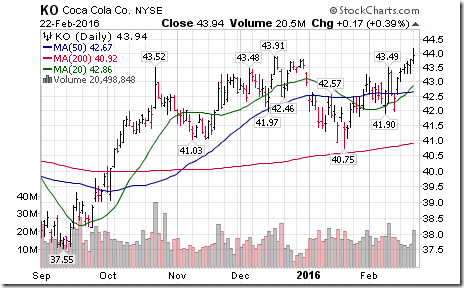

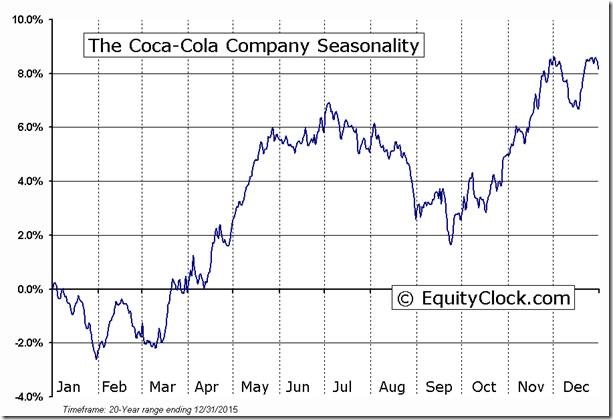

Nice breakout by Coca Cola above $43.91 to an all-time high! $KO.

‘Tis the season for strength in Coca Cola $KO until the end of May!

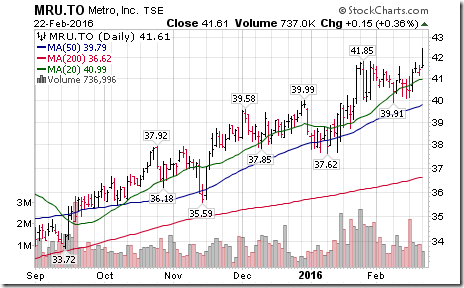

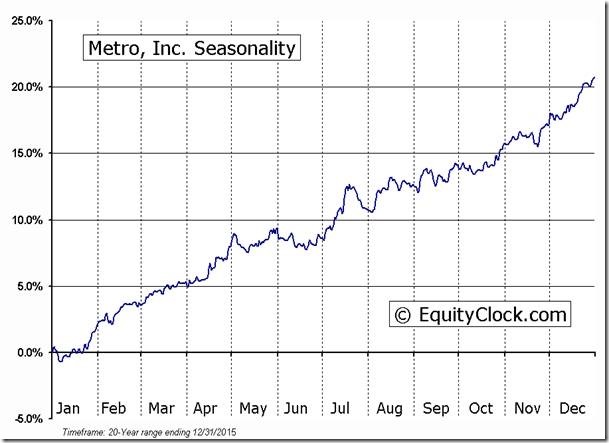

Nice breakout by Metro $MRU.CA above $41.85 to reach an all-time high!

‘Tis the season for strength in Metro $MRU.CA to the beginning of May!

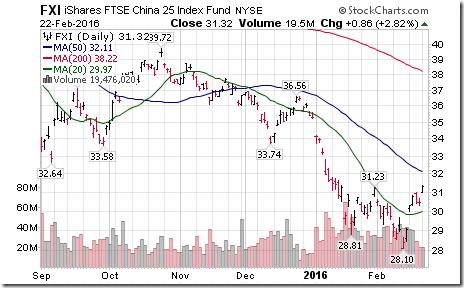

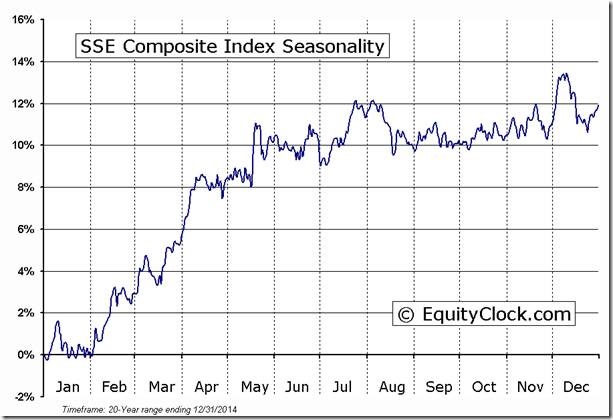

Commodity equity prices are responding to strength in Chinese equity ETFs. $FXI

‘Tis the season for strength in Chinese equity markets until mid-May! $FXI

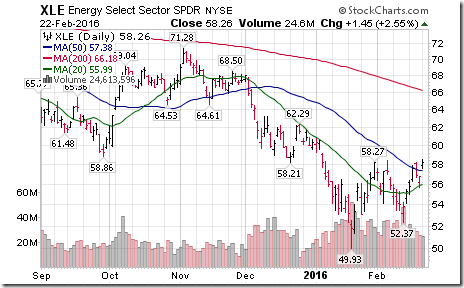

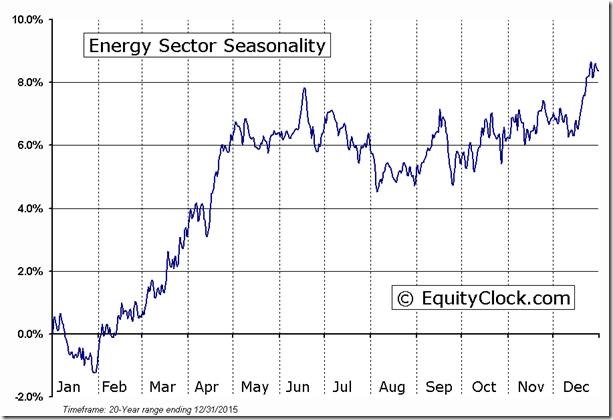

Nice breakout by Energy SPDRs above $58.27 to complete a base building pattern! $XLE

‘Tis the season for strength in U.S. Energy equities and ETFs until at least early May.

Trader’s Corner

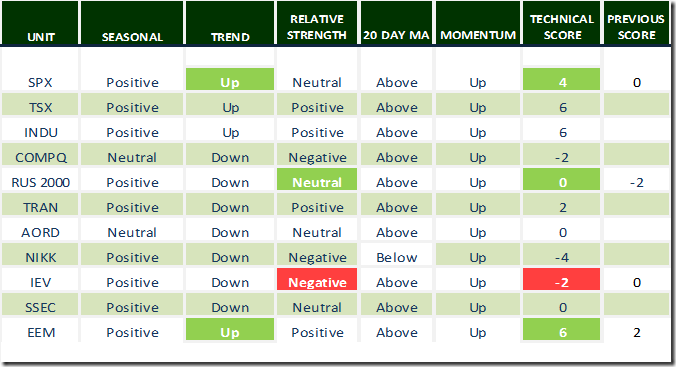

Daily Seasonal/Technical Equity Trends for February 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

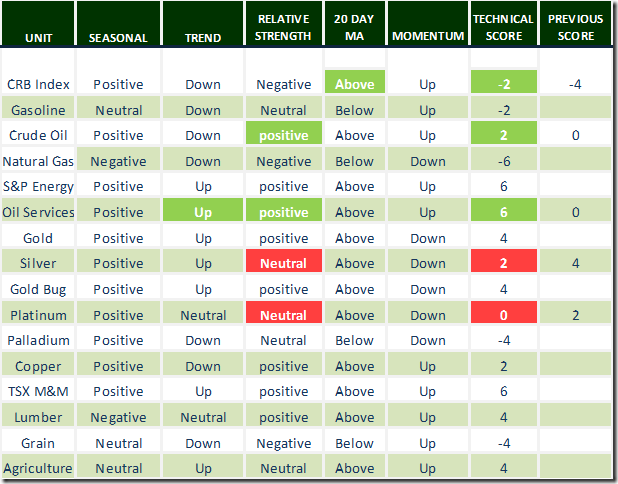

Daily Seasonal/Technical Commodities Trends for February 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

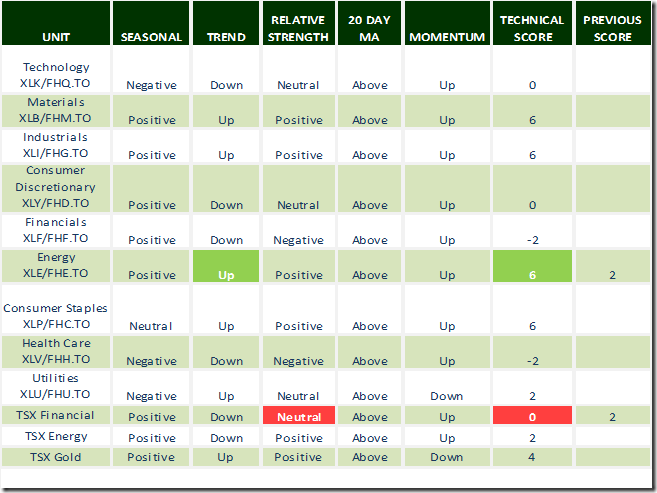

Daily Seasonal/Technical Sector Trends for February 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts with Increasing Technical Scores

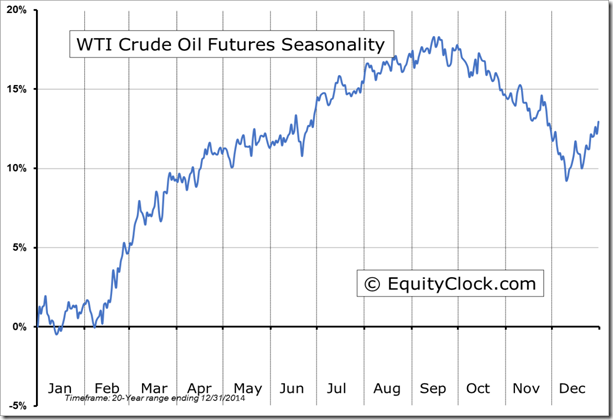

Technical score for Crude Oil improved to 2 from 0 when it started to outperform the S&P 500 Index

‘Tis the season for Crude Oil to move higher into Summer!

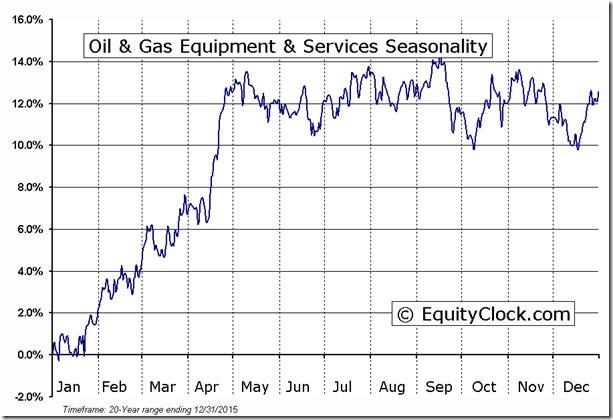

Technical score for the U.S. Oil Services sector improved to 6 from 0 when the Index moved above 6 from 0. Trend changed to up on a move above a base building pattern. Strength relative to the S&P 500 Index turned positive.

‘Tis the season for the sector to move higher to mid-May!

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Self Analysis for Traders

By Adrienne Toghraie, Trader’s Success Coach

There are many lessons I have learned over the years from traders. One that I would like to highlight is that new traders do not effectively analyze themselves along the way. Even if a trader thinks that he has learned everything he can from a top level trading teacher, he has not had the everyday experiences that it took for that teacher to develop his skills to become a successful trader.

To be more effective in reaching each new level of success, a trader must be willing to admit to himself that he is not always the best analyzer of what he has to do to improve his trading. A trader could admit to himself and others that he is not consistent; he does not take as much risk as he should, but misses other vital pieces that keep him from growing.

Afraid of success

Barry was a dedicated trading student who followed the rules of one of the best trading teachers available. He knew that he did not always follow his rules and consequently did not make the profits that were available to earn with his strategy.

When Barry did his periodic reviews, he thought he was being as honest as possible in his own analysis of himself. It was not because Barry did not want to face the truth; he did not know what the truth was for his not being able to follow his rules.

When I did my Evaluation of Barry, I found that his chief issue was fear of success. This did not compute with Barry until we delved deeper into his history. Barry’s father was a blue-collar worker who always complained about the big boss and all his wealth. Young Barry saw that his father suffered by not being able to give the family more then a meager lifestyle. He would hear his father say, “Those rich people might have a lot of stuff, but they don’t have integrity and happiness.”

So why would Barry ever want to be one of those people?

Change means suffering

Arnold learned his trading skills from his uncle who was in the S & P pit almost from its inception. He had a good run as a trader for earning top profits. When everything started to go electronic, Arnold fought it every step of the way. He did not consider the fact that when he was a young boy his family moved 21 times before he was 12 years old. Each change was painful, because it meant making new friends only to lose them.

Arnold fought the change until he had to give up trading. For two years he was an unhappy man in and early retirement. Fortunately, he met one of his old trading buddies at a coffee shop who was now trading successfully on a computer. He took Arnold under his wing and now Arnold is happy as a computer trader. What convinced Arnold was the fact that his friend told him about the way he struggled with change. Arnold related to him without considering his past experience. Perhaps, Arnold needed that 2 years off, or perhaps he could have made that transition sooner if he understood, acknowledged and worked through his problem.

Delusional people

You only need to watch programs like American Idol or So You Think You Can Dance to see how delusional people can be about their abilities and talents. Just because they are passionate, have an overwhelming belief and have a fan base of friends and family who think they are talented, does not mean so in the real world. This is also true about traders with little training or those with self-sabotage issues who keep themselves in the dark and see themselves as the next top trader.

Conclusion

It is a good thing to believe in yourself and your ability, but if you are not producing the profits that your strategy will allow, then there is something wrong. You must ask yourself, “How long am I willing to wait to make the profits I deserve?” Then seek out the help you need when you are ready to face the real issues.

Free Webinars Presented by Adrienne Toghraie

Email for Details – Adrienne@TradingOnTarget.com

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca