Brooke Thackray's Market Letter - February 2016

by Brooke Thackray, AlphaMountain Investments

February 10, 2015

Let’s not kid ourselves. The stock market has not been behaving well, and technically it is not strong. It is oversold, but it could be that way for long time. A few weeks ago I was watching the ticker screen and noticed that the S&P/TSX Composite printed 11,600. I recalled that this was the same value of the S&P/TSX Composite on the day that HAC was launched on November 19th, 2009. In other words, the Canadian market had done a round trip in six and half years. Fortunately, HAC was solidly in the green, starting at $10 and currently trading above $15.

The stock market has been defanged. Jim Cramer of CNBC developed the acronym FANG (Face Book, Amazon, Netfl ix and Google) in order to show the lack of breadth in the overall stock market. These four stocks have been the darlings that everyone has favored over the last few years. Until recently, it seems that even when the stock market would trend down, the FANG stocks would still perform well. The market breadth in the U.S. stock market has been getting narrower over time and the FANG stocks still managed to hold up. Over the last two weeks, FANG stocks have started to underperform.

The FANG stocks remind me of the Nifty-Fifty in the early 1970’s. At the time, everyone kept piling into the Nifty-Fifty stocks believing that even if the stock market went down, these fi fty large cap blue chip stocks would hold their value. The names in the Nifty-Fifty included many companies that investors would recognize today, such as IBM, Johnson & Johnson and McDonalds. It also included companies that have struggled and even have gone bankrupt over time, such as, Polaroid and Eastman Kodak. The point is that when these stocks fi nally did start to correct, it was the start of a bear market.

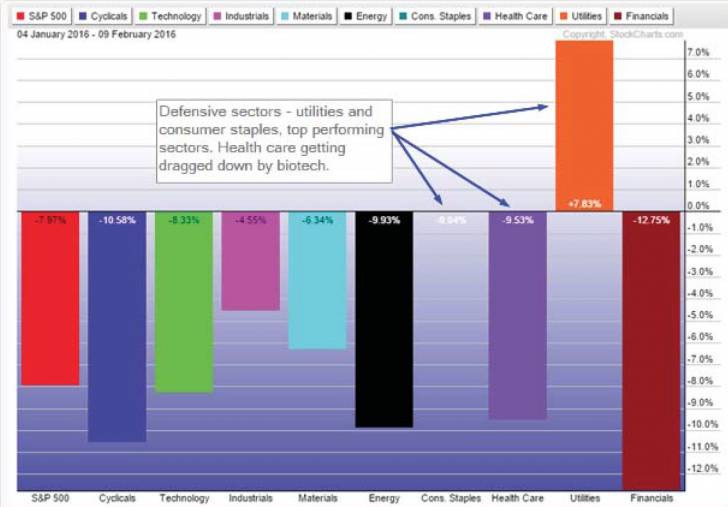

underperform the stock market. That is not the case this

year, as they are the leaders. The utilities sector

has been the strongest sector of this year, followed by

consumer staples. Health care has been negative with the market,

mainly because the biotech sector has dropped precipitously.

I am not saying that we are starting a bear market, but when the top performing stocks start to underperform…it is a concern. What would make me feel much better is if the FANG stocks started to become market leaders once again.

Typically at this time of the year the defensive sectors underperform the stock market. That is not the case this year, as they are the leaders. The utilities sector has been the strongest sector of this year, followed by consumer staples. Health care has been negative with the market, mainly because the biotech sector has dropped precipitously.

From an overall market perspective is typically expected that the defensive sectors will outperform when the market is correcting. Investors seek safety and more stable earnings when the market is in turmoil. If the market is able to stabilize and improve and the defensive sectors continue to outperform this will be sending a signal that the market is internally weak. When this happens it is the result of investors wanting to still be in the stock market but are scared to take risk. In this scenario it will mean the market and is likely to have another correction. I will endeavor to track this relationship over the next few months in my newsletters.

Read/Download the full report below:

Thackray Newsletter 2016 02 February

Copyright © AlphaMountain Investments