by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday

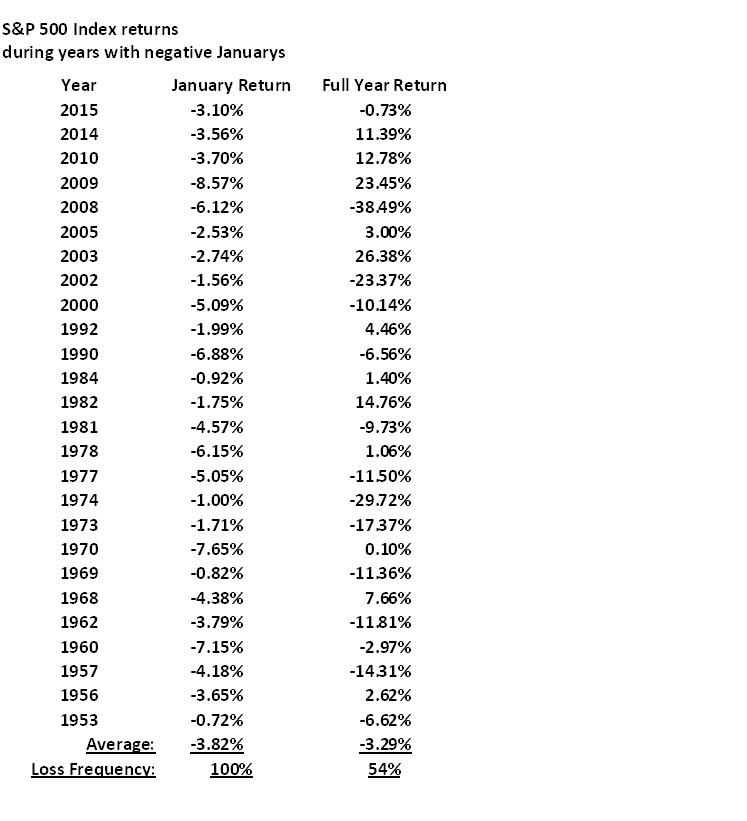

January barometer is very poor predictor of equity performance following losses in the first month of the year.

Technical action by S&P 500 stocks to 10:15: Quiet. Breakouts: $DLTR, $FLIR. Breakdown: $CF

Editor’s Note: After 10:15 AM, technical action by S&P 500 stocks quietly bearish. Breakouts included PCLN and HCP. Breakdowns included TRIP, NE, RIG, ITW and SWK.

Trader’s Corner

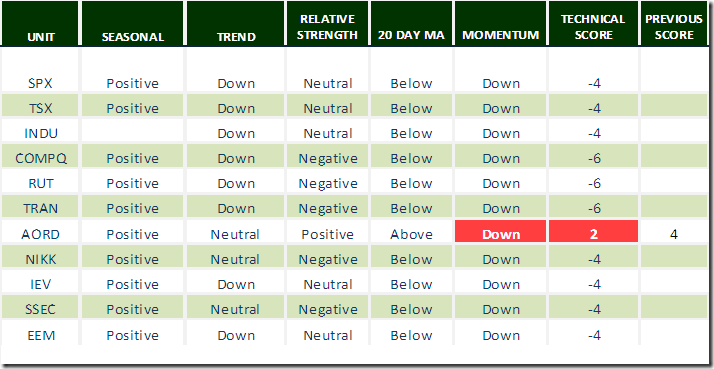

Daily Seasonal/Technical Equity Trends for January 5th 2016

Green: Increase from previous day

Red: Decrease from previous day

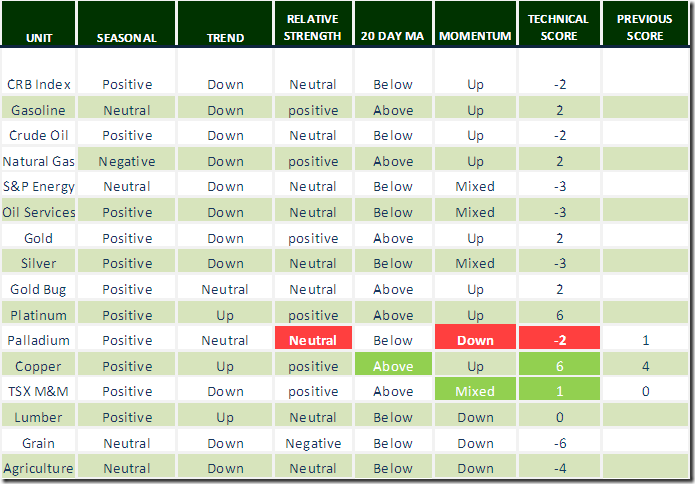

Daily Seasonal/Technical Commodities Trends for January 5th 2016

Green: Increase from previous day

Red: Decrease from previous day

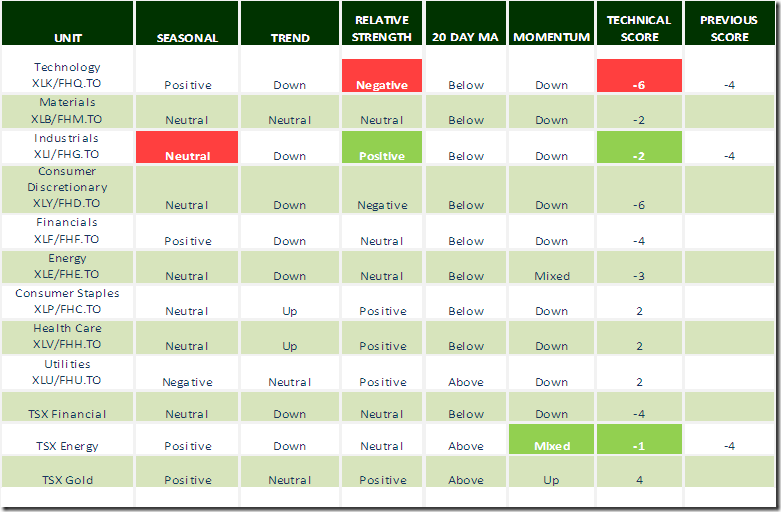

Daily Seasonal/Technical Sector Trends for January 5th 2016

Green: Increase from previous day

Red: Decrease from previous day

A Study on the Base Metal Sector

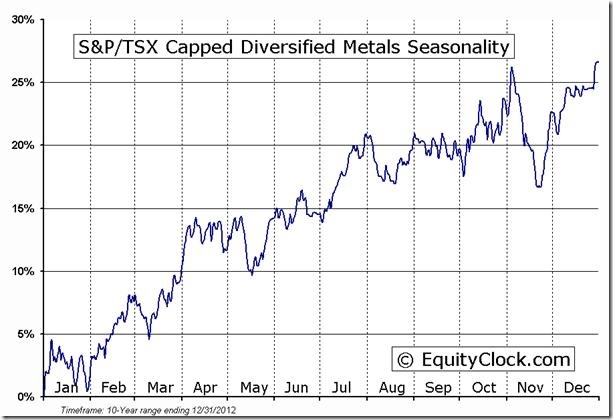

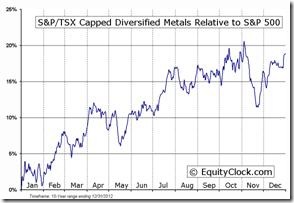

Seasonal and technical analysis shows that now is an interesting time to invest in the base metal sector, particularly in Canadian base metal stocks.

Sweet spot for the sector is from mid-December 14th to April 10th. The TSX Metals & Mining Index since its launch 13 years ago gained an average of 9.8% per period. Frequency of gains was 10 out of the past 13 periods. About 65% of the gains were recorded between mid-December and start of the annual Toronto Prospectors and Developers Conference at the beginning of March. This year, the Conference is held from March 6th to March 9th.

Favourable seasonal influences starting in mid-December 2015 arrived in dramatic fashion. The sector was deeply oversold partially due to tax loss selling pressures and was set up from a significant recovery. Indeed, the TSX Metals and Minerals Index rose from a low of 295.54 on December 17th to a high of 380.25 on December 23rd, a gain of 28.7%. Subsequently, the Index dropped to 350. 65. A base building pattern appears to be developing. The Index already is outperforming the S&P 500 Index and TSX Composite, a positive technical sign at the beginning of a period of seasonal strength.

The sector is starting to respond to a bottoming of metal prices:

Exchange Traded Funds that are candidates for a seasonal trade include BMO Equally Weighted Global Metals and Mining ETF (ZMT.TO $5.90) and iShares S&P/TSX Metals and Mining Index ETF (XBM.TO $7.42). Another way to own the sector is to own a basket of base metal stocks that currently are outperforming the S&P 500 Index including Alcoa, Lundin Mining, First Quantum Minerals, Southern Copper and HudBay Mining

A caveat to the seasonal trade! Fourth quarter earnings by all of these companies to be released near the end of January will show significant year-over-year declines. Preferred strategy is to accumulate ETFs and individual equities on weakness prior to release of difficult fourth quarter reports.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca