by Don Vialoux, Timingthemarket.ca

Another Milestone

StockTwits followers @EquityClock continues to grow and now exceed 15,000. Last milestone at 14,000 followers was celebrated by Tech Talk on November 18th

Economic News This Week

October Case/Shiller 20 City Home Price Index to be released at 9:00 AM EST on Tuesday is expected to increase year-over-year at 5.4% versus 5.5% in September.

December Consumer Confidence to be released at 10:00 AM EST on Tuesday is expected to increase to 93.5 from 90.4 in November.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday is expected to increase to 270,000 from 267,000 last week.

December Chicago Purchasing Managers Index to be released at 9:45 AM EST on Thursday is expected to recover to 50.1 from 48.7 in November.

Earnings News This Week

Nil

The Bottom Line

The classic Santa Claus rally from December 15th to January 6th is expected to continue this week. Primary sectors with positive seasonality at this time of year that will most benefit are Materials, Financials, Industrials and Technology. Subsectors with positive seasonality include and improving technical prospects include Biotech, Semiconductors, Medical Devices, Home Builders, Forest Products and Aerospace & Defense. Commodities with positive seasonality and improving technical prospects include Silver, Platinum and Palladium. Bonus events that are unique during the current Santa Claus rally period include an intermediate peak in the U.S. Dollar Index, a positive impact on equity markets of an El Nino weather event and anticipation of a return to earnings and revenue growth beyond the release of difficult fourth quarter results. The stage is set for continuation of strength in North American equity markets until at least January 6th and possibly until the end of February.

Equity Indices

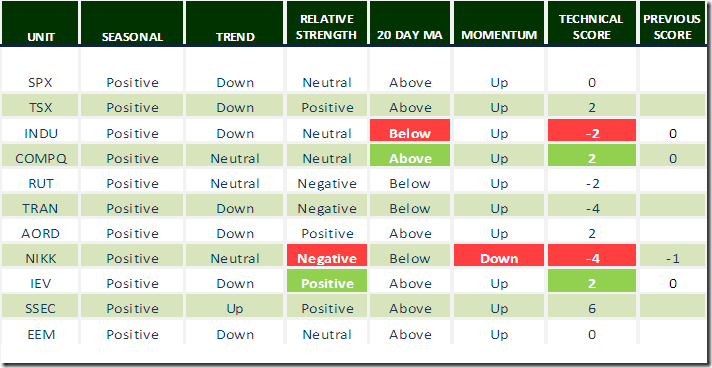

Daily Seasonal/Technical Equity Trends for December 24th 2015

Green: Increase from previous day

Red: Decrease from previous day

The S&P 500 Index gained 55.44 points (2.76%) last week. Intermediate trend remains down. The Index moved last week moved above its 20 day moving average. Short term momentum indicators are trending up.

Percent of S&P 500 stocks increased last week to 51.80% from 26.20%. Percent is recovering from an intermediate oversold level.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 48.00% from 40.00%. Percent is recovering from an intermediate oversold level.

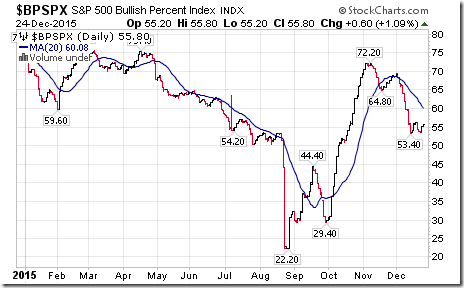

Bullish Percent Index for S&P 500 stocks improved last week to 55.80% from 54.40% and remained below its 20 day moving average. The Index has moved sideways during the past month.

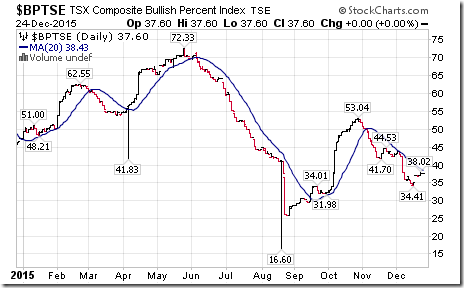

Bullish Percent Index for TSX stocks increased last week to37.60% from 36.78% and remains below its 20 day moving average.

The TSX Composite Index gained 285.50 points (2.19%) last week. Intermediate trend remains down (Score:-2). Strength relative to the S&P 500 Index remains positive (Score: 2). The Index moved above its 20 day moving average last week (Score: 1). Short term momentum indicators are trending up (Score: 1). Technical score improved last week to 2 from 0.

Percent of TSX stocks trading above their 50 day moving average increase last week to 42.98% from 32.33%. Percent continues to trend higher from an intermediate low

Percent of TSX stocks trading above their 200 day moving average increased last week to 30.17% from 28.10%. Percent continues to recover from an intermediate low.

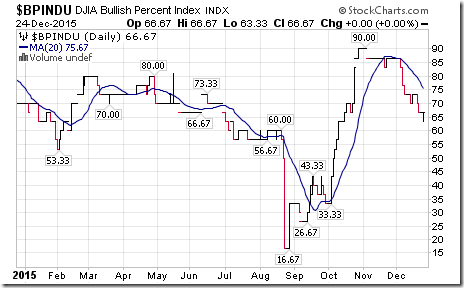

The Dow Jones Industrial Average added 423.62 points (2.47%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed last week to Neutral from Positive. The Average slipped back below its 20 day moving average last week. Short term momentum indicators are trending up. Technical score slipped last week to -2 from 1.

Bullish Percent Index for Dow Jones Industrial Average stocks slipped last week to 66.67% from 70.00% and remained below its 20 day moving average. The Index continues to trend down.

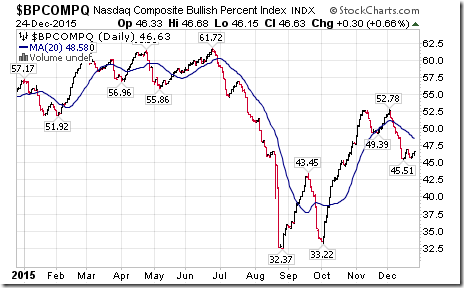

Bullish Percent Index for NASDAQ Composite stocks increased last week to 46.63% from 46.42% and remained below its 20 day moving average.

The NASDAQ Composite Index gained 125.41 points (2.55%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Neutral. The Index moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2.0 from -1

The Russell 2000 Index gained 33.74 points (3.01%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at -2.

The Dow Jones Transportation Average added 258.57 points (3.51%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Negative. The Average remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -4 from -6.

The Australia All Ordinaries Composite Index improved 99.60 points (1.93%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Positive. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0.

The Nikkei Average dropped 197.11 points (1.04%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index changed to Negative from Neutral. Short term momentum indicators are trending down. Technical score dropped last week to -4 from -1.

Europe 350 iShares gained $1.09 (2.74%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Positive from Neutral. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -5.

The Shanghai Composite Index gained 33.53 points (0.94%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought. Technical score remained at 6.

Emerging Markets iShares gained $0.35 (1.07%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 0 from -2.

Currencies

The U.S. Dollar Index slipped 0.70 (0.71%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators remain mixed. An intermediate high reached four weeks ago has been confirmed

The Euro gained 0.97 (0.89) last week. Intermediate trend remains down. The Euro remains above its 20 day moving average. Short term momentum indicators are mixed.

The Canadian Dollar added US 0.51 cents (0.72%) last week, effectively mirroring the U.S. Dollar Index. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen gained 0.66 (0.80%) last week. Intermediate trend remains down. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up.

Commodities

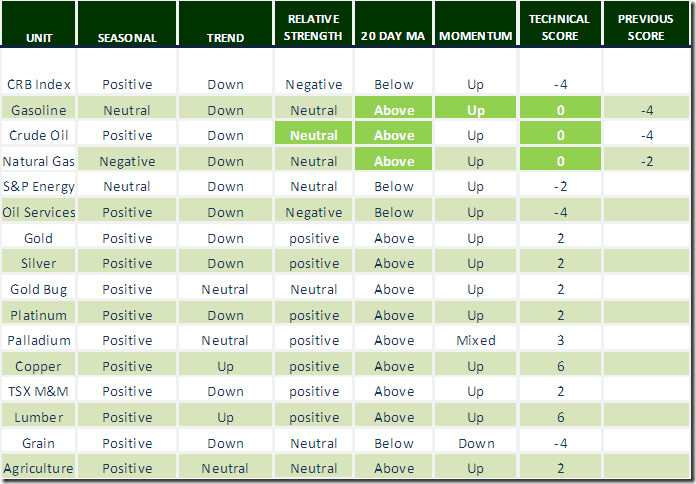

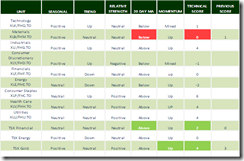

Daily Seasonal/Technical Commodities Trends for December 24th 2015

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index gained 3.93 points (2.28%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to -4 from -6

Gasoline added $0.01 per gallon (0.08%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Neutral. Gas moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to -2 from -3.

Crude Oil gained $2.04 per barrel (5.66) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to Neutral from Negative. Crude moved above its 20 day moving average on Thursday. Short term momentum indicators are trending up. Technical score improved to 0 from -4.

Natural Gas jumped $0.31 per MBtu (17.51%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to Neutral from Negative. “Natty” moved above its 20 day moving average on Thursday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -6.

The S&P Energy Index gained 20.21 points (4.61%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to Neutral from Negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -2 from -5.

The Philadelphia Oil Services Index gained 10.04 points (6.56%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to -4 from -6.

Gold gained $10.90 (1.03%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Positive. Gold moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -1

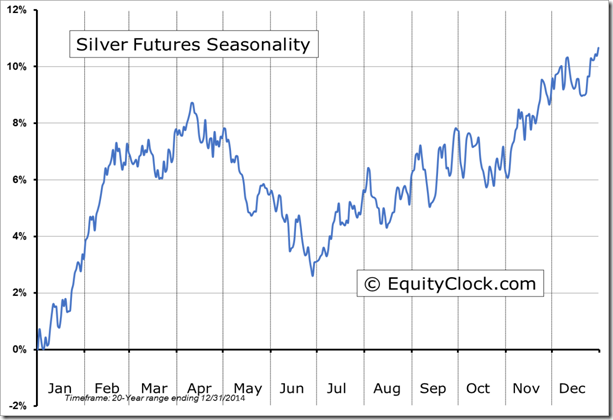

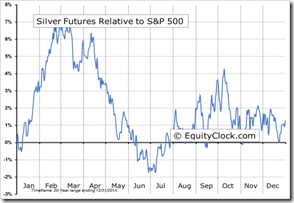

Silver jumped $0.28 per ounce (1.99%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains Positive. Silver remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2. Strength relative to Gold remains Neutral.

The AMEX Gold Bug Index gained 7.49 points (6.86%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0. Strength relative to Gold turned Positive.

Platinum gained $23.40 per ounce (2.72%) last week. Intermediate trend remains down. Relative strength remains positive. PLAT remains above its 20 day MA. Momentum trend: Up.

Palladium gained $0.30 per ounce (0.05%) last week. Trend remains Neutral. Strength relative to the S&P 500 Index remains Positive. PALL remains above its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped to 3 from 4.

Copper added $0.01 per lb. (0.47%) last week. Intermediate trend changed to Up from Down. Strength relative to the S&P 500 Index remains Positive. Copper remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 1.

The TSX Metals & Mining Index jumped 51.51 points (16.06 %) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned Positive from Negative. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 2 from -4.

Lumber slipped $1.90 (0.71%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains Positive. Momentum indicators are trending up. Technical score: 6

The Grain ETN lost $1.90 (0.71%) last week. Trend remains down. Relative strength changed to Neutral. Units fell below their 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to -4 from 1.

The Agriculture ETF added $0.07 (0.15%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index remains Neutral. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -1.

Interest Rates

Yield on 10 year Treasuries added 4.4 basis points (2.00%) last week. Intermediate trend remains up. Short term momentum indicators are mixed. Yield moved above its 20 day moving average.

Conversely, price of the long term Treasury ETF slipped $1.40 (1.16%) last week. Units remain above their 20 day moving average.

Other Issues

The VIX Index plunged 4.96 (23.96%) last week. Intermediate trend remains up. The Index dropped below its 20 day moving average.

Santa Claus has been kind this year. The Santa Claus rally period from December 15th to January 6th is expected to continue. The end of tax loss selling pressures is positive for sectors that have been hit hard during the first half of December (e.g. base metal, precious metal and energy stocks).

Technical action by individual S&P 500 equities was bullish last week with 27 stocks breaking resistance and 4 stocks breaking support. Look for technical action this week to remain positive in quiet trade.

The Canadian equity market is closed today for Boxing Day holiday.

Economic news this week is quiet, but mildly positive.

Earnings news this week is non-existent

The El Nino effect on equity markets is expected to be positive until at least the end of February.

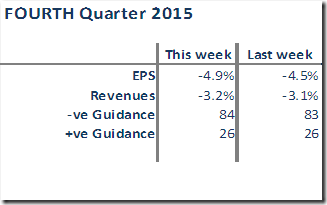

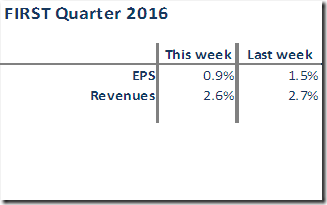

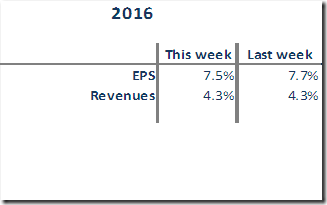

According to FactSet, consensus estimates for S&P 500 companies continue to move lower:

Question: When will investors begin to anticipate gains by earnings and revenues following their current fourth quarter downtrend? Probably when difficult fourth quarter reports are released in late January accompanied by positive guidance!

Sectors

Daily Seasonal/Technical Sector Trends for December 24th 2015

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Editor’s Note: Silver stocks are starting to respond to higher silver prices. Nice breakout on Thursday by First Majestic!

StockTwits Released on Thursday @EquityClock

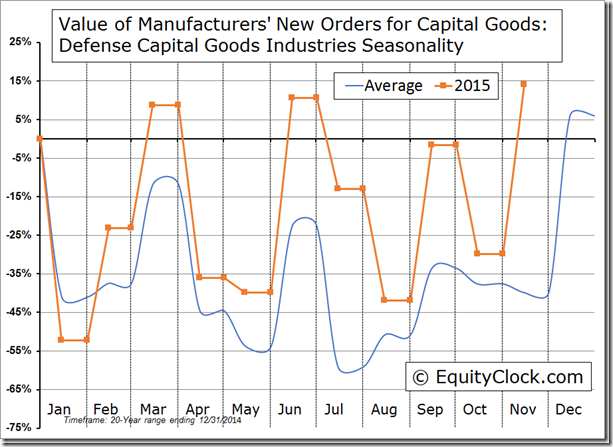

Strength in Defense spending masking weakness in other components of Durable Goods Orders.

Editor’s Note: Aerospace & Defense stocks and relative ETFs continue to outperform the S&P 500 Index.

Technical action by S&P 500 stocks by 10:15 AM: Quiet. Breakout: $IPG. No breakdowns.

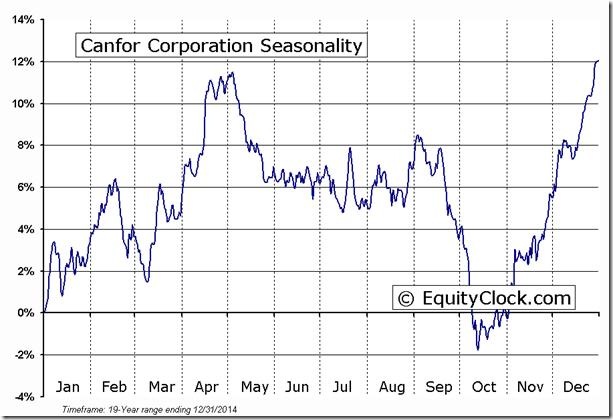

Nice breakout by Canfor $CFP.CA above resistance at $21.19 to extend an intermediate uptrend!

‘Tis the season for Canfor $CFP.CA to move higher until mid-April!

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca