The Absence of Bad News is Good News

by Scott GrannisOver the past 5 years or so, the price of oil has tumbled by two-thirds, gold is down over 40%, non-energy commodity prices are down 40%, and industrial commodity prices have fallen by one-third. Over the same period, Chinese economic growth has slowed from 12% to less than 7%, most industrialized economies have experienced persistently weak growth, and inflation has been relatively low and curiously resistant to central banks' efforts to boost it.

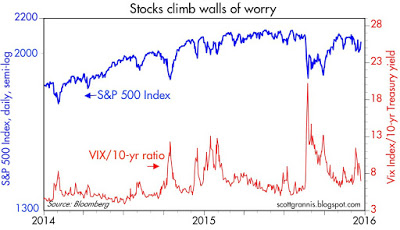

Many have looked at these facts and have concluded that the world is caught up in a deflationary death spiral. Bearish fever is alive and well, but it is countered by evidence that the economy continues to grow. As I've said many times before, when sentiment is braced for deflation and recession, all that matters is avoiding recession. This line of inquiry isn't very exciting, however, and that's one reason blogging on this site has been light of late. Nothing much has changed: the economy shows every sign of continuing to grow at a relatively disappointingly slow pace. The important thing nevertheless is that there is no sign of recession, deterioration, or deflation, and that's good news.

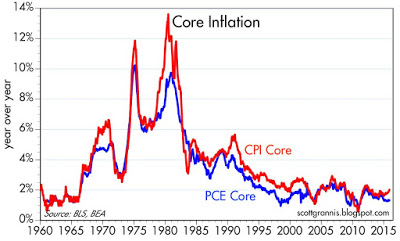

If ever it made sense to pay more attention to core inflation rather than headline inflation, it's now, given the magnitude of the collapse of oil prices over the past year or so. Headline inflation has been hugging zero for most of the past year, but core inflation has been averaging 1.6 - 2.0% for the past 10 years. In the 12 months ended November, PCE Core inflation was 1.33%, while CPI Core inflation was 2.02%. As the chart above shows, these two measures of inflation closely track each other over time, with the PCE Core tending to be about 40-50 bps lower than the CPI. The message here is that inflation has been relatively low and stable for a long time, with not even a hint of deflation in recent years or months. The fact that the Core PCE deflator measure of inflation is somewhat lower than the Fed's current 2% target is not troubling in the least, in my opinion.

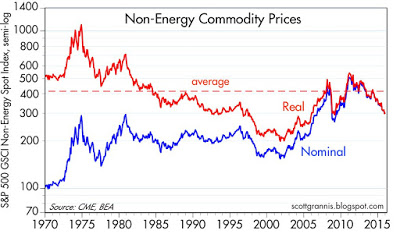

The chart above focuses on non-energy commodity prices, in both real and nominal terms. In real terms, non-energy commodity prices today are about 27% below their long-term average, but 50% above their all-time lows of late 2001. Commodity prices have fluctuated significantly over the past several decades, and their recent "plunge" is hardly unprecedented. In nominal terms, commodity prices today are still double what they were in late 2001. Message: business as usual. Plus, the recent downturn in commodity prices likely has much more to do with increased supplies than with any deflationary error on the part of the Fed. As such, lower commodity prices are good news for commodity consumers, since they free up money for other expenditures.

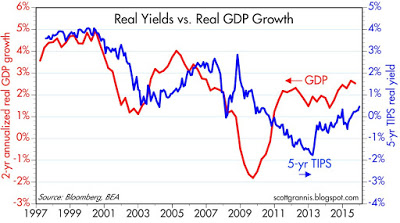

The commodity markets may be struggling, but the bond market is more sanguine. Real yields on 5-yr TIPS—arguably a good proxy for the market's perception of the economy's underlying growth potential—have risen from a low of -1.8% in early 2013 to almost 0.5% today. I note that this increase in real yields has tended to track an improvement in the economy's growth rate over the same period. Growth expectations are still modest, but they are improving on the margin, and not deteriorating.

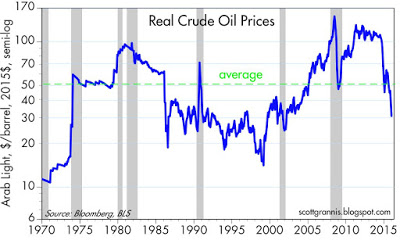

As for oil prices, in real terms (see chart above) they are only about 30% below their long term average. In real terms, oil prices today are about the same order of magnitude as they were in the 80s and 90s, when the economy enjoyed generally robust growth. Thank goodness for a return to relatively cheap energy.

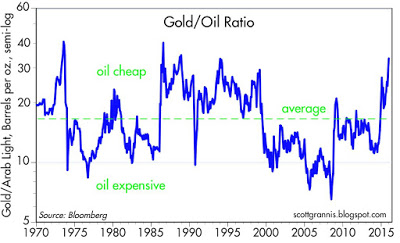

As the chart above shows, when we compare oil to gold, oil looks very cheap today. It's rarely been this cheap compared to gold.

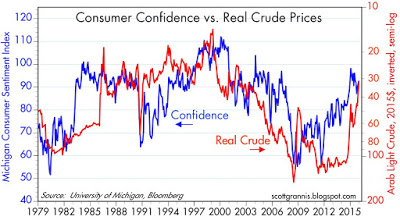

The chart above compares the real price of oil (inverted) to a measure of consumer confidence. Cheaper oil in the past year has helped boost consumer confidence considerably.

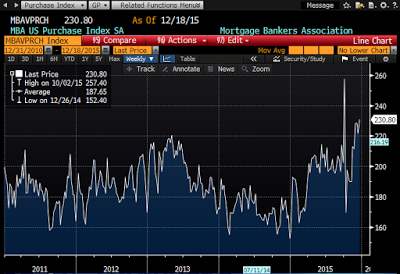

Today saw further proof that the housing market continues to firm: new applications for mortgages are now 35% above what they averaged in the latter half of last year. (This also confirms that the unexpected weakness in existing home sales reported yesterday was another artifact of a change in regulatory requirements that lengthened the closing process, not actual weakness.)

November capital goods orders confirmed that business investment remains lackluster, and this is a good reason why the economy continues to grow at a sluggish pace. But while the news was not optimistic, neither did it show any sign of deterioration. That's the important news.

And so the market continues to climb walls of worry. Worries abound (e.g., deflation, commodity collapse, Fed tightening, China weakness), but they amount to nothing: the economy keeps growing at a modest pace. Stocks are reasonably priced, and absent a deterioration in the outlook, are attractive, if only because earnings yields are significantly higher than the yield on cash.

Copyright © Scott Grannis