Peak Margins?

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

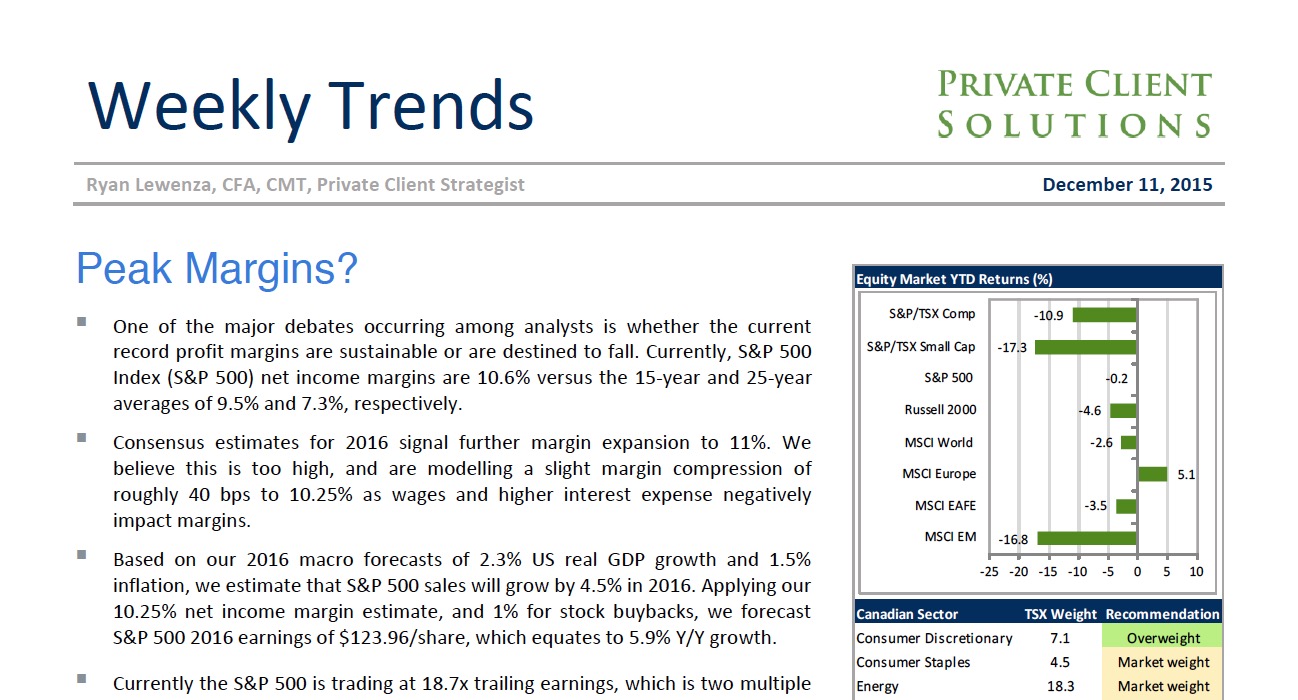

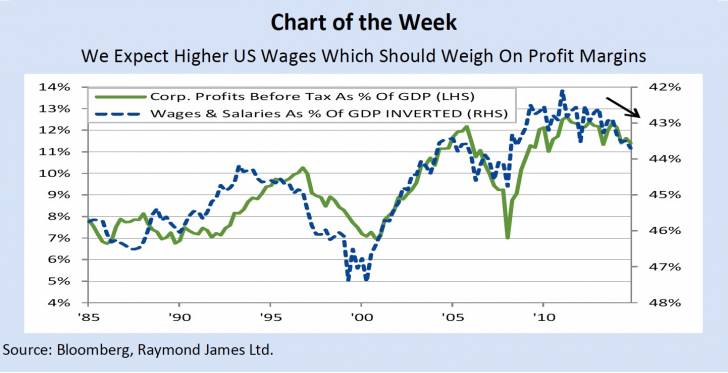

• One of the major debates occurring among analysts is whether the current record profit margins are sustainable or are destined to fall. Currently, S&P 500 Index (S&P 500) net income margins are 10.6% versus the 15-year and 25-year averages of 9.5% and 7.3%, respectively.

• Consensus estimates for 2016 signal further margin expansion to 11%. We believe this is too high, and are modelling a slight margin compression of roughly 40 bps to 10.25% as wages and higher interest expense negatively impact margins.

• Based on our 2016 macro forecasts of 2.3% US real GDP growth and 1.5% inflation, we estimate that S&P 500 sales will grow by 4.5% in 2016. Applying our 10.25% net income margin estimate, and 1% for stock buybacks, we forecast S&P 500 2016 earnings of $123.96/share, which equates to 5.9% Y/Y growth.

• Currently the S&P 500 is trading at 18.7x trailing earnings, which is two multiple points above the long-term average of 16.5x. Given the prospect of Fed tightening and other potential risks to the economy/stock market, we expect some P/E compression in 2016, and therefore are using a P/E target multiple of 17.5x. Multiplying our S&P 500 $123.96/share earnings estimate by our projected 17.5x P/E multiple, we derive a year-end price target of 2,170. If realized, this would equate to an 8% total return, including a 2% dividend yield.

Read/Download the complete report below: