Follow the Dollar: It’s Heading for China

by Fixed Income AllianceBernstein

The move to confer reserve status on China’s currency is part of a process that could lead to nearly US$3 trillion being injected into the country’s bond and equity markets. We’ve taken a close look at where the money could come from.

On its own, the inclusion of the renminbi (RMB) in the International Monetary Fund’s (IMF’s) basket of reserve currencies, known as the Special Drawing Right (SDR), could lead to capital flows of US$30 billion into China within the next 12 months.

These will come from countries that receive IMF funding. IMF programs use SDR as a unit of account, and countries that benefit from these programs need to hedge their liabilities in the underlying SDR currencies. The SDR basket is equivalent to US$280 billion, and the IMF has announced that the RMB will account for 10.92% of the basket—hence the US$30 billion.

This is relatively small in the scheme of things, however. The significance of the RMB’s inclusion in the SDR is that it’s a measure of the progress China has made to date with key reforms, such as the internationalization of its currency and the liberalization of its capital account.

Our research shows that a continuation of these reforms will force a rebalancing of global portfolios that could result in inflows to China of nearly US$3 trillion by 2020.

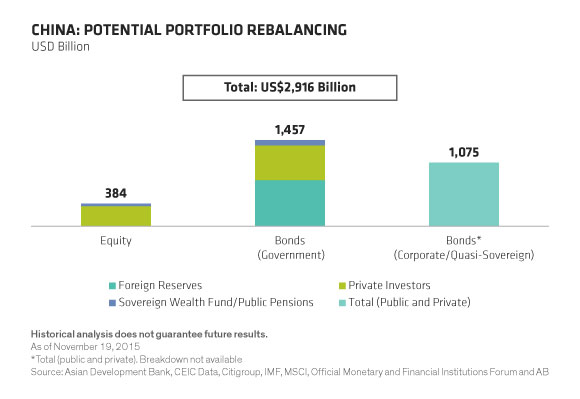

To put these figures in perspective, and to gain a sense of the overall shape of the portfolio rebalancing, we have carried out an analysis of the likely sources of these flows and how they will be distributed across China’s capital markets.

We have analyzed expected flows by asset category based on index weightings, types of investors and what we know of investors’ typical asset-allocation patterns.

US$2.5 Trillion for China’s Bonds…

Given the size of China’s government bond market, we expect it to account for 6.8% of the Citi World Government Bond Index. The index will be capitalized at around US$21.3 trillion after the bonds inclusion, so flows into the sector will need to be about US$1.46 trillion just for portfolios to maintain index weight (Display).

Of these flows, we expect US$783 billion from global central banks, based on our assumption that they allocate about 7% of their US$11.18 trillion in foreign exchange reserve assets into RMB, and that they invest most of it in government bonds.

Another US$90 billion will come from other public sector investors, such as sovereign wealth funds and public pensions. Their assets under management (AUM), excluding foreign exchange reserves, total US$18.24 trillion (according to the Official Monetary and Financial Institutions Forum, as of June 10, 2015). There are no detailed breakdowns of portfolio allocations, however, so we assume that these institutions allocate a total 66% to bonds, of which 25% is allocated overseas and 60% is allocated to government bonds. From this, we estimate that 5%, or US$90 billion, will be allocated to Chinese government bonds. Private sector investors will account for US$584 billion (US$1.46 trillion minus US$783 billion minus US$90 billion).

China’s corporate and quasi-sovereign bond sectors could receive inflows of US$1.07 trillion. We estimate this on the fact that municipalities, policy banks and corporate bonds currently have about US$5.4 trillion on issue, and on the assumption that overseas investors in these sectors will hold 20% (which is similar to foreign investor holdings in comparable markets elsewhere).

In total, China’s government and corporate bond markets will soak up inflows of US$2.53 trillion (US$1.46 trillion plus $1.07 trillion).

…and US$384 Billion for Equities

Our research suggests that foreign capital inflows into China’s equity markets will total US$384 billion. This figure is based on a statement by index provider MSCI that China A shares will account for 10.2% of the MSCI Emerging Market Index and on our estimate that the index will be capitalized at US$3.76 trillion when China is included.

Of this US$384 billion, US$43 billion will come from sovereign wealth funds and public pensions. We arrived at this figure by assuming that these investors allocate 22% of their US$18.24 trillion AUM to equities and, of this, 10.6% to emerging markets and then 10.2% of that amount to China A shares. The balance of the US$341 billion (US$384 billion minus US$43 billion) will be held by private investors.

In light of these estimates, we believe that investors should maintain a balanced view of the risks and opportunities in China, weighing the country’s slowing economic growth against the long-term benefits—such as these inflows—which are likely to result from the government’s reforms.

This article previously appeared in the Financial Times.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—Asia Pacific Fixed Income

Hayden Briscoe, Director of Asia-Pacific Fixed Income, joined AllianceBernstein in August 2009 and is responsible for the Asia-Pacific Fixed Income business and for managing global and regionally focused portfolios. He was previously a senior member of the Fixed Interest team at Schroders Australia, where he was responsible for domestic and global fixed-income funds and served on the multi-asset team. Prior to joining Schroders, Briscoe spent six years with Colonial First State Investments, where he managed local and global bond funds and had tactical asset-allocation responsibilities. He spent nine years with Bankers Trust in investment banking, starting out in the treasury, trading bonds, before becoming a proprietary trader. Briscoe moved to Macquarie for a short time after the Bankers Trust merger before he joined Colonial First State. He holds a BA in economics from the University of New South Wales. Location: Hong Kong

Economist—Asia-Pacific

Vincent Tsui joined AllianceBernstein in August 2011 as an Economist. Previously, he was as an economist on the Global Markets team at Standard Chartered Bank (Hong Kong), where he covered various economies across the Asia-Pacific region, including Australia, New Zealand, Japan and the Philippines. Prior to that, Tsui was a graduate associate in the bank’s wholesale banking division, where he gained experience in debt capital markets and in markets and institutions risk management. He holds a BS in economics and electrical engineering from the University of Virginia, and is completing his MFin in economic policy through the University of London. Tsui is a CFA charterholder. Location: Hong Kong

Related Posts

Copyright © AllianceBernstein