What If Factor Risk Premiums Go Away?

by Ben Carlson, A Wealth of Common Sense

A reader asks:

Will there be any significant premiums in the future? What is the future of risk premiums?

With the amount of competition in the markets nowadays this a legitimate concern. You can now invest in almost any strategy imaginable for pennies on the dollar and do so in a diversified, tax-efficient manner. This is a luxary investors in the past could only dream of.

This reader was talking about the value premium, but he just as easily could have been sharing worries about quality, momentum, shareholder yield, market cap or any other risk factor.

Not only is there increased competition in the financial marketplace for repeatable investment strategies, but investors also have to deal with inevitable bouts of underperformance. When something’s not working it becomes quite easy for doubt to seep in. And people these days are very quick to proclaim the beginning or the end of an era in just about anything. Investors are no different. Based on what you read in the financial media it would seem that well-known investment strategies are dying on an annual basis.

Obviously, no one knows for sure whether or not these premiums will continue to “work” in the future. Cliff Asness talked about the factor cycle in a recent conversation with Tyler Cowen:

If your car worked like this, you’d fire your mechanic, if it worked like I use that word. I think it is harder than you might guess, even if something works long term, to have it go away because a lot of investors can’t live through the bad periods. They decide why it’s never going to work again at the wrong time.

The point Asness is getting at here is that investors would have to collectively become completely rational all at once for risk premiums to be completely eliminated. I don’t see that happening any time soon. In the mutual fund era, investors would chase the past performance of star mutual fund managers. In the ETF era, investors will likely chase the best performing factor ETFs.

But I also think investors need to understand why they invest in different risk factors in the first place. Many try to pick a single factor in hopes of beating the market. I’m a huge fan of simplifying the investment process, but if you’re heavily reliant on a single variable for your investment decisions, you’re probably going to be out of luck unless you are extremely disciplined. Even then it probably makes sense to diversify by different risks and strategies.

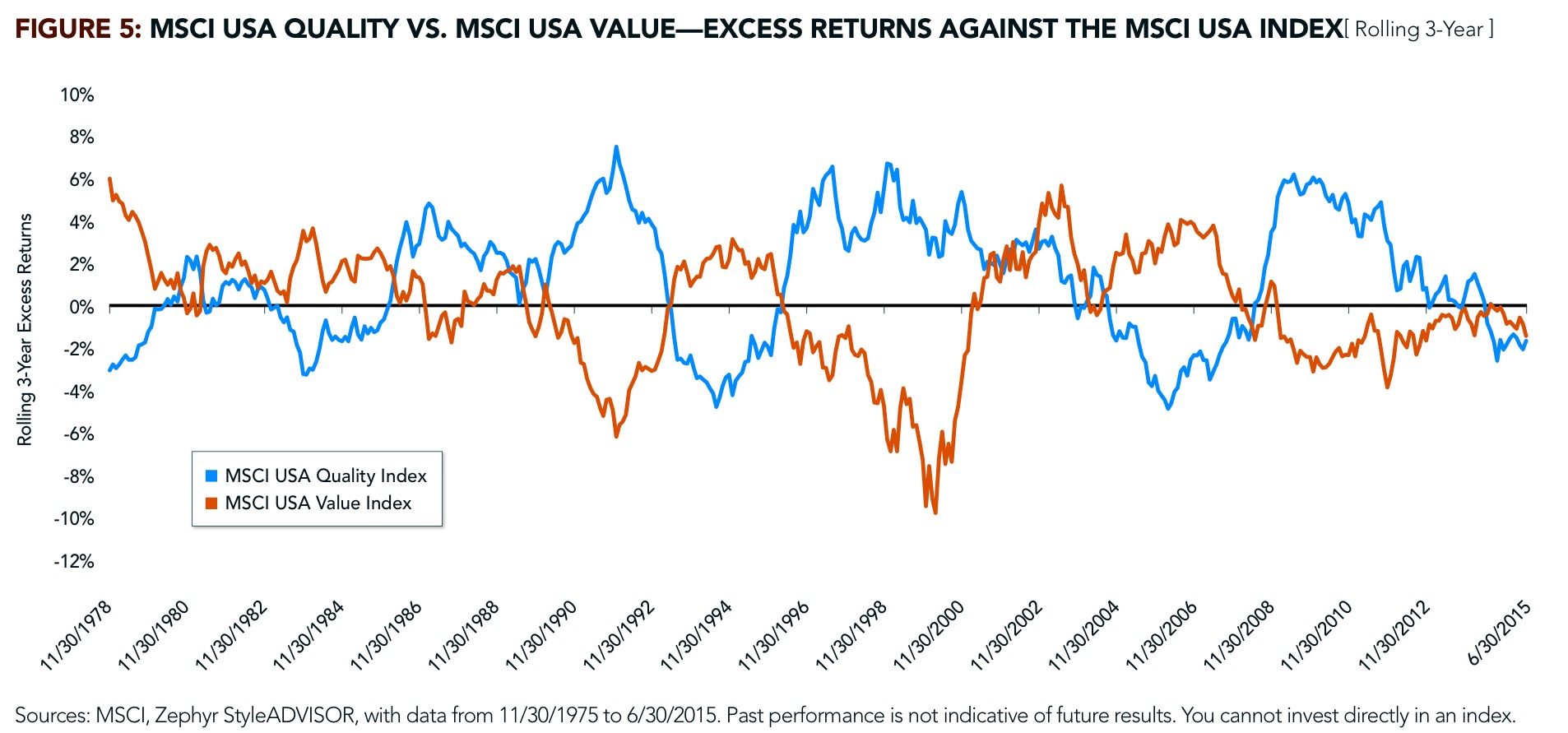

Jeremy Schwartz from WisdomTree had a really interesting graph on the quality and value factors in a recent piece:

This shows the rolling three year excess return for each strategy. You can see the periods of outperformance in quality match up quite nicely with periods underperformance in value (and vice versa). Holding a portfolio of either value stocks or quality stocks would have worked out well for investors during this time frame, but holding a diversified portfolio utilizing both quality and value would have given you a much smoother ride with far fewer sleepless nights.

Factor diversification provides something of a counterbalance so things never get too hot or too cold.

Investors spend far too much time worrying about outperforming the market and far too little time with portfolio construction and planning. It’s not only about finding strategies that have worked in the past that you think will work in the future. It’s about finding risks that complement one another. It’s not just security or asset class selection. It’s about certain investments behave within the construct of an overall portfolio.

In his talk with Cowen, Asness says it would be silly to assume that the historical premiums seen in popular factors won’t become compressed in the future now that everyone knows about them. But knowing about something is not the same as implementing it in real time.

Let’s say for argument’s sake that all risk factor premiums go away in the future. Even if that were to happen I think you could still make a case that owning a handful of different strategies makes sense simply because of the diversification benefits from rebalancing.

If competition in the markets makes it harder to earn risk premiums then investors will have to make sure they take advantage of many minor edges — diversification, rebalancing, tax deferral, compound interest, costs and behavior. The last one — behavior — is by far the most important one because any successful strategy requires that you understand the behavior of both yourself and the other market participants.

Sources:

Cliff Asness: Conversations with Tyler

The Dividends of a Quality and Growth Factor Approach (WisdomTree)

Further Reading:

What Happens When The Umbrella Shop Gets Too Crowded?

Why Value Investing Works

Why Momentum Investing Works