by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Tuesday December 1st

U.S. equity index futures moved higher this morning. S&P 500 futures were up 7 points in pre-opening trade. Index futures were led by strength in commodity sensitive equities thanks to weakness in the U.S. Dollar Index

The Canadian Dollar moved slightly lower following release of the annualized third quarter gross domestic product report. Consensus was growth at 2.3%. Actual was 2.3%. In September, GDP slipped 0.5% versus a consensus of no change.

Bank of Nova Scotia added $1.10 to US$46.65 and Bank of Montreal gained $2.34 to US$59.98 after reporting higher than consensus fourth quarter earnings.

Cott Beverages (COT $) added $0.17 to 10.63 after Canaccord initiated coverage on the stock to Buy. Target is $15.

Barclays upgraded the U.S pharmaceutical sector. Johnson & Johnson (JNJ $102.04), Eli Lilly (LLY $82.04) and Merck (MRK $53.43) were upgraded to Overweight.

Campbell Soup added $0.39 to $52.63 after Argus upgraded the stock to Buy. Target is $65.

Morgan Stanley gained $0.20 to $34.50 after UBS initiated coverage with a Buy rating. Target is $42

Yum Brands rose $0.77 to $73.28 after Cowen upgraded the stock to Outperform. Target is $88.

Cenovus added $0.10 to US$14.90 after Goldman Sachs upgraded the stock to neutral.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/11/30/stock-market-outlook-for-december-1-2015/

Note the variety of seasonality charts showing markets, sectors and stocks that outperform in the month of December

Don Vialoux on BNN’s Market Call Today

Taped yesterday. Following are links:

http://www.bnn.ca/Video/player.aspx?vid=760104 (Opening segment with market comment)

http://www.bnn.ca/Video/player.aspx?vid=760125

http://www.bnn.ca/Video/player.aspx?vid=760124

http://www.bnn.ca/Video/player.aspx?vid=760123

http://www.bnn.ca/Video/player.aspx?vid=760126

http://www.bnn.ca/Video/player.aspx?vid=760130

http://www.bnn.ca/Video/player.aspx?vid=760145

http://www.bnn.ca/Video/player.aspx?vid=760158 (Top Picks)

Weekly Globe Investor Comment

Authored by Jon and Don Vialoux. Headline reads,”How to take advantage of a Santa Claus rally”. Following is a link:

StockTwits released yesterday

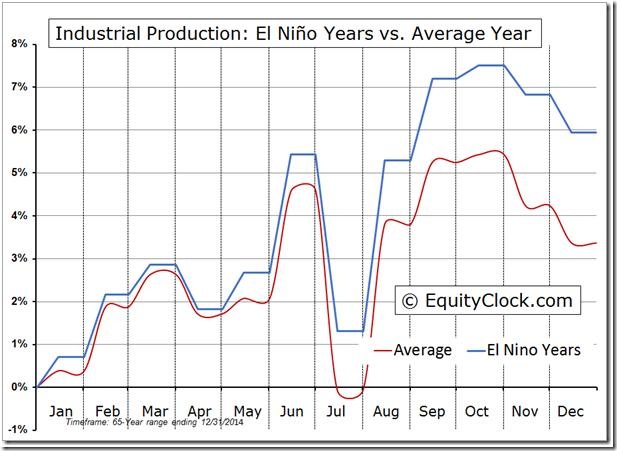

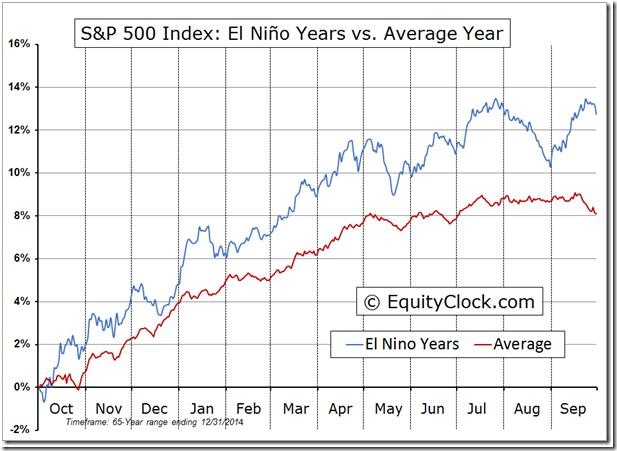

El Nino winters typically see above average economic activity and equity market performance

Technical action by S&P 500 stocks to 10:00 AM: Quietly bullish. Breakouts: $MKC, $CSC, $NVDA. No breakdowns.

Editor’s Note: Technical action after 10:00 AM remained mildly bullish. Breakouts included FITB, ADT, ALLE and PBI. Breakdown: REGN

Trader’s Corner

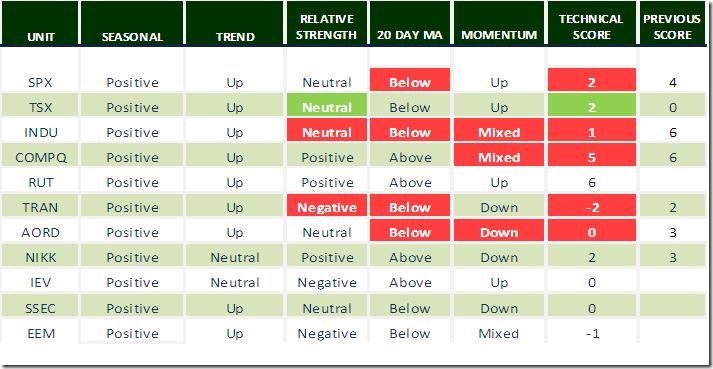

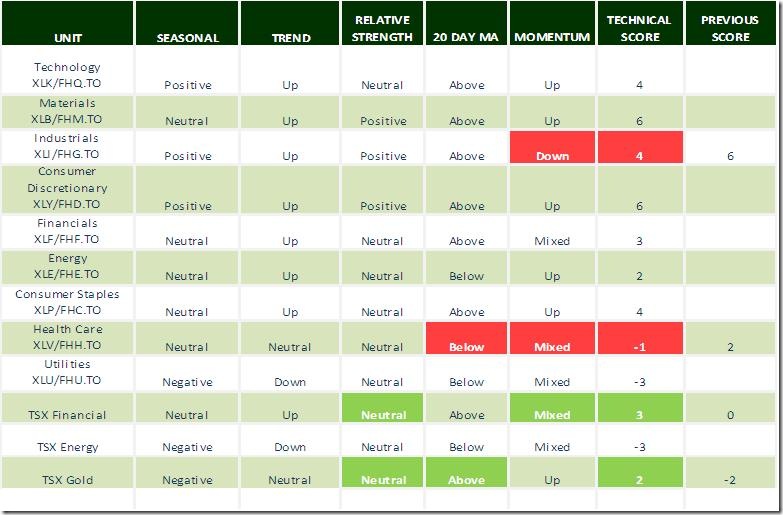

Daily Seasonal/Technical Equity Trends for November 30th 2015

Green: Increase from previous day

Red: Decrease from previous day

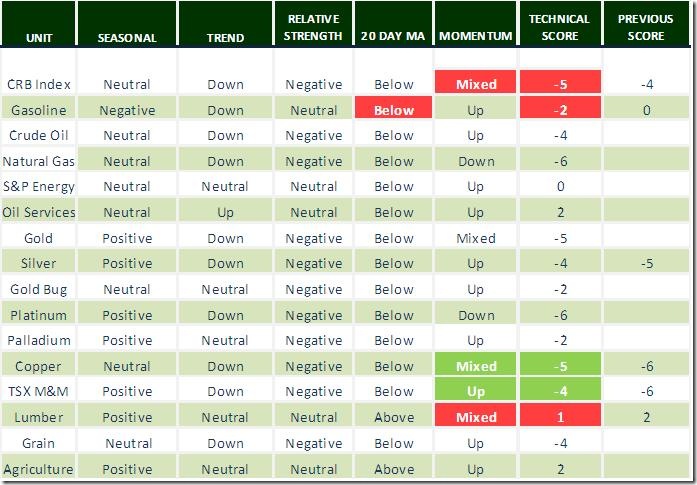

Daily Seasonal/Technical Commodities Trends for November 30th 2015

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for November 30th 2015

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

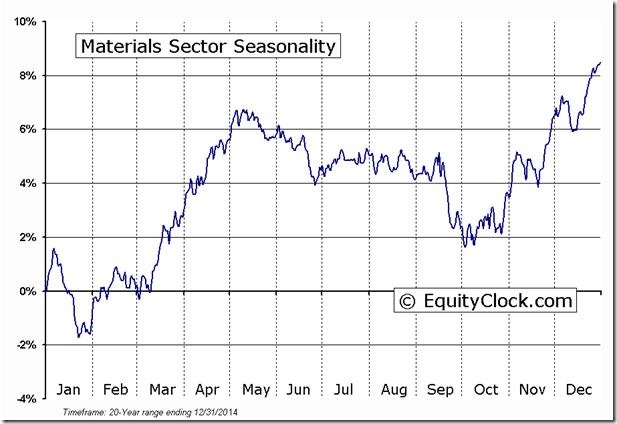

Following is an example:

|

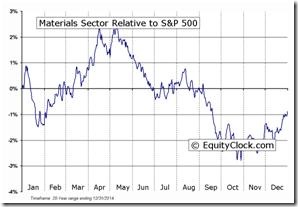

MATERIALS Relative to the S&P 500 |

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

|

|

|

Copyright © DV Tech Talk, Timingthemarket.ca