SIA Weekly: "Top Down" Look at Metals and Mining

In this week’s Equity Leaders Weekly, we are going to focus on the recent moves from the bottom in some of the metals and mining names as well as the overall Metals and Mining/Commodity sector as a whole. Most recently, some of you may have noticed some brief rather sizable moves in some commodity based names within the S&P/TSX 60 report. We are going to discuss these moves and stress the importance of looking at SIA’s Relative Strength Rankings from a Macro “Top-Down” Asset Class approach first, and then drilling down a level to the Sector Level before deciding to enter into select individual names. Paying attention to this “Top Down” mentality will help you in deciding whether these moves are just short term trading rallies or a more important long term change in trend through SIA’s continual analysis of the supply/demand relationship of relative strength comparisons.

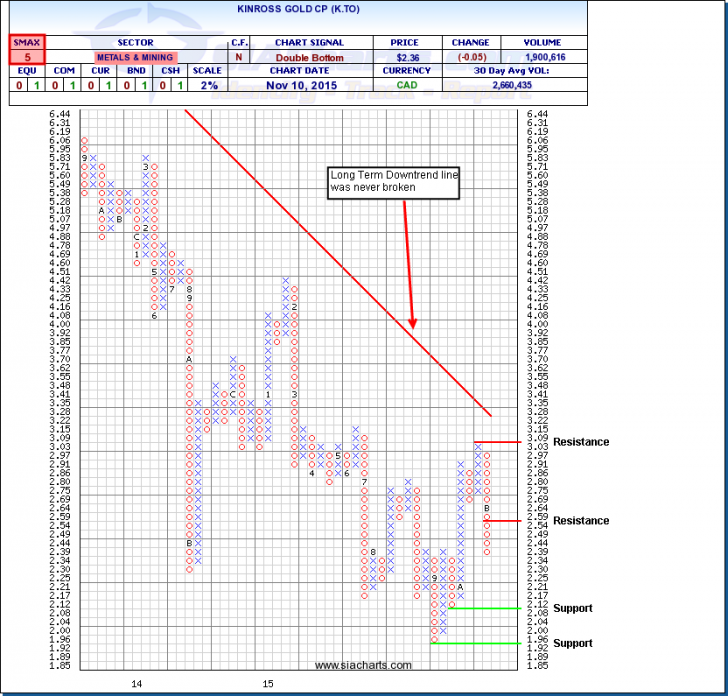

Kinross (K.TO)

Let’s look at Kinross Gold (K.TO) as an example of a brief sizeable move within the resource sector that has moved significantly within SIA’s S&P/TSX 60 report. As you can see from the attached chart, Kinross had rebounded from a recent low of $1.96 back in September all the way up to $3.03 in October. How do we decide if this is just a short term rally or a change in longer term perspective based on our relative strength analysis? As you can see the long term downward trend line was never broken and Kinross has started another downtrend with its recent price of $2.36. Current support is at $2.08, and below that, $1.92. Resistance is at $2.59 and, above that, the most recent rally at $3.09. Throughout this whole time, the metals and mining sector as a whole and the commodities asset class remained very weak within their respective relative strength rankings on a Market Sector level and Asset Class level.

Click on Image to Enlarge

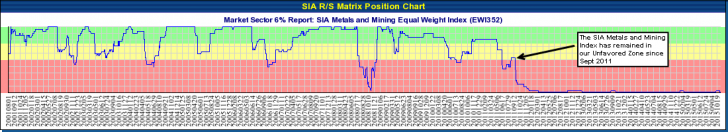

Metals and Mining (Sector Level)

Let’s examine the Metals and Mining Sector and discuss how the sector performed during this same time period. We will use the SIA Metals and Mining EWI as an example. In the attached Relative Strength Matrix Position Chart of the SIA Metals and Mining EWI (found in the Stock Sectors Tab) you will see the Metals and Mining EWI remained very low within our Unfavoured Zone. On an Asset Class Level, Commodities continued to sit as the weakest of the 7 asset classes within our Asset Class Ranking List. There will always be short term trading rallies with any stock but from a longer term perspective, the supply/demand relationship through our analysis of relative strength for resources continues to be weak. The most important consideration to remember is when deciding to enter into an individual name, you should always consider the Macro “top down” aspects by assessing the Asset Class level first and then drill down and assess the Market Sector’s relative strength. If both the Asset class and the Sector are exhibiting characteristics of strength relative to other Asset classes and sectors, it is safer (from a risk perspective) to enter into those strong individual select names within those Classes and Sectors. Failure to assess the relative strength from an Asset Class and Sector level first, significantly increases the risk profile of your position.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or siateam@siacharts.com.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © SIACharts.com