Global reflation = Buy risk (and cyclicals)

by Cam Hui, Humble Student of the Markets

Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

Global reflation

As long time readers are aware, the Trend Model uses commodity and global equity prices to spot market trends. The trading model component of the Trend Model was fortunate to have turned bullish in late September, which coincided with the start of the rally (see my post A choppy bottom). Today, those trends of global reflation are becoming more evident, which is a more definitive signal that the path of least resistance for stocks is up.

Gavyn Davies described the global economy as having dodged the recession bullet:

In this month’s regular report card on global activity growth rates, we conclude that the downward momentum identified by our “nowcasts” a month ago seems to have been arrested during October. The risk of a global recession has therefore declined recently, but growth in the emerging markets remains well below trend, and global spare capacity is continuing to rise.

Furthermore, the growth rate in activity in the US has dropped since mid year, and is now slightly below trend. Other advanced economies, especially the euro area, continue to record reasonably healthy, above trend growth rates, with some signs of a recent acceleration.

Overall, we therefore conclude that the risk of a global hard landing has diminished in the past month. However, while not in recession, the global economy does appear to be in the midst of a growth malaise, in which the “miracle” of the 2000s in the emerging world is unraveling, and productivity growth in the advanced economies has maintained its long term downtrend.

Remember how the market fretted about slowing growth in China and Europe in August? Now those fears can be laid to rest. We can see that from this chart of stock market averages, which show American and European stocks in solid uptrends.

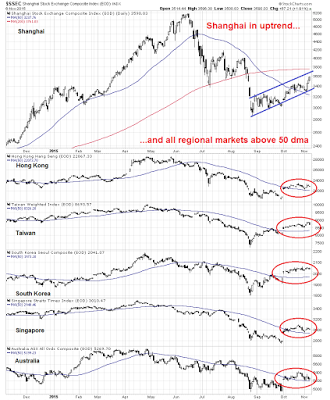

The Greater China markets of China and her Asian trading partners are also in solid recovery modes. The Shanghai market is in an uptrend and all regional markets are above their 50 dma. Late Friday, China reported its FX reserves rose in the month, which alleviated much of the angst over capital flight in China.

The upturn is starting to show up in economic statistics. Ambrose Evans-Pritchard pointed out that global PMIs are rising.

...with improvements in US ISM Manufacturing new orders, with ISM Manufacturing. while weak, beat market expectations:

...an upside surprise in eurozone M-PMI:

...and signs of a bottom in China:

More helpful are signs of the Chinese economy rebalancing towards the household sector as Services PMI is outperforming Manufacturing PMI (via Callum Thomas):

On top of that, we had the blowout US Employment Report, which confirmed a trend of improving fundamentals. The Citigroup Economic Surprise Index, which measures whether high frequency economic releases are missing or beating expectations, is trending up:

On a bottom-up basis, the Street displayed its optimism for the future by raising forward EPS for a second week, according to figures from John Butters of Factset:

A bullish setup for commodities

At a sector level, equities have seen cyclical sectors and groups start to bottom and turn up. The chart below shows the market relative performance of cyclicals, starting with mid-cycle sectors such as industrial and semi-conductor stocks, as well as the globally sensitive Korean market. The bottom two panels show the late cycle commodity cyclical sectors, energy and materials, which appear to be basing but haven't turned up yet on a relative basis.

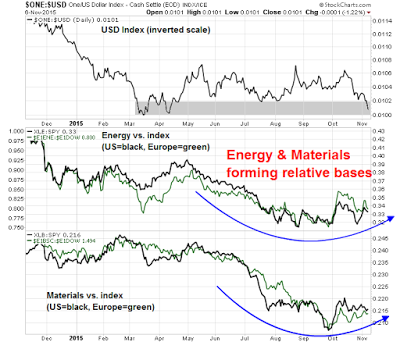

My bullish call on commodities last week seems to be premature (see How to energize returns even as momentum fades). In retrospect, it could be better characterized as a trade setup rather than an actual trade. Nevertheless, I believe that this bullish setup remains valid. Here is the updated version of the chart I showed last week of the USD (inverted scale, top panel) and the relative performance of energy and materials sectors (US=black, Europe=green).

One technician admonished me about jumping the gun on commodities, "What you have is a setup. Wait for the breakout or some signs of a reversal before committing to the trade."

I was overly eager and I stand corrected. Nevertheless, the weight of the evidence, based on the behavior of cyclical sectors and the confirmation of bottoming formation from Europe, all suggests to me that I am on the right track.

There are two components to the bullish commodity call, a currency element, which is facing headwinds from a strong USD, and a cyclical element, which is more bullish. The upside surprise in Friday`s Employment Teport raised expectations that the Fed would hike rates in December. This caused the USD to rally hard and created significant headwind for commodity prices. However, I believe that the market is giving little weight to the global reflation, which raises commodity demand,

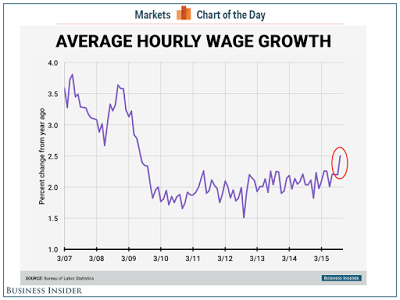

The currency element of the commodity trade can be measured by what happens to inflationary expectations. Inflation is starting to tick up. Business Insider highlighted the fact that the NFP report showed that average hourly earnings rose to 2.5%:

Another measure of inflationary expectations is gold and gold stocks. Gold stocks appear to be setting for a rally as well as breadth is appearing to be constructive. The silver-gold ratio (in green) shows high-beta precious metal silver outperforming gold. As well, the bottom panel showing % of bullish stocks is bottoming and turning up.

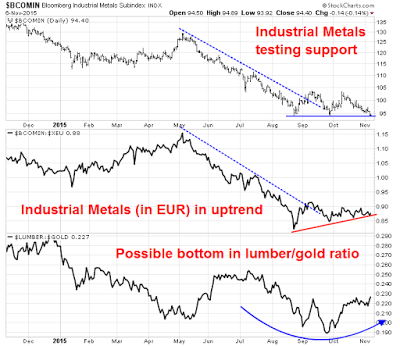

One way of measuring the cyclical element of commodity prices is to separate their cyclical factors from their currency influence. The top panel of the chart below shows the highly cyclical industrial metals in USD, which is a chart many analysts look at. while the next two panels focuses on the cyclical element of commodity prices. A conventional analysis of industrial metals show them to have rallied out of a downtrend and in the process of testing support. The middle panel filters out much of the effects of USD strength by showing industrial metal prices in euros, indicating a minor uptrend with a series of higher lows and higher highs (in red) after rallying out of a downtrend. The bottom panel shows lumber prices, which is highly dependent on the cyclical sensitive housing sector, to gold prices, which is mainly perceived as an alternative currency to the USD. The lumber-gold ratio appears to be making a rounded bottom, which is also constructive.

As global growth rises, the cyclical dimension of the commodity trade will start to assert itself. As well, better non-US growth will also serve to push the USD downwards, which will also be commodity bullish. My inner trader is inclined to take a partial position should either energy or material stocks move to the bottom of their market relative trading range and buy a full position on a relative breakout.

The week ahead

Looking to the week ahead, a period of consolidation and pullback is likely at hand, though any weakness is likely to be shallow and should be bought. Both the SPX and its RSI(14) have breached short-term uptrends. A logical downside support target would be the 2055-2060 area, which is the site of the 200 dma and a gap that likely needs to get filled. However, breadth metrics such as the SPX advance-decline line remains constructive as it made a new high last week.

The dual downside support consisting of the trading gap and 200 dma is graphically even more evident in the chart of the NASDAQ Composite.

I am near-term cautious. Last week's market action dispalyed the signs of an extended market reversing itself from its overbought condition, which is a corrective signal. Quantifiable Edges showed what happened under the unusual condition of when both the VIX Index and stock prices rose, in this case to a 50-day high:

My inner investor remains bullishly positioned, in both the energy sector and in the broad market. My inner trader took profits in long positions in energy stocks last Wednesday and in the SPX Thursday. He is in cash in anticipation of a pullback and lower prices next week and buy hopes to buy into positive seasonality for the remainder of the year.

The week ahead is likely to be volatile, stay tuned for any mid-week updates on Twitter at @humblestudent.

Friday, November 6, 2015

How Muslims will (not) marry our daughters and conquer us with births

I love reading Zero Hedge. Its constant theme of disaster-is-just-around-the-corner is the financial equivalent of skimming the supermarket tabloid at the checkout to see which celebrity was caught with the babysitter. The most amusing headline I saw recently was about the rise of xenophobia in Germany entitled Muslim Man Warns Germans: "We Will Marry Your Daughters And Conquer You With Births":

A week ago, we showed a video of what we hoped was not representative of the general sentiment among Germans towards the refugee crisis as two ladies suggested, "Every year 2-3 million arrive...it’s generally about foreign infiltration." Now we have the other side as the following video shows a muslim man threatening a German that "his daughter will wear a headscarf and marry a Muslim and that Germans stand no chance with their low birth rate," adding that muslims will "conquer Europe not with weapons, but with birth rates."

OH PUH-LEEZ! I hope that readers took that as seriously as the tabloid story about the transsexual who obtained a sex change operation but ultimately became a lesbian.

A demographics lesson

In order to make good on that threat, Muslim newcomers would have to surpass European populations with higher birth rates and overwhelm the hosts culturally. I would suggest that the opposite is much more likely to occur.

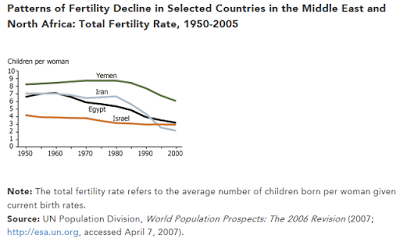

Consider, for example, the 2008 UN report indicating that fertility rates have been plummeting in the Middle East.

While the UN report only documented the decline in birthrates, the reason is obvious from an economic perspective. Prosperity and development are the best forms of birth control. In an agrarian or hunter-gatherer society, children quickly become production units and therefore profit centers. In a modern industrialized society, children are cost centers.

Callum Thomas recently highlighted this well-known inverse relationship between income and fertility rates, though the topic of discussion at the time surrounded China`s decision to abolish its one-child policy.

Even though China has abolished its one-child policy and tacitly encouraging two children per family, getting people to have more babies is not as easy as it sounds, according to this NY Times article:

Demographers and economists say the cost and difficulty of child-rearing are likely to deter many eligible couples from having two children despite the relaxed rules, Mu Guangzong, a professor of demography at Peking University, said in a telephone interview.

“I don’t think a lot of parents would act on it, because the economic pressure of raising children is very high in China,” he said. “The birthrate in China is low and its population is aging quickly, so from the policy point of view, it’s a good thing, as it will help combat a shortage of labor force in the future. But many parents simply don’t have the economic conditions to raise more children.”

As I noted before, children become cost centers in industrialized societies and the economic incentives to procreate in the era of birth control are low.

Bottom line: Muslim Europeans are likely to see their birthrates decline and converge to the levels of their hosts.

Cultural assimilation or invasion?

The second question involves the issue of cultural assimilation, or cultural invasion. To answer that question, we can turn to two case studies: China and Iran.

During the 13th Century, the Mongols conquered China and established the Yuan Dynasty to rule China. Over the space of a generation, the Mongol conquerors adopted many of the habits of the locals and became, in many ways, Chinese:

Notwithstanding the aspects of their rule that were certainly negative for China, the Mongols did initiate many policies — especially under the rule of Khubilai Khan — that supported and helped the Chinese economy, as well as social and political life in China.

In order to ingratiate himself with Confucian China, for example, Khubilai restored the rituals at court — the music and dance rituals that were such an integral part of the Confucian ideology. He also founded ancestral temples for his predecessors — his father and Chinggis (Genghis) Khan (his grandfather) — in order to carry out the practices of ancestor worship that were so critical for the Chinese.

And in an even greater effort to ingratiate himself personally to the Chinese, Khubilai insisted on giving his second son, Jin Chin, a Chinese-style education. Confucian scholars tutored the young boy, and he was introduced to the tenets of both Confucianism and Buddhism.

Khubilai also set up institutions to rule China that were very familiar to the Chinese, adapting or borrowing wholesale many of the traditional governmental institutions of China. For example, the Six Ministries that had been responsible for carrying out policy were retained by Khubilai's government, as was the Secretariat, a decision-making body. And the provincial administrative structure that organized China into provinces, further divided into districts and counties and so on, was not changed. The Chinese, therefore, found much of the Yuan Dynasty's political structures to be familiar.

Cultural invasion is not as easy as it sounds - and that occurred in an instance when the invaders militarily conquered the region, which is not the case in Europe today.

For a more modern example, consider the demographics of Iran. As the chart below shows, about one-third of the population was alive when radical students stormed and took over the American embassy in 1980.

It also shows the long-term problem facing Iran`s religious clerics. Young Iranians are becoming secular, which creates problems of control by the ayatollahs, according to this NY Times Op-Ed that compared and contrasted the political landscape between Israel and Iran:

For more than three decades, Iran’s oil wealth has allowed its religious leaders to stay in power. But sanctions have taken a serious economic toll, with devastating effects on the Iranian people. The public, tired of Mr. Ahmadinejad’s bombastic and costly rhetoric, has replaced him with Hassan Rouhani, a pragmatist who has promised to fix the economy and restore relations with the West.

But Mr. Rouhani’s rise is in reality the consequence of a critical cultural and demographic shift in Iran — away from theocracy and confrontation, and toward moderation and pragmatism. Recent tensions between America and Russia have emboldened some of Iran’s radicals, but the government on the whole seems still intent on continuing the nuclear negotiations with the West.

Iran is a land of many paradoxes. The ruling elite is disproportionately made up of aged clerics — all men — while 64 percent of the country’s science and engineering degrees are held by women. In spite of the government’s concentrated efforts to create what some have called gender apartheid in Iran, more and more women are asserting themselves in fields from cinema to publishing to entrepreneurship.

Many prominent intellectuals and artists who three decades ago advocated some form of religious government in Iran are today arguing for popular sovereignty and openly challenging the antiquated arguments of regime stalwarts who claim that concepts of human rights and religious tolerance are Western concoctions and inimical to Islam. More than 60 percent of Iranians are under age 30, and they overwhelmingly believe in individual liberty. It’s no wonder that last month Ayatollah Khamenei told the clerical leadership that what worried him most was a non-Islamic “cultural invasion” of the country.

In other words, Iranian youth prefer to party rather than spend their days in religious devotion. If they are tilting towards western influences and culture, then the more likely outcome of a mass migration of Muslims into Europe is cultural assimilation.

For an example of how cultural assimilation can work, consider the new government of Canadian Prime Minister Justin Trudeau. While this is not a Trudeau endorsement, I would point out that new cabinet ministers include a former refugee from Afghanistan and a turban wearing Sihk who was a soldier with tours in Bosnia and Afghanistan as Minister of Defense.

Now, that`s assimilation!

Bottom line: Europe may experience some temporary indigestion as it copes with the flood of refugees, but the more likely long-term outcome will be "how Muslims will become more secular, affluent and see their birthrates fall."

Copyright © Cam Hui, Humble Student of the Markets