10 -- 9 -- 8 -- 7 -- I wish it were that easy!

October 27th....seasonal stock market buy date....set to go

by Brooke Thackray, Alphamountain Investments

Once out...hard to get back in...for some

Most investors that exit the stock market or reduce their holdings suff er from stress as they try to get back into the stock market. Seasonal investors do not suffer from this syndrome as they have an entry discipline for guidance.

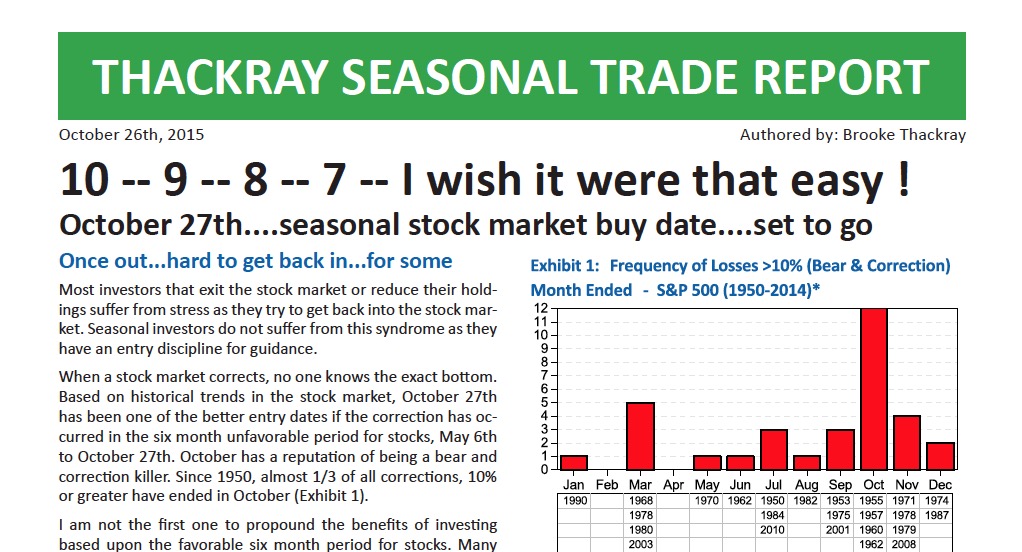

When a stock market corrects, no one knows the exact bottom. Based on historical trends in the stock market, October 27th has been one of the better entry dates if the correction has occurred in the six month unfavorable period for stocks, May 6th to October 27th. October has a reputation of being a bear and correction killer. Since 1950, almost 1/3 of all corrections, 10% or greater have ended in October (Exhibit 1).

I am not the first one to propound the benefits of investing based upon the favorable six month period for stocks. Many other have written about this phenomenon. The most recent study is from October 2012 entitled “The Halloween Indicator: Everywhere and all the time” by Ben Jacobsen and Cherry Y. Zhang from Massey University in New Zealand. Jacobsen and Zhang looked at more than 300 years of market data in 108 countries. The study found stock market returns from November through April were on average 4.5% greater than the other six months1.

According to my research there is extra value entering the S&P 500 on October 27th versus waiting until November. Since 1950, buying into the S&P 500 on October 27th (to be in the market for October 28th) has produced an average gain of 0.8% for the last few days of the month. On average, the S&P 500 tends to perform well for the last few days of October and then rally into November (Exhibit 2). The trend has been persistent over time from 1950 to 2014 and from 1990 to 2015.

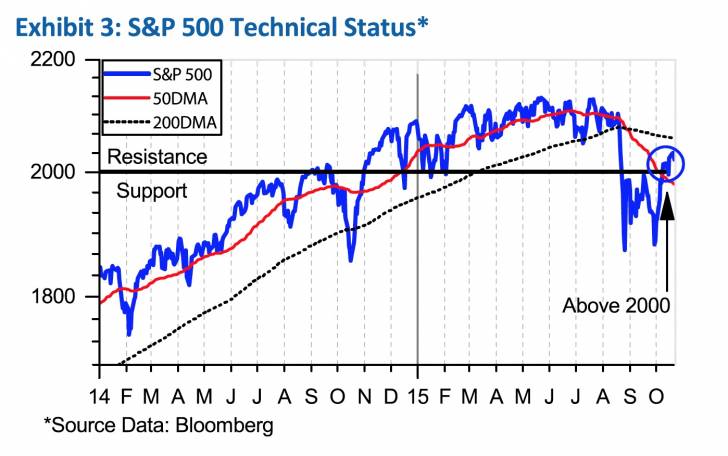

Exhibit 3: S&P 500 Technical Status

After a major drop in the late summer, the S&P 500 bounced late September and has managed to break above a key resistance level of 2000, which is now acting as support. This should provide a good base for the S&P 500 to make its way to its previous May high of 2135, by year-end. In the last few days, solid earnings, favorable comments by ECB President Mario Draghi about negative interest rates and the possibility of more quantitative easing, and China cutting interest rates, have helped give the S&P 500 a strong move above 2000. Even with the strong move, the outlook is solid as the S&P 500 has completed a double bottom breakout above 2000.

Conclusion

Given that it is highly probable that the low was set on August 25th, is October 27th a good time to increase equities? No one knows for sure, but historically the next six months tend to be a good time for stocks...so....10...9...8...7...October 27th.

Read/Download the complete report below:

Copyright © Alphamountain.com