Precious metals could rally

by Tiho Brkan, The Short Side of Long

Precious metals sector is attempting to break out from a downtrend

As stated many times by various FOMC members throughout the year, Federal Reserve has a desire to hike interest rates in 2015. Despite the fact that the recent September decision was dovish and rates remain on hold, many of the FOMC members continue to prepare the market for a rate hike with media commentary. However, not every investor believes them. Probability of a rate hike for the rest of the year stands at around 50 – 50. Throughout history, whenever FOMC tried to hike rates it also tried not to surprise the market, with probability standing at 100% chance of hike almost every time.

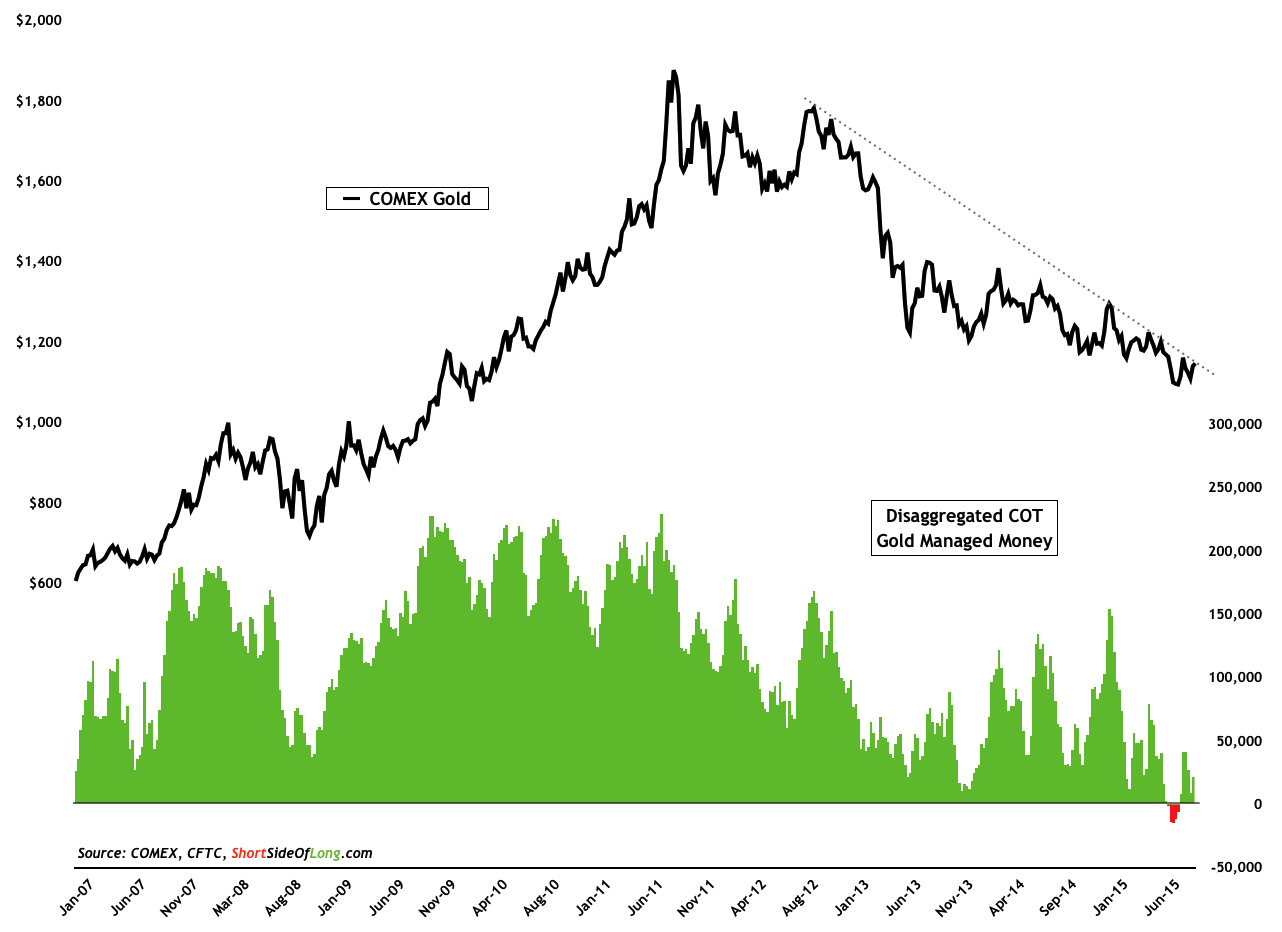

Precious metals seem not to believe the Fed either. Recent price action is becoming more and more constructive with Gold (NYSE: GLD), Silver (NYSE: SLV) and Junior Gold Miners (NYSE: GDXJ) all pushing against their downtrend lines. With a breakout now becoming a possibility and Gold traders seem to be anticipating (or speculating) that FOMC won’t rise rates in 2015. Furthermore, if the stock market and economy weakens, more and more of the commentary could turn towards dovish views of more QE easing. One thing is for sure, hedge funds and other speculators are definitely underinvested towards this sector.

Gold is pushing against a downtrend line with hedge funds underinvested

by Tiho Brkan, The Short Side of Long