The cash is king playbook

by Cullen Roche, Pragmatic Capitalism

We’re seeing something really unusual in the financial markets this year. As I’ve noted recently, there’s almost nothing that’s working this year. No matter where you’ve diversified your savings you’ve likely lost money with the exception of cash. If we look at the two primary asset classes, stocks and bonds, cash has only outperformed both in the same year 10 times in the last 90 years. So this is a pretty unusual event. But there’s some potential good news on the horizon. When this occurs both stocks and bonds tend to bounce back very strong.

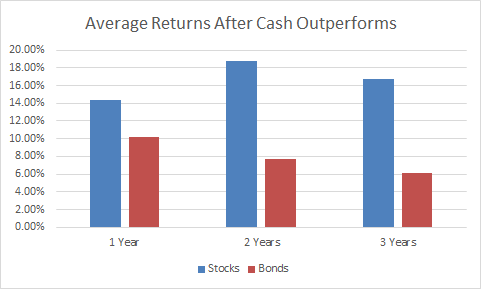

In the 10 times this has occurred in the last 90 years stocks have followed up with average 1, 2, and 3 year returns of 14.34%, 18.76% and 16.72%. Bonds have done a bit worse with a 1, 2 and 3 year average return of 10.24%, 7.7% and 6.17%.

A balanced portfolio has also generated abnormally high returns with a 1, 2 and 3 year average return of 12.29%, 13.23% and 11.44%.

As is often the case with diversification, it’s not timing the market that counts. It’s time in the market. So, while cash looks particularly smart today the historical figures say that cash won’t be king for long.