The China syndrome: Meltdown or recovery ahead?

by Stephen Green, and Andrew Dougherty, Capital Group

A sharp selloff in China’s stock market, a surprise currency devaluation and a persistent slowdown in economic activity have raised doubts about the ability of the world’s second-largest economy to maintain the hypergrowth levels of the past two decades. Against this backdrop, economist Stephen Green and China affairs specialist Andrew Dougherty discuss:

• Their outlook for China’s economy, which remains generally positive over the long term

• The origins and potential implications of China’s stock market correction

• Segments of the economy that are poised for growth despite an overall slowdown in activity

• China’s uneasy shift toward a market-based foreign exchange regime

What is your economic outlook for China, both short- and long-term? Stephen: During the next six months, I think economic activity will improve slightly compared to the first half of 2015.

What is your economic outlook for China, both short- and long-term? Stephen: During the next six months, I think economic activity will improve slightly compared to the first half of 2015.

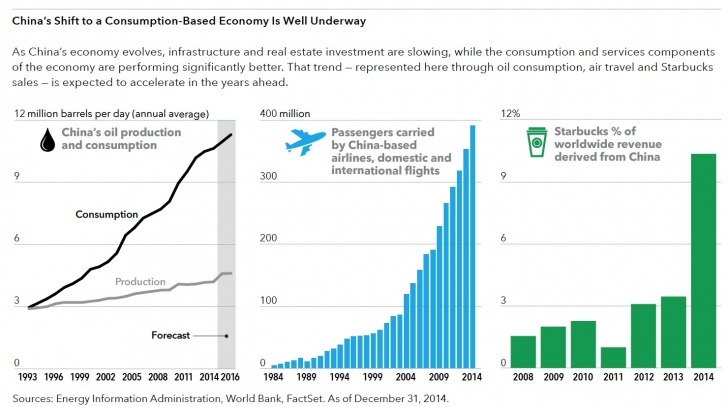

The past two years have been tough. Growth is clearly slowing. The Chinese government tells us the economy is growing at a 7% rate, but many people, including myself, are skeptical about that number. If you look across the investment complex, whether it’s real estate or infrastructure, there is a lot of evidence that China is in a recession, or at least growing at a very slow pace. But the consumption and services components of the economy are doing significantly better and growing at a 4% to 6% rate, while the investment side remains weak. Overall, total gross domestic product (GDP) growth is likely in the 3% to 4% range.

Over the next 10 years, it would be reasonable to expect an average annual rate of growth of around 7%. Before the global financial crisis, China was probably growing at 15% to 16% a year, which was extraordinary. It has slowed down a lot since then. Future economic growth will be driven more by consumption, services and technology — areas that intrinsically grow a little bit slower. Overall, China remains a relatively low-income economy compared to more developed countries.

There is still a lot of catch-up growth that should be relatively easy to achieve. Many people say that China can only grow at a 2% to 3% rate over the next 10 years, but I think that is overly bearish.

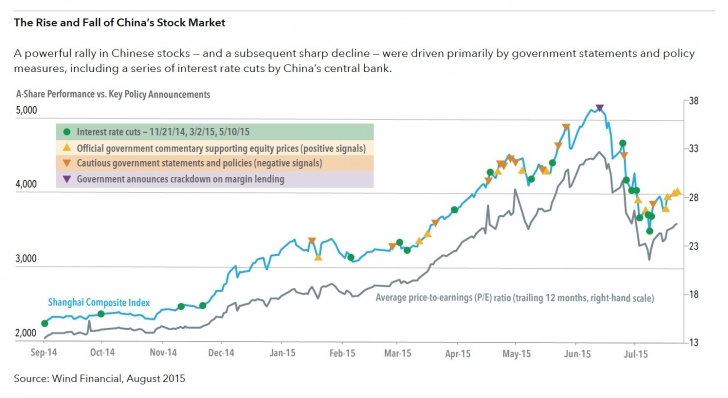

What forces do you believe triggered the recent selloff in China’s stock market? Andrew: The bull market, which started in the summer of 2014 but really accelerated in November, has been supported by explicit and implicit government measures.

The explicit support has been through government statements emphasizing the importance of equity markets. The indirect macro policy support has been through cuts in interest rates and reserve ratio requirements. China’s central bank started cutting interest rates last November and the market accelerated aggressively from there.

Given the government support, investors started buying heavily on margin and Chinese stocks rose sharply: the Shanghai Composite Index soared by more than 150% from mid-2014 to early June 2015, while the Shenzhen Composite Index rose by more than 200%. Both indices lost around a third after the government acted in June to curb margin lending. By some estimates, margin lending at the peak was equivalent to 8% to 10% of the market’s free float, which is a much higher ratio than the 2% to 3% typically seen in developed markets. Eventually, the trigger for the selloff was securities regulators increasing their enforcement of “shadow” margin lending restrictions, along with some recognition by investors of excessively high valuations in an environment of weak earnings growth.

Will China’s stock market activity eventually normalize? If so, how do you see that unfolding?

Stephen: Although valuations have come down, they are still quite high. Amid the selloff, the government jumped in with an array of policies and stabilized the market. That has been welcomed by some investors, but the market is still expensive overall. So the government now has a dilemma: it doesn’t want equities to fall again, but it probably needs to dial back some of the interventions, otherwise it is not really a market-based system anymore.

One of the reasons the stock market sold off was that regulators were cracking down on leverage. Ideally, this should have happened much earlier in the year. Since the crash, regulators have continued to go after much of the leverage in the system. If that approach is successful, then the next time equities fall, the decline may not be as sharp or steep, and the government may not have to prop up the market.

On the other hand, if it responds more aggressively, we are still looking at the possibility of another fairly sizable downdraft in prices, because there are still a lot of very expensively valued companies.

Over the long term, the government wants a healthy equity market, partly because it recognizes the huge problem of corporate debt. Authorities can help ameliorate that by making it easier for companies to swap debt into equity and raise money in stock markets.

What signal is China sending with the recent currency devaluation? Is it motivated by a true desire to adopt a more market-based foreign exchange regime?

Stephen: Yes, I think it’s a genuine attempt. For many years now, the mechanism to set the daily starting exchange rate for the dollar/Chinese renminbi, or yuan, has not worked well. It was clearly set by the country’s central bank, the People’s Bank of China (PBOC), rather than by the market. The currency then could only trade within a band of plus or minus 2% around this price, so the PBOC effectively controlled the exchange rate.

This was a barrier to the International Monetary Fund’s including the renminbi as a reserve currency. Now, the daily rate should be set more by market-making banks, and should reflect the last day’s traded rate as well as the overnight moves in other currencies. The PBOC also will have the chance to adjust the rate in line with its broader aims. The 2% band is still in place.

What does the devaluation mean for Chinese interest rates and the economy overall?

Stephen: I don’t expect much impact — the move is too small. To put this in context, the Chinese currency has appreciated by some 50% over the past seven years. I expect Beijing to continue rolling out moderate stimulus policies to prevent further deceleration. This includes all the normal actions: lowering interest rates, cutting the required reserve ratio, launching more infrastructure investment, doing quiet quantitative easing, and maybe even moving toward tax cuts and subsidies for certain retail goods.

Where are the opportunities for further growth in China?

Stephen: If you fly into Beijing or Shanghai, you see skyscrapers and great infrastructure, and it looks as though China has already built itself. But about half the population — around 600 million people — is still living in poor rural areas.

While it’s true that we are coming to the end of the fast-growth phase of investment, there is still an awful lot more investment to come in the inner parts of the country, away from the coastal areas. But that investment has to move away from building roads and airports to building more schools and hospitals, cleaning up the environment and solving water problems.

Moreover, China’s GDP growth rate often understates consumption. For example, the government does a good job of capturing the number of cars produced, but a very bad job of tracking the number of karaoke nights that people are enjoying, or the restaurants and coffee shops they are visiting, or travel-related activity, or even online shopping. That’s where the growth is. Many independent surveys suggest that there is a lot more consumption going on than the official statistics suggest, which means the economy is probably more balanced than people think.

Andrew: Wages continue to grow on average 5% to 7% per year on a nationwide basis, and are still growing in some regions and sectors 10% to 15% per annum, even in the current slower growth environment. This puts money in the pockets of the masses. Even though luxury goods consumption has fallen sharply, mass market consumption is still quite healthy. We see this in the online shopping numbers and health care expenditures.

What are the risks that might derail China’s growth story in the years ahead? Andrew: There are a number of potential risks — everything from a further downturn in the real estate market to a collapse in wage growth that results in much weaker consumption. But I don’t think either of those things is likely to happen in the next couple of years, due to increasingly aggressive government policy support.

The biggest risk, near term, is that global economic growth slows further and puts a bigger dent in China’s export activity, thereby increasing unemployment and deflationary expectations. Economic reforms are seen as important for China to continue modernizing and maintaining a decent growth rate. What are important markers for you in terms of these reforms?

Stephen: This government has gained credibility by taking a strong stance against corruption, levying charges against thousands of bureaucrats. But to have a long-term, deeper impact, it must address these problems at the root. There are many large, influential state-owned enterprises that are deeply troubled. It would be an important signal if the government would lay out a roadmap for privatization — which areas they want to keep private for strategic reasons, such as petrochemicals, and which are going to be privatized, such as hotels, autos and leasing companies. It would allow China to raise funds to pay off debt and improve efficiency in the economy. The second big marker would be fiscal reform.