DeVoe’s unprovable but highly probable theories

by Jeffrey Saut, Chief Investment Strategist, Raymond James

For the College Humor Magazine I submitted a collection of many ‘laws’ and other items , including my College Course Descriptions: 1) If it’s green, wiggles or slithers, it’s biology; 2) If it stinks, it’s probably chemistry, although don’t rule out economics; 3) If it doesn’t work, it’s most likely physics, although don’t rule out economics; 4) if it’s incomprehensible, it’s most likely mathematics, but that’s part of economics also; 5) if it stinks, doesn’t work, is incomprehensible, and doesn’t make sense, it’s either economics or philosophy.

. . . Ray DeVoe

I don’t claim to be an economist, although I do have a degree in economics. Fortunately, I have forgotten most of the economics I learned at university. Also fortunate is that I work with one of the best economists on Wall Street in the form of Scott Brown, Ph.D., but I digress. For the past few months I have been suggesting the economy was doing better, which has brought about cat calls from many of the negative nabobs. My sense has been that GDP was growing by at least 3%. Bolstering that belief, on one of my CNBC appearances I actually heard Tim Geithner say, “I think the U.S. economy is stronger than the official figures suggest.” Last week that proved to be the case as the Gross Domestic Product (GDP) figures came in much stronger than anticipated, prompting Scott Brown to write, “Real GDP rose at a 3.7% annual rate in the 2nd estimate for 2Q15 (vs. +2.3% in the advance estimate).”

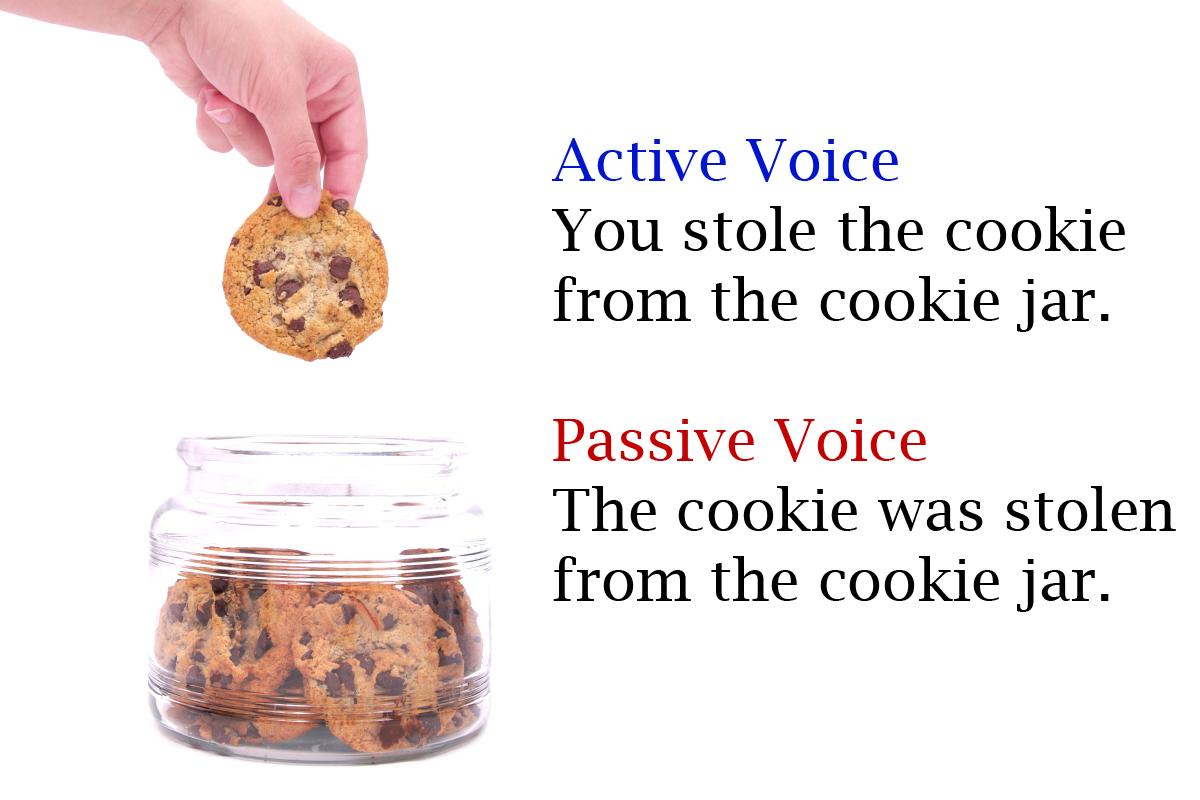

Now I have always found the terms “real” versus “nominal” to be interesting. The main difference between nominal and real values is that real values are adjusted for inflation, while nominal values are not. As a result, nominal GDP will often appear higher than real GDP. Last week’s “real” GDP number brings back memories of a Jim Grant conference where Van Hoisington (Hoisington Investment Management) was a guest speaker. He began (as paraphrased):

Real GDP does not exist. I mean, literally, it does not exist. It’s a figment of the imagination of scorekeepers at the Department of Commerce who apply various adjustments to nominal GDP. Nominal GDP is what’s in your billfold. You go to a grocery store, you give them a dollar. That’s nominal GDP. That’s the sales that are entered as nominal growth. Nominal interest rates are what you pay. You have never met a real interest rate; I have never met one. You have never met a real GDP; I have never met one.

“Nominal versus Real,” what a novel concept; so, let’s see what happens if we apply it to the stock market. Measuring the D-J Industrials Average (INDU/16643.01) from its then all-time high of 11722.98 in the spring of 2000 shows that index is higher by 42%. However, in “real” terms the Industrials are virtually unchanged. Of course, hereto, you have never met a “Real Dow.” I have never met a “Real Dow.” While these charts from Advisor Perspectives are a few months old, you’ll get the idea. We live in a nominal world, not a “real” (inflation-adjusted) world. So, what happened in nominal terms last week?

Actually, the saga began in early July when my timing models said the equity markets were going into a period of contraction that should last into August 13 – 18th +/- 3 sessions. Since Friday August 21st fell within that +/- 3-session margin of error, August 21st’s 531-point drop should have come as no surprise. Normally, or should I say nominally, that Friday should have been “it” on the downside. But, as I stated on CNBC that morning, “Never on a Friday,” meaning once the stock market gets into one of these “selling skeins” it rarely bottoms on a Friday, giving participants over the weekend to brood about their losses and show up Monday/Tuesday in “sell mode” . . . aka, “Turning Tuesday.” And, that is pretty much the way it played, which is why I stated on CNBC the following Monday (8/24/15) today is “it,” the bottom/capitulation. Tuesday morning that “call” was looking good, but the early/mid-session strength gave way to late-session weakness as a number of trading platforms like the BATS Exchange were “off line,” causing liquidity to evaporate. That freaked traders out and they hit what bids were out there, leaving the senior index off 205 points at the closing bell. Still, our conviction was high and we bought some stocks. Obviously that conviction was rewarded on Wednesday (+619 points) and Thursday (+369 points). The 1300-point Dow Wow, from Monday’s intraday low to Thursday’s intraday high, took the Industrials back up to resistance levels, which is why we said, “We would not look for much more upside strength.”

Importantly, last Monday did qualify as a 90% Downside Day, as well as the most oversold the S&P 500 (SPX/1988.87) has been since the 1987 crash. At such inflection points what you typically see is a two- to seven-session recoil rebound. I think that started on Tuesday, leaving us four sessions into said rebound. If correct, it would imply some kind of downside retest beginning sometime this week. Yet by far, at least for me, the biggest event of last week was Monday’s Dow Theory “sell signal.” As repeatedly stated last week, we are temporarily ignoring that signal, but it does make me nervous. The next few weeks should tell us if ignoring such a signal is right or wrong. If wrong, we will change our views. In the meantime, on the premise that we are in a successful downside retest environment, we continue to urge you to get your shopping list together. Last Monday we gave a list of our fundamental analysts’ best ideas for sustainable high single-digit (or higher) free cash flow yields companies. Last week another list was compiled with our fundamental analysts’ strongest conviction ideas. While the list consisted of 12 names, only three of them screened well on our algorithm system. Those were: Ctrip.com (CTRP/$69.50/Strong Buy); Jarden (JAH/$52.34/Strong Buy); and Yadkin Financial (YDKN/$20.39/Strong Buy).

I also bought some mutual funds last week. I have met with Columbia Threadneedle’s portfolio manager David King a number of times and have become comfortable with his investment style. The two funds I bought were Columbia Flexible Capital Income Fund (CFIAX/$11.51) and Columbia Convertible Securities Fund (PACIX/$18.07). CFIAX takes a different tack from most other equity income funds in that it is able to invest across ALL asset classes without sector or security constraints. PACIX is just what its name states, a convertible securities fund. Those of you that have followed my work over the years know that I really like converts. In fact, one idea I shared with David was Iridium Communications’ 6.75% convertible preferred (IRDMB/$279.50), which is currently yielding 6% and whose common shares (IRDM/$7.18) have a Strong Buy rating from our fundamental analyst. Last week I also met with arguably the best straight preferred portfolio manager (PM) in the country. Don Crumrine is the PM for a number of preferred stock mutual funds and closed end funds. I bought one of his funds as well last week, the Flaherty & Crumrine Dynamic Preferred and Income fund (DFP/$22.42). As a sidebar, Don managed a preferred portfolio for Charlie Munger and Warren Buffett. For more information on such funds, please contact our mutual fund research, and our closed-end funds, research departments.

The call for this week: A few weeks ago I said I was not concerned with China’s wrongly named “devaluation” and its potential to start a currency war. Over the weekend China stated there is no basis for the renminbi’s continued depreciation. Speaking to China’s impact on the U.S., Gluskin Sheff’s David Rosenberg notes that China’s economy has only a 16% correlation to the U.S. economy and is therefore insignificant. Bank of America Merrill Lynch writes that $19 billion of mutual fund redemptions occurred last Tuesday, the second largest since 2007, which smacks of capitulation. Of course, capitulation was also registered by two consecutive 90% Downside Days (August 21st and 24th), which were followed by last Thursday’s 90% Upside Day. Such capitulation is typically followed by a two- to seven-session “throwback rally” and then a downside retest. If that pattern plays, it should tell us over the next few weeks if ignoring last Monday’s Dow Theory “sell signal” is the correct strategy. And this morning our late week “call” to not expect much more upside above the 1970 – 2000 level on the SPX appears to be playing with the S&P preopening futures off some 16 points. Stay tuned . . .

Copyright © Raymond James