If Chinese policymakers don’t alter course soon, the current Chinese equity market correction could turn into a stock market plunge similar to what happened in the United States in 1929.

Global CIO Commentary by Scott Minerd

Having spent the summer ruminating over the macro events in Europe, my focus has now turned to the U.S. stock market crashes of 1929 and 1987. Why, you might ask? The answer lies in China, where policy interventions in the face of a steep selloff are quickly becoming the first blemish on Xi Jinping’s leadership record.

Whether the current period becomes known as China’s version of 1929’s Black Thursday in the United States or a much healthier scenario analogous to 1987’s Black Monday, now depends very much on the strategy its policymakers adopt over the next few months. For China’s sake, I hope it is the latter, but at this point investors should take note that the world’s second-largest economy could just as likely find itself at the epicenter of this century’s greatest equity market correction.

Despite the selloff, the Chinese stock market is still grossly overvalued, with the median P/E more than double that of the S&P 500.

Fueled by demand from Chinese retail investors, the Shanghai Composite Index soared by more than 150 percent from mid-2014 and early June 2015. In the same period, the Shenzhen Composite Index rose by more than 200 percent. Such exuberance has come to a violent end, with indices down almost a third from their June 12 peak of more than $10 trillion in market capitalization.

Despite the recent selloff, the Chinese stock market is still grossly overvalued, with the median price-to-earnings (P/E) ratio* for the Shanghai Composite Index hovering around 40, more than double the median P/E ratio of the S&P 500. By another valuation measurement, the market-capitalization-to-gross-domestic product (GDP) ratio for China is currently above 60 percent, well above its average of 40 percent over the past 10 years.

From here, the best case for Chinese equity markets may be a scenario similar to what happened in 1987 in the United States, when, after a huge selloff in October, the market retraced, then reversed, but ultimately established a base that began a rally that lasted until 1989.

The alternative scenario to 1987 is 1929, the course upon which China currently seems set. Chinese policymakers’ unorthodox attempts to bridle the runaway market resemble the policy response of the United States in 1929, which basically relied on investor groups to purchase large blocks of stock in the hope of propping up equity markets. As in 1929, this type of market intervention will do nothing to solve the fundamental problem in China’s equity markets today. The unresolved issue is that prices have detached from fundamental value due to a wave of debt-fueled retail investor mania.

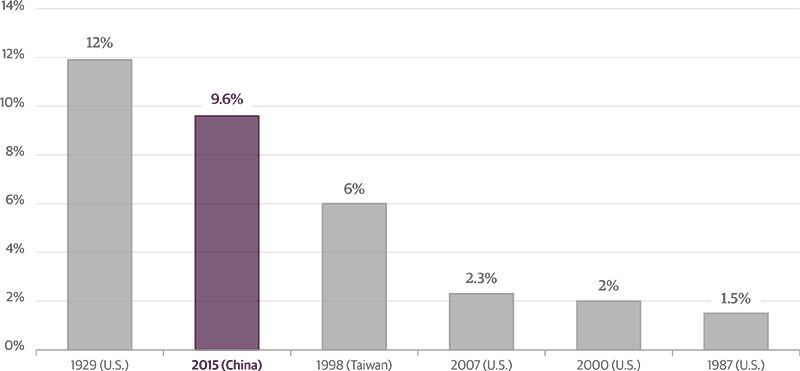

This too is analogous with 1929. China’s sky-high margin-debt-to-total-market-capitalization ratio is estimated to be near 10 percent. In reality, it is likely even higher when you factor in margin lending by China’s shadow banking system. By comparison, U.S. margin debt is currently less than 3 percent of total market cap, but in 1929, margin debt in the United States reached a high of 12 percent of total market capitalization prior to the stock market’s collapse.

The clear answer at this point is not for China to endeavor to apply splints to its broken market, but instead for the People’s Bank of China (PBOC) to flush the system with cash and allow the renminbi (RMB) to depreciate significantly. Unfortunately, this may not be palatable. Chinese policymakers will do anything they can to avoid devaluation ahead of the International Monetary Fund’s November decision on the RMB’s special drawing rights (SDR) status. China may not have that long to act if it is to avoid a full-blown disaster. In the meantime, my best estimate is that the PBOC will be forced to increase sales of Treasury securities to prop up the RMB as more capital flows out of China. I would expect up to $300–500 million of Treasury liquidation may be necessary to hold the line on RMB depreciation in the coming months.

If China’s crisis does turn into a 1929 scenario—which would be devastating for China and would have broad implications for the rest of the world—one takeaway for investors is that the United States is likely to remain at least somewhat insulated. A Chinese slowdown will put energy and commodity prices under pressure, which will benefit U.S. consumers and U.S. manufacturers as input prices fall, and should help support earnings in the near term.

The transitory period that lies ahead, however, promises to be rocky for all global markets. Consider how much Greece’s $300 billion debt crisis roiled investors (a figure dwarfed by the $3 trillion lost by Chinese equities markets since June). Under any circumstances investors should expect to see increased market volatility with a growing safe-haven bid for Treasury securities, which I expect will push the U.S. 10-year note to 2 percent or lower in the near term. Renewed downward pressure on interest rates will increase market volatility and is likely to adversely affect credit spreads. On a positive note, lower interest rates, along with declining energy prices, should spur U.S. housing activity, and assuage any lingering concern caused by last week’s disappointing new home sales data, which fell 6.8 percent to 482,000 homes sold in June.

For China, the outcome to this crisis is still far from a foregone conclusion. There is still time for its policymakers to refocus. The best path would be to further loosen monetary policy and inject as much liquidity as possible into its markets—even if this forces the party to relax its control of the RMB and put some strategic political objectives on the back burner. If it doesn’t adopt this strategy, China may learn the painful and lasting lessons taught by the calamitous market collapse in the United States in 1929.

High Margin Debt Could Pose Further Risk to Chinese Selloff

A key factor driving Chinese equity markets higher over the past year has been a rapid run up in margin debt, which climbed to a high of 9.6 percent of market cap at the market peak in June. This figure is high by both historical and global standards, and is likely understated due to significant hidden leverage outside the system. While margin debt has begun to unwind in the midst of the latest stock selloff, there is still a great deal of margin debt outstanding, meaning more turbulence could lie ahead for China’s stock market.

Margin Debt as Percent of Market Cap Prior to Crashes

Source: Haver, Bloomberg, Wallstreetcn, Guggenheim Investments. Data as of 7/24/2015.

Economic Data Releases

Consumers and Housing Support Second-Quarter GDP

- Second-quarter real GDP rose at a 2.3 percent annualized rate, slightly under expectations. Consumer spending accelerated and housing investment remained strong, while business investment fell.

- Durable goods orders rose roughly in line with expectations in June, up 3.4 percent. Orders excluding the volatile transportation component rose 0.8 percent.

- Home price appreciation was flat in May, according to the S&P/Case-Shiller 20 City Composite Index, which ticked down to 4.94 percent year over year from 4.95 percent.

- The Conference Board’s Consumer Confidence Index fell to 90.9 from 99.8, the lowest level since September 2014.

- Pending home sales fell 1.8 percent in June, the first decline this year.

- Initial jobless claims rose off a multi-decade low for the week ending July 25, to 267,000 from 255,000.

European Outlook Firms as Growth Accelerates

- Euro zone economic confidence made a four-year high in July, rising to 104.

- Germany’s IFO Business Climate Index beat expectations in July, rebounding to 108 after falling the past two months.

- Consumer confidence in Germany was unchanged in the August GfK survey, holding at 10.1.

- Germany’s Consumer Price Index rose 0.1 percent year over year in July, an unchanged rate from June.

- Spain’s second-quarter GDP rose 1.0 percent, its best quarter since 2007.

- Second-quarter GDP in the United Kingdom rose in line with expectations, up 0.7 percent on the back of strong service sector activity.

- Japanese retail sales were down 0.8 percent in June from a month earlier, in line with expectations.

- Industrial production in Japan rose 0.8 percent in June following a 2.1 percent drop in May.

Definitions

* The price-to-earnings, or P/E, ratio of a stock is calculated by dividing the current price of the stock by its trailing 12- month’s earnings per share.

Important Notices and Disclosures

This article is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2015, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.