by Jeffrey Saut, Chief Investment Strategist, Raymond James

I have been traveling a lot recently and this week will be no exception as I am in Victoria, British Columbia currently and am leaving for Vancouver tomorrow. While traveling is exciting and educational, it is also exhausting. Moreover, sleeping in strange beds doesn’t help the exhaustion factor. To be sure, I often find myself suffering from dyssomnia in a fitful sleep accompanied by some pretty strange dreams. Take Saturday night: I fell asleep around 10:00 p.m. dreaming of four sheep jumping over a fence. Then it was four pickles and then four women. The dream seemed to center on the recurring number four. Consequently, when I awoke I decided that the number 4 couldn’t lose so I picked up the phone and placed a $444 bet on the forth horse in the fourth race. Later that day I called back to find out the results of said race only to hear that my horse had lost, but had come in fourth. “Well, who won?” I inquired. “Pickles” was the response!

Similarly, many stock market participants seen to currently be dreaming about 7-come-11, which is the winning “come out” roll of the dice on a crap table. And from my perspective, this mindset has given the biotech complex the appearance of a casino. Indeed, each morning when the “casino” opens, it’s as if the dealer is saying, “Ladies and Gentlemen, place your bets.” Recently, those “bets” have been getting more and more speculative as seen by the volume and tremendous price acceleration (Chart 1). Moreover, on Friday my Bloomberg machine showed more than one-third of the percentage gaining stocks were in the biotech space. Even more to this speculation point is that most of those biotech names were under $10 per share. Clearly, speculation is back on the Street of Dreams and it reminds me of an era gone by when, like now, we were living in a low interest rate world. The era was the late 1960s where any company whose name ended with “onics” traded towards the moon. I called it the great garbage market where the investment strategy du jour was hold your nose and buy. Back then, the environment was surrealistic with an increasing aura of detachment and unreality. Of course, many of the old fogies of the day, who had experienced previous bear markets and were consequently managing their risk, were accused of losing their nerve and subsequently were replaced with a new breed of young money managers that had no fear. Those of us who remember that era know how it ended ... and it ended badly. While seasonality continues to favor the biotechs, with the index advancing from mid-June to mid-September in 20 of the past 23 years, I would choose my biotech names very carefully, trying to emphasize those companies that are actually making money.

While there is clearly speculation in the biotech space, there is not such speculation in the overall stock market. In last Friday’s Morning Tack I shared an email from one of our particularly insightful Financial Advisors (Peter Muckerman) who wrote:

I have been buying the Barron’s every Saturday for the last 20 years, and the local grocery store where I buy it only orders about 5 of them. They are never sold out and what’s possibly more interesting is that they have stopped carrying the IBD. Now, I find this to be somewhat interesting only from the respect of the public’s lack of interest in the stock market.

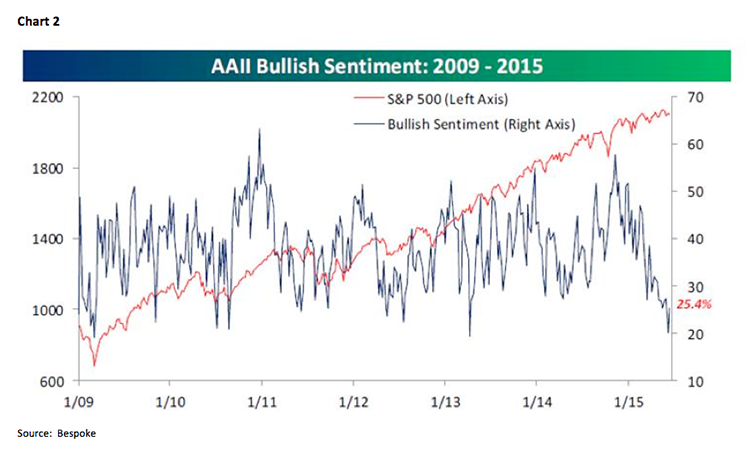

You can see this lack of bullishness in Chart 2. Peter went on to note:

Also, this is profoundly interesting since one of the panelists speaking up on the Hill in regards to the recent “DOL Proposal” noted that: “some 50% of all TSP money is sitting in the G Fund.” Now, that is striking to me, and it tells me: 1) They have gotten no advice, 2) Has the Government failed in their own fiduciary responsibility to educate their work force?, 3) the general public still hates the stock market, and 4) The market has further to run on the upside.

To clarify I wrote:

Now I lived in the D.C. area for years and therefore am familiar with many of the acronyms. But for those of you that are not, DOL stands for the Department of Labor and the DOL proposal would change the way investment advice is given for retirement accounts. On Tuesday a House bill was introduced to stop the DOL’s proposal to change investment advice standards for retirement accounts. TSP is the acronym for Thrift Savings Plan, and the G Fund is basically a Treasury-centric money market fund. Now that we have the acronyms right, we can better understand Peter’s point. The investing public has very little interest in stocks, which is yet another reason we are a long way from the end of this secular bull market.

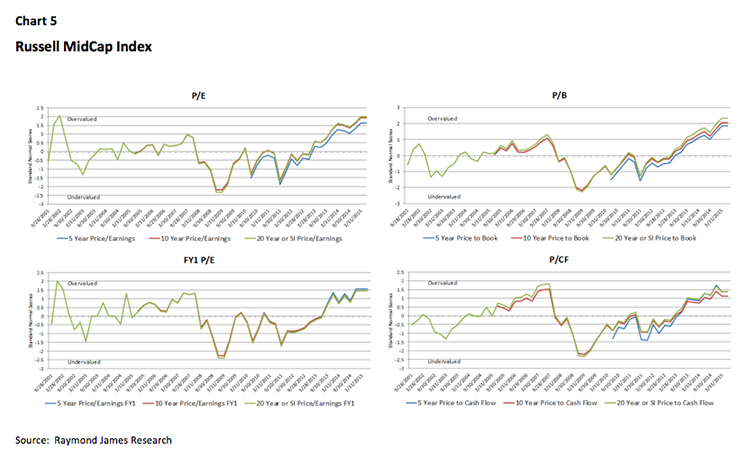

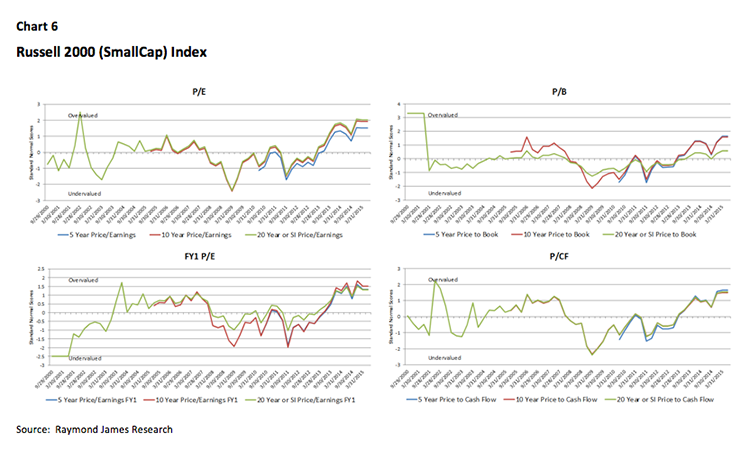

On Friday, however, the S&P 500 (SPX/2109.99) failed to follow through on its upside breakout above 2115. This type of action has been frustratingly endemic this year as the SPX is up one day and down the next as can be seen in Chart 3 where the green bars represent “up” days and the “red” ones down days. Yet, while indices like the Dow and S&P have pretty much flat-lined year to date (YTD), the Russell 2000 (RUT/1284.66) has held its uptrend lines and gained 6.64% (Chart 4). Yes, I know the Russell MidCap and SmallCap Indices are expensive on a Price to Earnings, Price to Book, Price to Forward Earnings, and Price to Cash Flow basis, but they are working on the upside despite being 1.5 to 2 standard deviations above the norms (Charts 5 and 6). I think the reason they are working is because, in a low earnings growth environment, small/mid-caps for the most part are delivering decent earnings growth. Additionally, many individual mid/small-cap names are not all that expensive.

The call for this week: Historically, the week after the June “witch twitch,” the Dow has been down an average of 1.1% and has fallen 22 of the last 25 years, according to The Stock Trader’s Almanac. Friday’s failure to follow through on Thursday’s rally only reinforces the probability for more consternations this week. It is also worth mentioning that the recent new highs in some of the major indices have been unconfirmed by new highs in the normal and Operating Company Only Advance/Decline lines, and as well that the spread between the Demand (read: buyers) and Supply (read: sellers) lines is at the narrowest point since the mid-October of 2014 lows (we were bullish). While I do not think Supply will cross above Demand (read: negatively), it is an indicator worth monitoring closely. It is also worth noting that the SPX has tested, and held, its recent intraday reaction low of 2072 twice, which is 2 standard deviations below its 50-day moving average. In the process, the SPX has formed what looks to be a “W” trading bottom in the charts. Whether that means anything in this Greek Gotcha’ market environment is debatable. Plainly all eyes will be on Greece again this week given next week’s debt deadline. I continue to believe a last minute deal will come to “kick the can” further down the road, giving folks time, that will likely be squandered, to come up with a workable solution. Meanwhile, there are NO signs of a bull market top, but my models/indicators do suggest the short-term stock market “expansion phase” is over and a contraction phrase will begin this week into the July 4th holiday. Stay tuned ...

Copyright © Raymond James