Mother Nature Designed You to be a Bad Investor

by Jim O'Shaughnessy, O'Shaughnessy Asset Management

Mother Nature has it in for your investment results. She has programmed all of us to make a lot of mistakes when making investment decisions. Using the world’s largest twin registry, the Swedish Twin Registry, matched with detailed data on identical twins’ (who share 100 percent of their genes) investment behaviors, allowed researchers Henrik Cronqvist and Stephan Siegel to tease out how much our genetic programming affected our investment behavior. In their paper, “The Genetics of Investment Biases,” the authors state:

“For a long list of investment ‘biases,’ including lack of diversification, excessive trading, and the disposition effect, we find that genetic differences explain up to 45% of the remaining variation across individual investors, after controlling for observable individual characteristics. The evidence is consistent with a view that investment biases are manifestations of innate and evolutionary ancient features of human behavior.”

In other words, all of the things that helped us survive as a species tend to make us horrible investors. Here’s psychologist Philip Zimbardo’s take:

“Because of the rapid change of the world around us since our birth, we humans are living anachronisms. Our world has changed dramatically in the past 150 years. Human physiology, in contrast, took millions of years to create and has not changed much in 150,000 years. Your body—even if it is in mint condition—is designed for success in the past. It is an antique biological machine that evolved in response to a world that no longer exists. Although we live in a world in which computer processing speed doubles roughly every twenty-four months, human information processing has not expanded substantially over the past 150,000 years. Our physiology is clearly behind the times.”

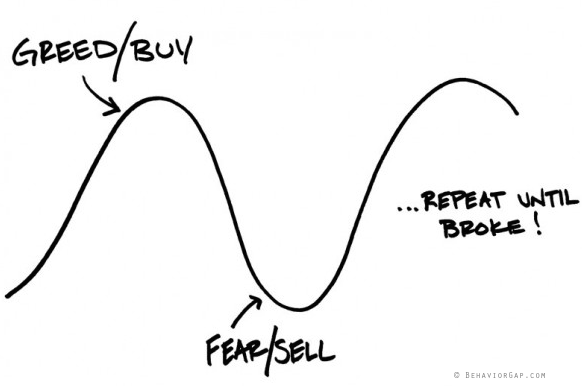

Our very humanity serves as a significant headwind to long-term investment success. It’s why each generation commits the very same investment mistakes time after time—selling near market bottoms; buying enthusiastically after the market has gone significantly higher; failing to do any real homework on an investment’s particular merits, all of which generally leads to very poor results.

I have long said that the four horsemen of the investment apocalypse are fear, greed, hope and ignorance. And note, that of the four, only one is not an emotion. These four things have wiped out more value in an investor’s portfolio than even the most vicious bear market. So what are we to do?

First, take this article to your investment advisor—and if you don’t have one, I highly recommend you find one for this plan to work. Tell your advisor that you want to work with them on building a rules-based methodology to guide your investments. Acknowledge that you realize at some point in the future you will become extremely emotional about some component of your overall investment portfolio and that you give them permission—I would go so far as actually writing up your plan and have you and your advisor sign it—so that they can show it to you when things look particularly bleak. It really doesn’t have to be anything fancy—indeed, it could be a simple commitment to keep your overall portfolio allocation in line with what you agree seems a prudent allocation.

So, for example, if you have decided that you want 60 percent of your investments in stocks and 40 percent in bonds, this agreement allows your advisor to sell down an asset as it exceeds the allocation and move the money toward assets that have declined and are below the allocation you agreed to when you started. Think of how well this would have worked during the financial crisis: Instead of panic selling your stock holdings, this simple agreement would have you selling some of your bond holdings—which did well—and reallocating those funds to equities. Of course, almost no one actually did that during the crisis. Yet, if you had this rules-based system in place, coupled with your new knowledge of how nature has stacked the deck against our succeeding with our investments, you would have. And would have been very happy you did, looking back from today’s vantage point. It might not be nice to fool Mother Nature, but it’s the only way to ensure investment success.

Copyright © O'Shaughnessy Asset Management