by Ben Carlson, A Wealth of Common Sense

Stock market prices are artificially high. Bond market yields are artificially low. Valuations are at unsustainable levels. It’s all paper gains that will be erased eventually. We need a more normalized environment.

Investors and pundits have been hammering these points home for some time now. And there is some legitimacy to the idea that interest rates are too low and valuations are above average. But waiting around for the markets to return to “normal” could mean you’re waiting for a long time. Normal markets just don’t occur very often when you look back historically.

The average 10 year treasury yield since 1871 is 4.6%. Let’s assume that normal market conditions are in the 4-6% range. I’m sure fixed income investors would kill for high quality bonds offering those types of yields today. Looking back at the historical data shows that interest rates have only been in this range about 25% of the time over the past one hundred and forty plus years.

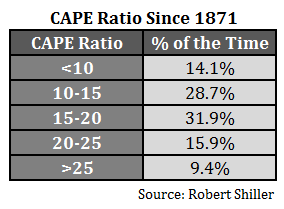

Average stock market valuations are even more rare. If you look at Robert Shiller’s cyclically adjusted price to earnings ratio (CAPE) going back to 1871, the average has been close to 16 times the trailing inflation-adjusted average ten years’ worth of company earnings. Assuming a normal valuation for CAPE falls between 15-17, the market has traded in this range just 14% of the time.

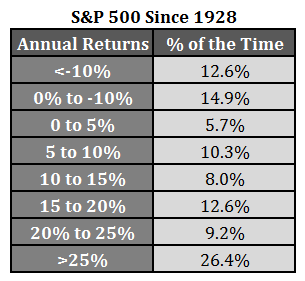

Average market returns follow a similar pattern over time. The long-term average annual return on U.S. stocks has been close to 10% or so since the late-1920s. Since 1928, the S&P 500 has only finished the year with a return in the range of 8-12% just three times. That’s roughly 3.5% of the time that the market has performed near the long-term average.

Here are bond yield ranges broken down over time:

These numbers show how often stocks have traded in certain CAPE ranges over time:

And finally here are the annual return breakdown for the S&P 500 going back nearly 90 years:

Markets are far from average these days, but it’s quite rare for markets to ever end up average at any given time. There’s no such thing as a normal market. Change is the nature of the beast. The markets spend most of their time either overshooting or undershooting the long-term averages. And those long-term averages are a moving target, as well, as things are never static.

Unfortunately, markets never make it easy on you.

Further Reading:

The CAPE Ratio and a Range of Historical Outcomes

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense