Managing risk

April 13, 2015

by Jeffrey Saut, Chief Investment Strategist, Raymond James

Most people acknowledge that losses will happen regardless of the type of business venture. A light bulb manufacturer knows that two out of three hundred bulbs will break. A fruit dealer knows that two out of one hundred apples will rot. Losses per se don’t bother them; unexpected losses and losing on balance does. Acknowledging that losses are part of business is one thing; taking and accepting those losses in the markets is something else entirely. In the markets, people tend to have difficulty actively taking losses. This is because all losses are treated as failure; in every other area of our lives, the word loss has negative connotations. People tend to regard the words loss, wrong, bad, and failure as the same, and win, right, good and success as the same. For instance, we lose points for wrong answers on tests in school. Likewise, when we lose money in the market we think we must have been wrong.

... What I Learned Losing a Million Dollars, by Jim Paul and Brendan Moynihan

While some of this letter is a reprint from an era gone by, its wisdom stands the test of time because everyone knows how to win and few know how to lose. Yet the secret to making money in the markets is knowing how to lose, or how to control your losses. Listen to the pros:

“I’m always thinking about losing money as opposed to making money. Don’t focus on making money; focus on protecting what you have.” – Paul Tudor Jones

“The majority of unskilled investors stubbornly hold onto their losses when the losses are small and reasonable. They could get out cheaply, but being emotionally involved and human, they keep waiting and hoping until their loss gets much bigger and costs them dearly.” – William O’Neil

“One investor’s two rules of investing:

1) Never lose money.

2) Never forget rule No. 1.” – Warren Buffett

All of those pros have different market philosophies. They have contradictory strategies for making money. Some are traders; some are value players; some are growth-stock advocates; others are emerging-growth seekers; etc., etc., etc. But the message is clear – “Learning how not to lose money is more important than learning how to make money!” Now consider another quote from the brilliant Peter Bernstein (author of “Against the Gods”):

After 28 years at this post and 22 years before this in money management, I can sum up whatever wisdom I have accumulated this way: The trick is not to be the hottest stock-picker, the winning forecaster, or the developer of the neatest model; such victories are transient. The trick is to survive. Performing that trick requires a strong stomach for being wrong, because we are all going to be wrong more often than we expect. The future is not ours to know. But it helps to know that being wrong is inevitable and normal, not some terrible tragedy, not some awful failing in reasoning, not even bad luck in most instances. Being wrong comes with the franchise of an activity whose outcome depends on an unknown future. Look around at the long-term survivors at this business and think of the much larger number of colorful characters who were once in the headlines, but who have disappeared from the scene.

I don’t know how much of a “colorful character” I am, but I am a survivor because I learned to manage the risk of being “wrong” during the 1973 to 1975 bear market. Manifestly, managing losses has been a lesson that has served me well over the years. It has been particularly helpful during the 2000 – 2013 range-bound stock market. To be sure, since the Dow Theory “sell signal” of September 1999 I have tried to manage the risk in keeping with the mantra, “Don’t let ANYTHING go more than 15% - 20% against you.” In conjunction with that mantra I have also employed asset allocation, as well as a strategy of rebalancing investment positions in an attempt to manage the risk.

Portfolio rebalancing, when done correctly, is an art form. Simply stated, portfolio rebalancing is the strategic redistribution of asset classes within a portfolio to keep said portfolio’s objectives in-line with its original objective. As John Valentine of Valentine Capital notes:

To provide a simplified allegory, think of investment planning for the future as an automobile, conveying an investor to his or her financial goals. The investment portfolio is its motor, the asset allocation model is the fuel mixture, and the assets invested are the fuel. The more efficiently the motor runs, the greater the speed with which the whole vehicle travels toward the destination. Should the fuel mixture, or asset allocation, run too rich, the motor wastes precious fuel. Should it run too thin, the car has trouble achieving enough forward momentum. ... Many individuals on the road to their financial goals fail to make these periodic adjustments and still eventually arrive. Not surprisingly, the investor who rebalances his portfolio at regular intervals may arrive sooner and with more fuel in his tank. ... Rebalancing a portfolio is crucial to the investor seeking to reduce the volatility in a portfolio and increase cash flow simultaneously. ... The longer a portfolio is left unbalanced, the more compromised its asset allocation may become. There are two potentially negative repercussions associated with a compromised allocation: being overexposed to the downside and underexposed to the upside. Don’t let this happen to you!

At the end of last year I strongly recommended rebalancing portfolios with the cry, “If you have stocks in your portfolio that have not rallied in this straight-up rally since June of 2012 there is probably something wrong with the company. Since the indicators/models that have served us so well over the years are ‘saying’ the first few months of 2015 are going to be rocky and more volatile, you should sell those non-rallying stocks and raise some cash to take advantage of forthcoming opportunities in the new year.” So far that has been a pretty good call.

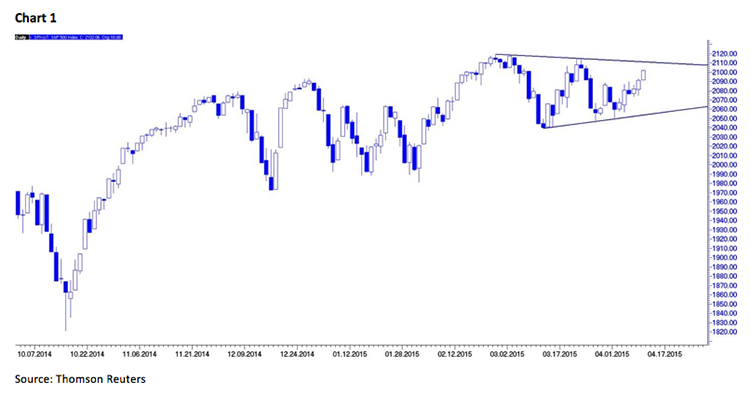

The call for this week: In the near-term the S&P 500 (SPX/2102.06) has worked itself into what a technical analyst would term a wedge chart formation (see chart on page 3). It has also been trapped between 2120 and 2040 since early February of this year. Accordingly, I told Jacqueline Doherty of Barron’s (see today’s issue) last Friday, “While no one can consistently time the stock market, if you listen to the market’s message you can certainly decide if you should be playing hard, or not playing so hard. Eventually the SPX will resolve its range-bound condition and hopefully we will be able to recognize it when that happens.” This morning the preopening S&P 500 futures are relatively flat (-3) amid the headlines “China’s exports shrink by 15% y/y in shock fall,” Greece may have blown best hope for a debt deal,” and “The U.S. loses sparkle as Europe shows signs of hope.” Headlines like these have oil up (+1%) and the U.S. Dollar index better by 0.6%.