by Ben Carlson, A Wealth of Common Sense

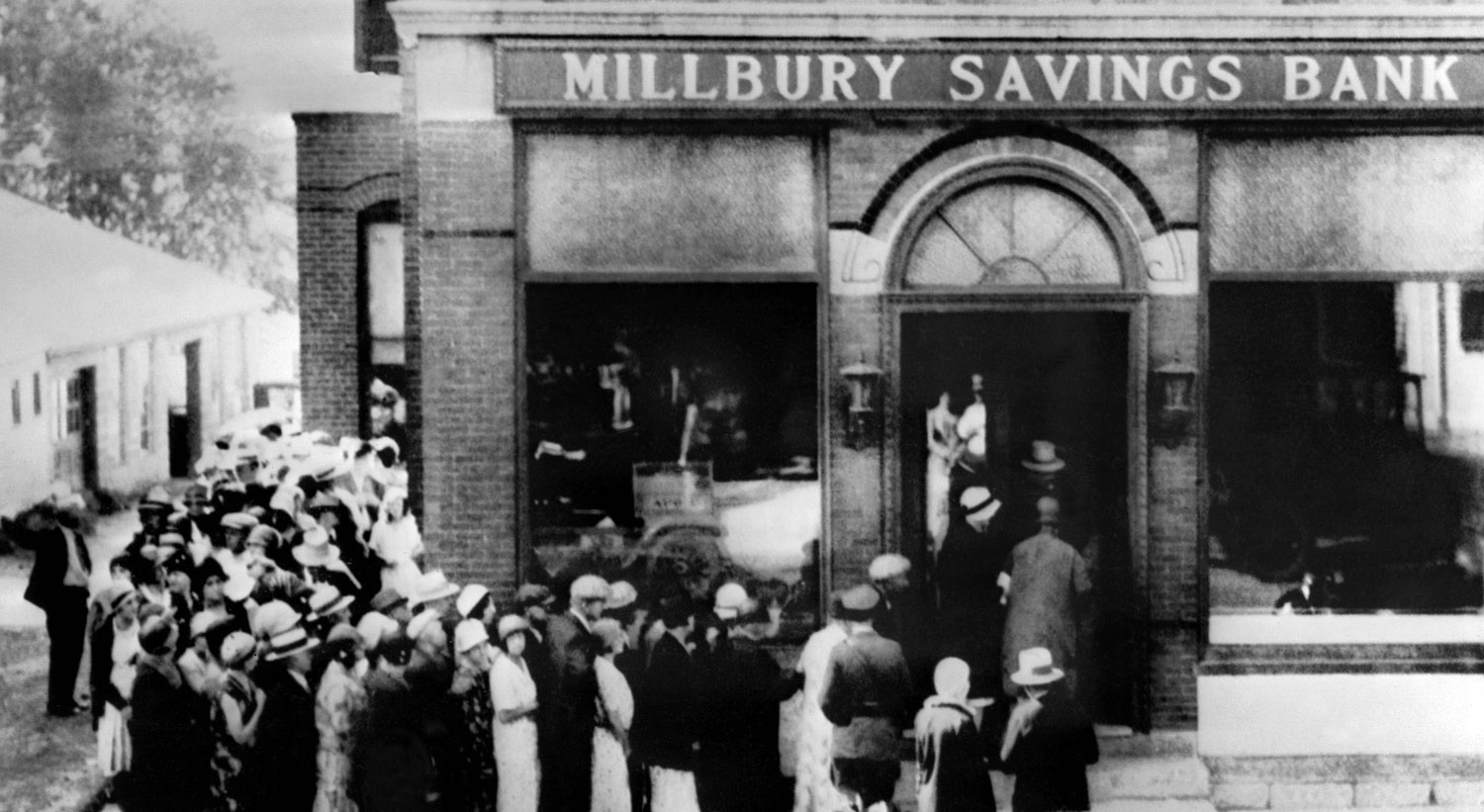

Dean Mathey was a successful investor who served as chairman of the investment committee at Princeton from the 1920s through the 1940s. Late in his career he privately published a book called Fifty Years of Wall Street that included a section with nine lessons learned during the Great Depression.

It was reprinted in the book The Investor’s Anthology by Charles Ellis. I think his commentary has aged well and is worth a read:

1. That once about every 7 to 10 years there is a period of excessive general speculation culminating in a severe panic or depression when the man that is borrowing money is at a great disadvantage and he who has cash ready stands like a tower, four square to the ill winds that blow.

2. Extreme situations do not last, no matter what the apparent justification. No ladder is high enough to reach to Heaven. While we may have “new eras,” old laws will still operate.

3. Avoid commitments, particularly of the delayed variety, they are more insidious. These birds may be depended upon to come home to roost when they are least welcome. Also, be definite about commitments made by to you by others. When the storm comes, misunderstandings are so easy and so natural. What a joy a good clear record is in such a predicament!

4. Both in 1920 and 1929 the so-called “big fellows” in general said everything was o.k. But if the big fellows in general thought otherwise the stage could not be set for the unexpected. Panics occur because the leaders themselves have lost their way. And panics on Wall Street are notoriously periodic.

5. Never borrow money without continuously reviewing and questioning your ability to pay it back under the worst conditions. Never borrow short-term money on unmarkable collateral.

6. It’s right to be an optimist, but be prepared for the worst.

7. Make a practice of not giving GRATUITOUS ADVICE ABOUT THE PURCHASE OF SECURITIES.

8. People borrow money in good times and pay it back in bad times — just the opposite of what they should do.

9. The public are just as blind to recognizing the bottom of a depression as they are in recognizing the top of a boom. While there is no ladder that reaches Heaven, the ladder that reaches all the way down to Hell in a country like America is just as fantastic.

His talk of investment cycles still holds up well, but I find it fascinating how much he talks about the pitfalls of leverage. You really get the sense that investors were scarred for life from overdoing it with borrowed money after what they experienced during the Great Depression. I also subscribe to the be an optimist but prepare for the worst line of thinking.

Source:

The Investor’s Anthology: Original Ideas From the Industry’s Greatest Minds

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © Ben Carlson, A Wealth of Common Sense