by Walter Kurtz, Sober Look

Back in September the idea that the Eurozone's economy could potentially undergo a recovery (see post) was met with some skepticism. And yet here we are. The EuroStoxx50 index is up 14% for the year while the Dow is up 2.5%. We now see plenty of indicators showing strengthening economy in the euro area.

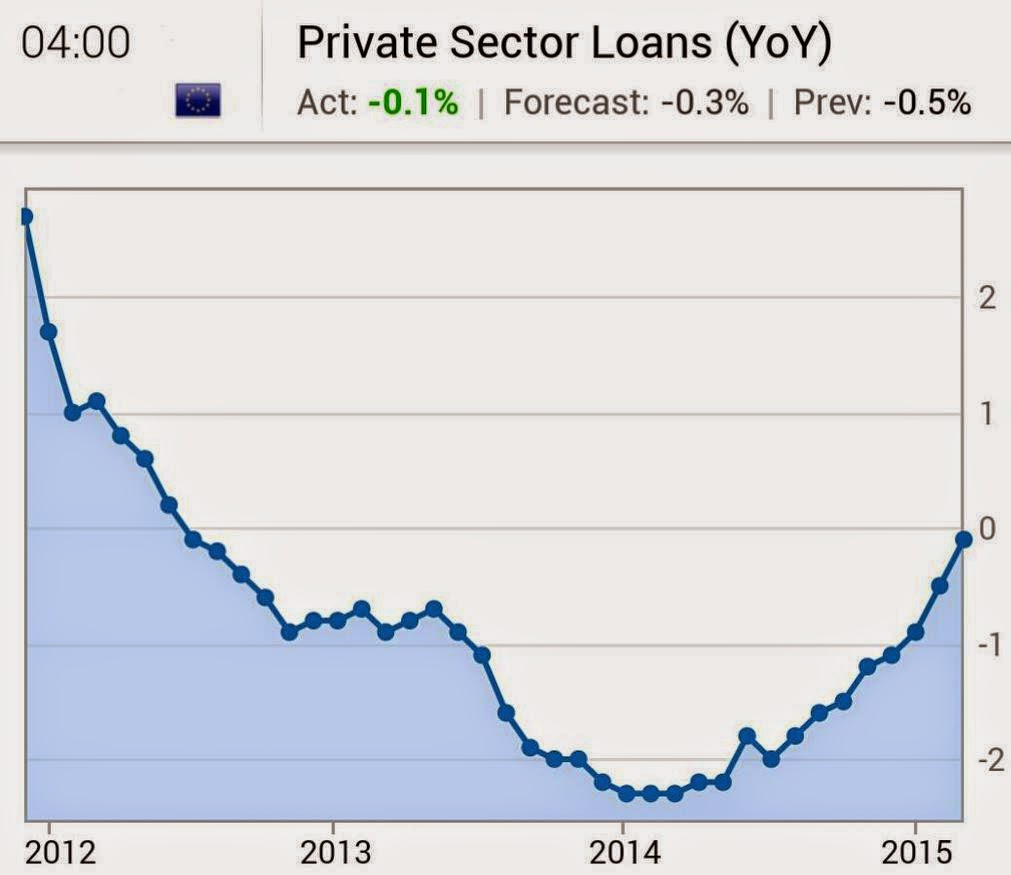

To begin with, the area's credit conditions continue to improve as loan growth is about to turn positive for the first time since the middle of 2012.

|

| Source: ECB, Investing.com |

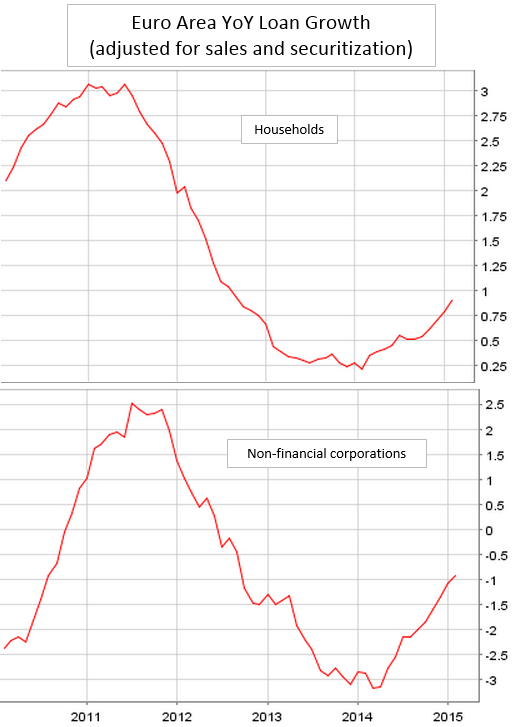

Corporate and household loan expansion, while still terrible relative to the US, is on the right path. This is particularly true after the conclusion of the ECB's stress tests (which were a major source of uncertainty in 2013).

|

| Source: ECB |

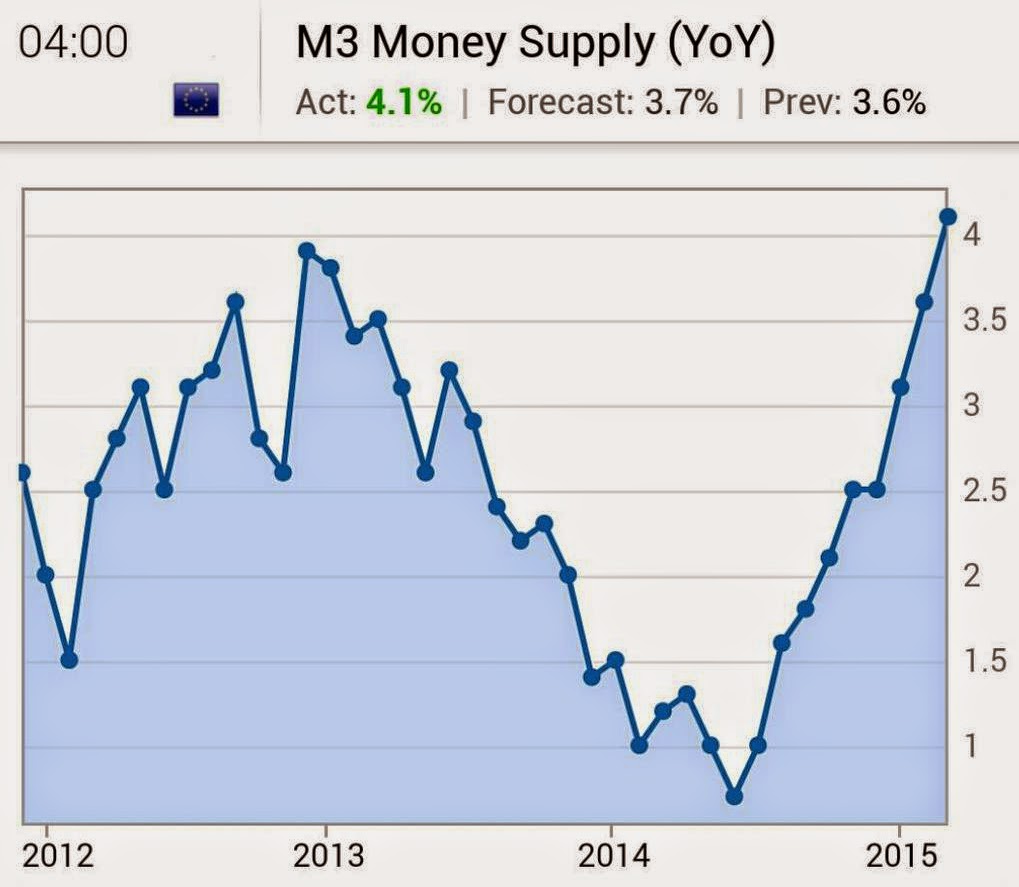

The area's bank deleveraging is ending (see post) and the strongest evidence of that can be seen in the acceleration of the broad money supply growth. The M3 expansion trend has been fairly consistently beating economists' forecasts.

|

| Source: ECB/ |

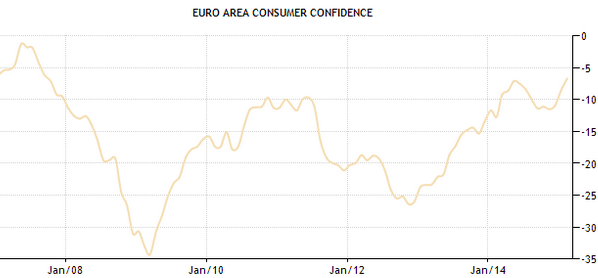

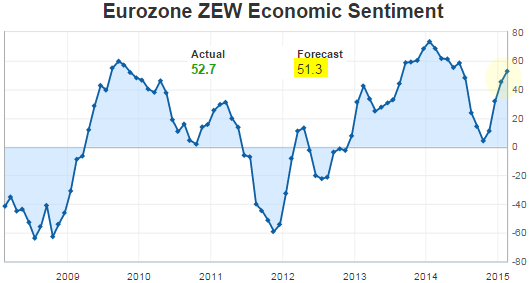

Both business and consumer sentiment surveys, which soured significantly after the Russia sanctions went into effect, showed marked improvements recently. Part of the reason is the decline in fuel prices.

|

| Source: TradingEconomics |

|

| Source: Investing.com |

Moreover, the labor markets are exhibiting signs of stabilization. Just to be clear, the declining unemployment is highly uneven across the various states and nobody claims the job situation in the Eurozone is in good shape.