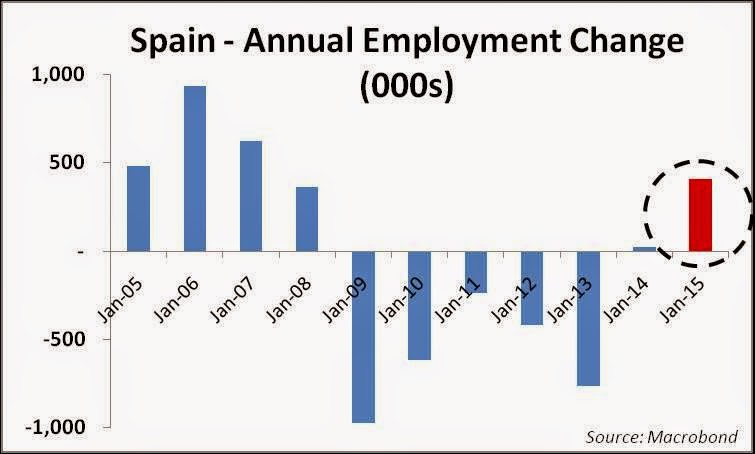

By any measure, the job markets in some of the periphery nations are dreadful. But on a relative basis, hiring across the euro area has been improving.

RBS: - Baby steps. The Spanish labour market has enjoyed its best year since 2007 - a start on a 23.4% unemployment rate.

|

| Source: RBS |

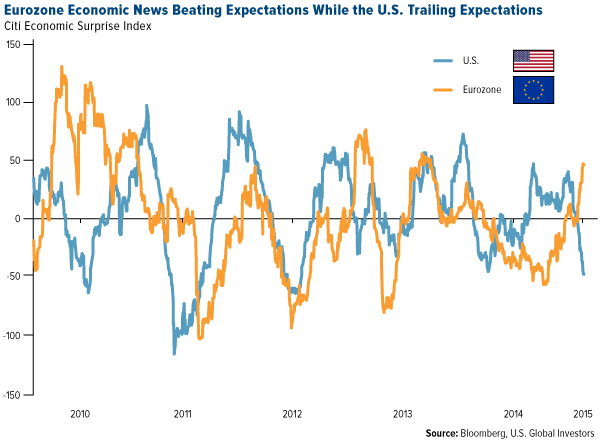

A number of these surprises to the upside are reflected in the Citi Economic Surprise Index, which shows the Eurozone diverging from the US.

|

| Source: @sobata416, @valuewalk, @HedgeLy |

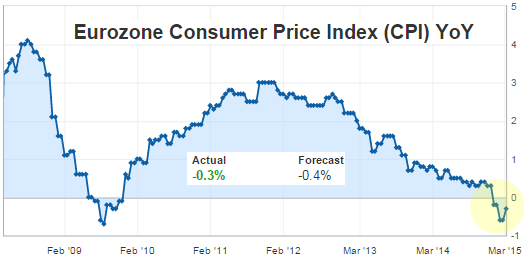

Going forward, the sharp deterioration of the euro and the ECB's expected massive bond buying program should halt deflationary pressures (although just as the case in Japan, inflation is likely to remain below the ECB's target for a while). Weaker euro may also help the area's exporters.

|

| Source: Investing.com |

But the euro area's economy is not out of the woods yet. The greatest and the most immediate risk to the recovery remains the developments in Greece. While the Eurogroup has kicked the can down the road, the situation could deteriorate quickly even before the bridge financing matures. Depositors are continuing to withdraw money out of Greek banks.

|

| Source: @Schuldensuehner |

Nobody wants to get caught with a Cyprus type situation where people's property was confiscated by the state via deposit haircuts. An even worse scenario would be having deposits forcibly converted into drachmas that will find no bid in the FX market.