Why Own Bonds?

by Anthony Valeri, Investment Strategist, LPL Financial

Revisiting the Benefits of Owning Bonds

The presence of record, or near record, low yields in early 2015 has diminished bonds’ ability to provide diversification benefits for investors. Bonds are off to a strong start so far in 2015, in part due to stocks stumbling out of the gates to start the new year. One year ago, at the start of 2014, strong equity market performance in 2013, combined with a tough year for bonds and still low yields, caused some investors to overlook the fact that bonds can still serve as an effective diversification tool. Fast forward to early 2015 and many overseas bond markets are offering all-time record low bond yields. In the United States, the 30-year Treasury yield closed January 2015 at a fresh record low with the 10-year Treasury not far from its 1.4% all-time low of 2012. This week we revisit our “Why Own Bonds?” commentary from January 14, 2014, to illustrate that bonds, even in a lower-yield environment, can still provide diversification benefits.

As corporate earnings move higher, the case for stock investing remains compelling, in our view. Still, pullbacks can occur without warning and, as mentioned in our Outlook 2015: In Transit, we expect more volatility, as is typically common when the economy enters the latter half of the business cycle. Pullbacks of 5% or more have been infrequent over recent years but such calm is rare. Investors with shorter-term horizons may consider seeking protection against an equity market sell-off. After all, the average annual peak-to-trough decline in the S&P 500 has been 16% (over the past 50 years) and pullbacks arrive without warning. Investors need to be prepared and bonds can help provide protection.

Over the last few months, pullbacks have indeed become more frequent. The broad stock market, as measured by the S&P 500 Index, declined by almost 7.5% in October 2014 and by nearly 5% in December 2014. These pullbacks were brief, but the current pullback from December 29, 2014, through January 30, 2015, has been longer and reached -4.1% before a bounce back on Monday, February 2, 2015. In contrast, the high-quality bond market, as measured by the Barclays Aggregate Bond Index, gained 2.1% during January 2015. Clearly, bonds offered a diversification and wealth preservation benefit during a tough month for stocks.

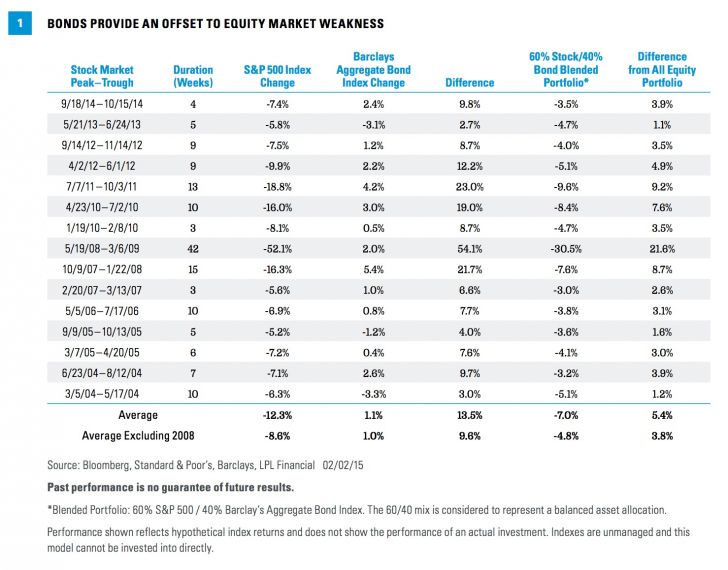

This is nothing new. A look back at prior stock market pullbacks illustrates how bonds have historically provided good diversification benefits. Figure 1 shows all equity market pullbacks of 5% or more that lasted at least three weeks over the past 11 years, with the corresponding returns for stocks and high-quality bonds. The figure also illustrates the hypothetical return of a balanced 60% stock/40% bond portfolio and the dampening impact bonds can have on stock weakness. During stock market pullbacks in excess of 5%, bonds outperformed stocks by a double-digit margin, a significant difference. Excluding the historic mid-2008 to early-2009 sell-off, the performance differential narrows but is still notable at a 9.6% advantage in favor of high-quality bonds.

In a few cases, both stocks and bonds declined together. This is a troubling outcome and reflects a failure of diversification, but it is rare. Still, bonds managed to outperform stocks on those occasions. In 2008, high-quality bonds provided a buffer but not without volatility, as investment-grade corporate bonds declined for the year and even high-quality mortgage-backed securities (MBS) suffered brief declines. While not all segments of the bond market perform similarly every time, an allocation to high-quality bonds can potentially be effective at offsetting stock market weakness. Although the current pullback in equities has not reached 5%, and may not, bonds are once again showing their diversification benefits.

A total of 13 central banks have lowered interest rates so far in 2015, and combined with quantitative easing (QE) from the European Central Bank (ECB), helps explain part of bond market strength early in this year. However, it does not detract from the potential diversification benefit still prevalent.

Not About Yield

Today’s very low-yield environment does not negate the potential diversification benefit of bonds. During 2012, the stock market suffered two pullbacks greater than 5%, and bonds rose more than 1% over each period. The 10-year Treasury yield varied between 1.4% and 1.9% during the 2012 equity market sell-offs, similar to today’s levels.

In fact, during each stock market pullback in Figure 1, bond market performance was fairly consistent, averaging 1%, despite varied levels of interest rates. Two of the bond market’s strongest gains during stock market sell-offs occurred in 2010 and 2011, a post-recession period in which yields had already declined sharply.

Over short-term periods, price movement, not interest income, is the primary driver of bond performance. Interest income accrues slowly, and although it is the primary driver of long-term bond returns, price changes (up or down) often overwhelm the impact of interest income over short periods of time. Therefore, a low-yield environment does not preclude bonds from acting as an effective diversification tool.

Conclusion

Low yields will likely translate into lower long-term bond returns, and therefore the hurdle for stock investors to beat bond performance over the long term is lower. However, for investors with shorter horizons or those simply unwilling to endure stock market swings, bonds can play a diversification role even in today’s low-yield environment. In conjunction with sectors that historically hold up better against rising rates, such as high-yield bonds and bank loans, an allocation to core bonds may make sense to protect against potential stock market weakness.

*********

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

Mortgage-backed securities are subject to credit, default, prepayment risk that acts much like call risk when you get your principal back sooner than the stated maturity, extension risk, the opposite of prepayment risk, market, and interest rate risk.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

Copyright © LPL Financial