by Ben Carlson, A Wealth of Common Sense

Following my last post on the historical performance of long-term treasuries, a few people asked me if I was implying that bonds have no place in a portfolio at these interest rate levels. That was definitely not my intention.

Even at ultra-low interest rates around the globe, bonds deserve a place in a portfolio for a number of reasons. I just think there are a few things bond investors need to understand about longer maturity bonds, so I was pointing out the possible risks. Here are some other considerations:

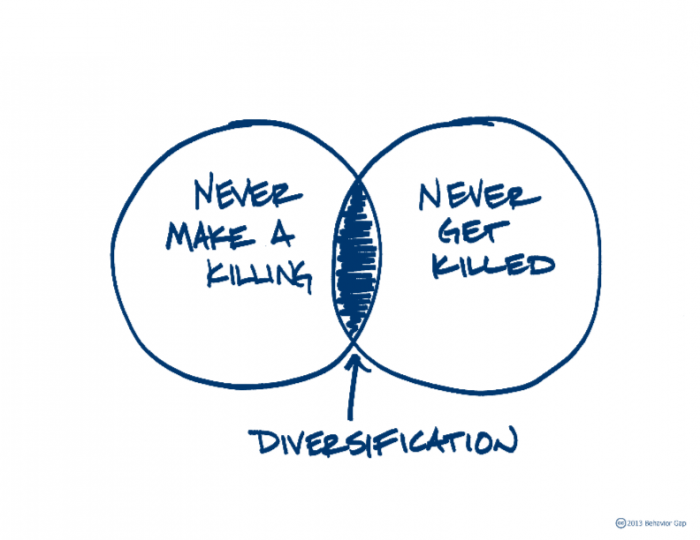

Diversification benefits. High quality bonds protect investors during times of market stress and deflation, providing a diversification benefit with little-to-no correlation to stocks in the short-term.

See also: There’s no such thing as precision in the markets & How often do stocks and bonds decline at the same time

Bonds don’t crash like stocks. Unless we were to see an enormous re-pricing of interest rates happen overnight, in a magnitude never seen before, bonds don’t necessarily crash like the stock market (this depends on quality and maturity though).

See also: What does the bursting of a bond “bubble” look like?

Higher yields require higher levels of risk. All else equal, the longer the maturity in your bond holdings, the higher the yield. But longer maturities also lead to higher volatility, which is actually even higher at lower interest rate levels.

See also: How interest rates affect the behavior gap & How the markets tempt us into making mistakes

Bond investors have to set reasonable performance expectations. Interest rates have fallen a great deal since the early 1980s. The bond bull market is now well over 30 years in length. Even if rates don’t rise from here, fixed income investors have to understand that the historical performance in bonds since the 1980s cannot be repeated from these yield levels for very much longer.

See also: Resetting bond return expectations & Back-testing the Tony Robbins All-Weather strategy

Total return matters more than yield. Bond substitutes with higher yields may look enticing, but they come with their own risks. Because of the way bonds are structured — think about bonds like a mortgage or loan — they are far less risky in terms of losses than dividend-paying stocks, preferred stocks, convertibles, bank loans, REITs and the like.

See also: What’s an investor to do about bonds?

Bonds provide and emotional hedge. Finally, bonds offer investors something of an emotional hedge against poor behavior. Not every investor is willing or able to have their entire portfolio in the stock market. There’s no use in trying to implement a risky portfolio strategy if it’s going to be impossible for you to stick with it. Bonds can help by providing stability in the event of a market sell-off in stocks.

Even if they were to fall in a down stock market, it wouldn’t be very far. In this respect, bonds can as a source of funds for either rebalancing into stocks at lower levels or for spending purposes for cash flow needs. But they also give risk-averse investors the stability they crave to balance out the craziness of the moves in the stock market.

Sign up for email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense