MYTH: Time reduces risk

EXECUTIVE SUMMARY

> Alternative investments are still not fully destigmatized by many investors , despite the fact that their inclusion in balanced portfolio s has proven their merit at least twice during the previous decade. The purpose of this Series of reports is to demystify some of the misconceptions still surrounding alternative investments .

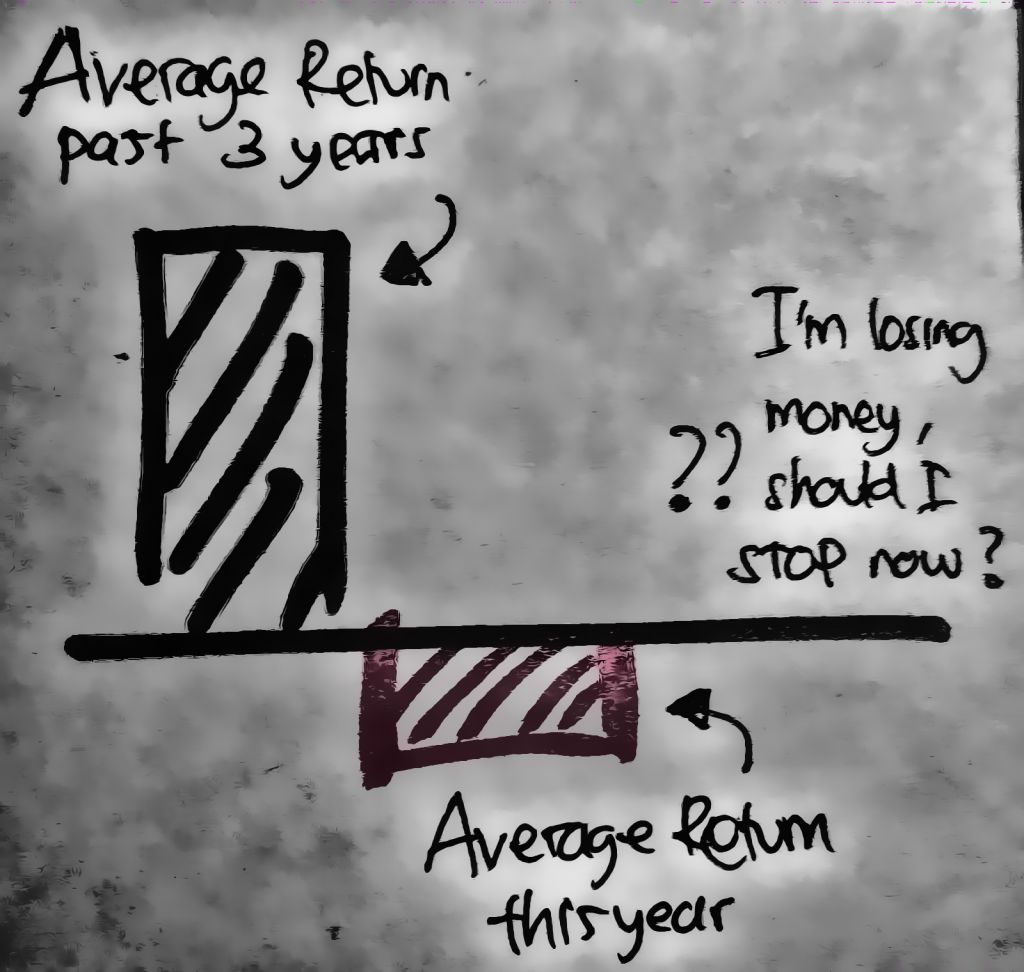

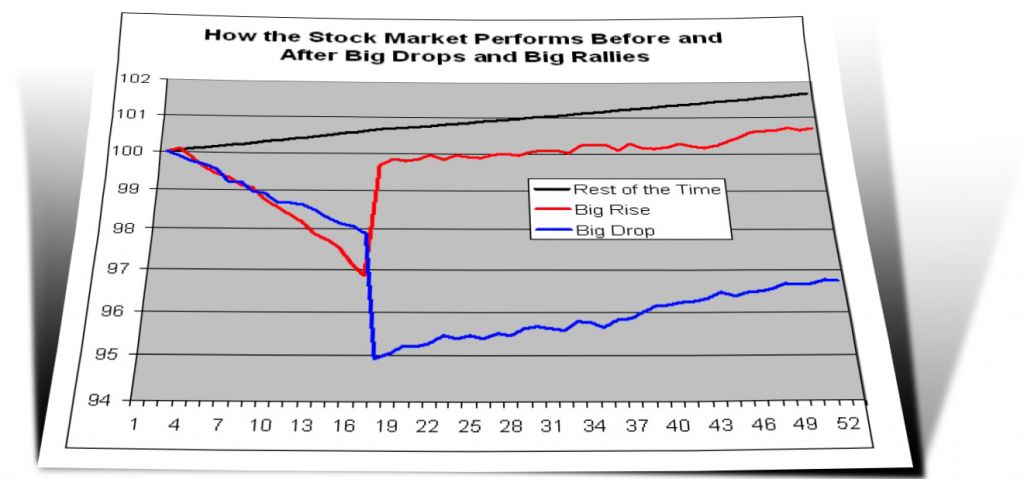

> Some academic finance literature suggests that time diversifies risk , meaning that investing for the long term reduces risk. Disciples of buy - and - hold strategies also believe in the idea of time diversification. The logic is that if one has a very long investment horizon, one can recover from large losses. The counter argument is that time actually amplifies risk. The logic here is that over the longer term, more bad things can happen and the probability of failure and destruction is higher.

> As this decade has progressed and the current credit crisis has continue d to unfold , it is becoming apparent that the science we refer to as finance , and which is built on Modern Portfolio Theory , has its shortcomings. Volatility is not a good proxy for risk. Accidents happen. Things can go wrong and volatility has very little to do with it.

> We think time diversification is a myth . Time amplifies risk. It is true that the annual average rate of return has a smaller standard de viation over a longer time horizon. However, it is also true that the uncertainty compounds over a greater numb er of years. Unfortunately, the latter effect dominates in the sense that total return becomes more uncertain the longer the investment horizon. Furthermore, betting on the long term might not be applicable for most investors. After all, the long term is nothing else than many short - term periods joined together.

> Uncertainty begets risk. Risk, however, can be actively managed.

Read/Download the complete Virtus report below: