by Ben Carlson, A Wealth of Common Sense

“International diversification might not protect you from terrible days, months, or even years, but over longer horizons (which should be more important to investors) where underlying economic growth matters more to returns than short-lived panics, it protects you quite well.” – Cliff Asness

I’m probably belaboring the point on global diversification, but I think it makes sense to revisit these types of important topics to offset the recency bias of assuming the future will play out exactly like the recent past.

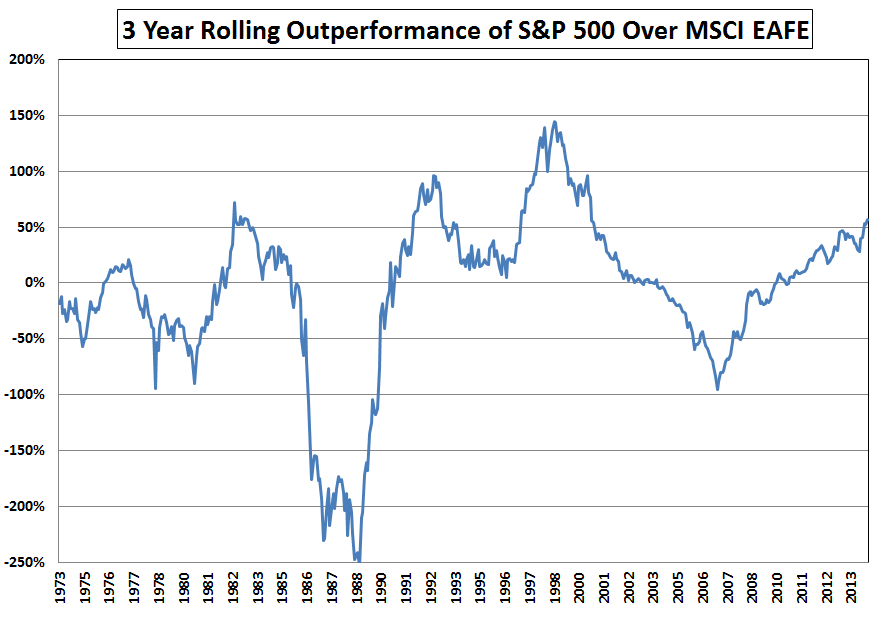

Markets are in a constant state of change and above all else, they are cyclical. See the rolling three year outperformance of the S&P 500 over the MSCI EAFE since 1970 for proof:

Any time that line dips below 0% that means foreign stocks were outperforming on a total return basis over the previous three years. This shows that U.S. stocks are outperforming international stocks by more than 50% over the last three years.

The over- and underperformance can get to extreme levels (yes, that’s over 250% of outperformance for international stocks in the late-1980s) for both U.S. and international markets, but there were also some fairly quick reversals as well.

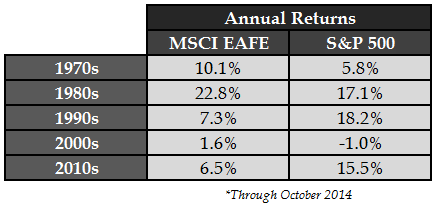

Looking at the annual returns by decade for each shows how out of sync the developed markets can become over longer periods:

Globalization was supposed to increase the correlation between the different stock markets around the world, but it just doesn’t seem to be happening quite yet. We are still seeing periods of divergent performance.

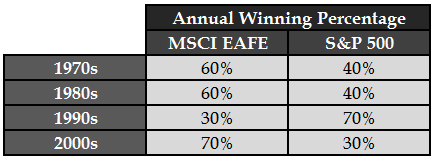

It very well may turn out that having a larger exposure to U.S. stocks will continue to be the right move for the next few years. These trends can last longer than many think. But even if a long-term cycle of outperformance continues, over shorter time frames the results can still prove to be uneven. Take a look at the winning percentage of annual returns by decade for the EAFE and S&P 500:

While foreign stocks slaughtered U.S. stocks in the 70s and 80s, they only outperformed six out of every ten years. Even when U.S. stocks came back with a vengeance in the 1990s, foreign stocks outperformed three out of the ten years, which abruptly reversed over the following decade.

This type of back and forth leadership is actually a good thing for a diversified portfolio because it allows an investor to rebalance from the relatively strong market to the relatively weak market. Even those decades with severe underperformance allow investors to take advantage of shorter-term outperformance by the laggards in any given year.

A balanced portfolio is always going to have an asset class or two that’s out of sync with the winner(s) in the portfolio. That’s the trade-off for managing risk. The mistake most investors make is abandoning diversification right before they need it the most. Unfortunately, the markets don’t run on a set schedule to tell us when those regime changes will take place.

Further reading:

Global diversification: Accepting good enough to avoid terrible

How diversification works

Copyright © Ben Carlson, A Wealth of Common Sense