Jeremy Grantham's GMO has recently released its Letter to Investors, presented below without comment:

Grantham's advice to a prudent investor:

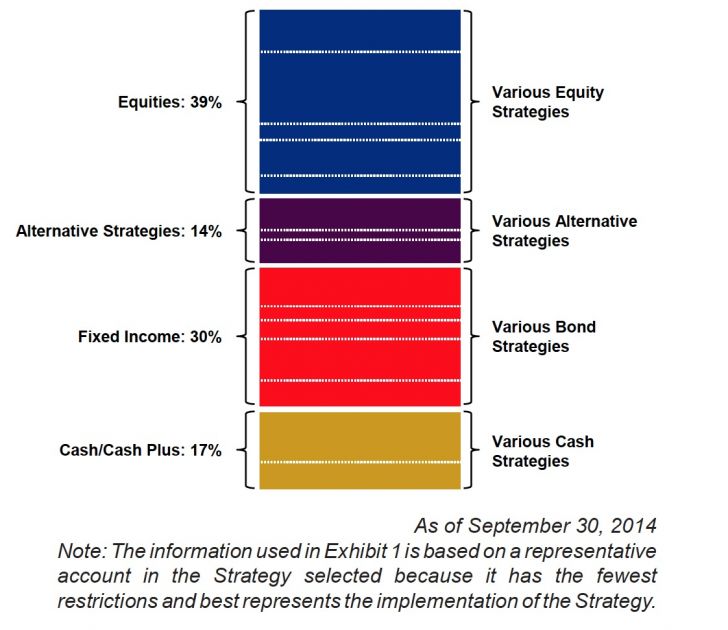

As always, the prudent investor (unlike the political year three) should definitely recognize overvaluation, factor in regression to the mean, and calculate the longer-term returns that result from this process. More easily, such prudent investors can use our seven-year numbers, which have a decent long-term record measured when we have viewed markets as overpriced, as we believe they are today, and a better record measured in the periods after bubbles break. The other necessary ingredients to the investment mix are suitable measures of risk, and when these are added to estimated returns we believe efficient portfolios can be produced. On our data, with U.S. large cap equities offering negative returns (-1.5%) except for high quality stocks (+2.2%), with foreign developed and emerging equities overpriced (+3.7%), and with bonds and cash also very unattractive, investors have to twist and turn to find even a semi-respectable portfolio. It is a particularly tough process today with nowhere to hide and no very good investments compared to, say, the time around the 2000 bubble when there were several. My colleagues Ben Inker and James Montier have written in some detail about the problems of investing in these difficult times.2 Designed to help your thinking about this topic, Exhibit 1 shows an example of a portfolio that might be used in a world that excludes private equity and venture capital, and for a client who can do without a benchmark and can settle for owning a (hopefully) sensible long-term efficient portfolio. Efficient, that is, in terms of trying to minimize risk per unit of estimated returns. As always, and particularly in this type of overpriced environment, there are no guarantees of success even if every GMO recommendation were to be implemented for, regrettably, we too are often imperfect.

Exhibit 1: Benchmark-Free Allocation Strategy

His Conclusion:

My personal fond hope and expectation is still for a market that runs deep into bubble territory (which starts, as mentioned earlier, at 2250 on the S&P 500 on our data) before crashing as it always does. Hopefully by then, but depending on what the rest of the world’s equities do, our holdings of global equities will be down to 20% or less. Usually the bubble excitement – which seems inevitably to be led by U.S. markets – starts about now, entering the sweet spot of the Presidential Cycle’s year three, but occasionally, as you have probably discovered the hard way already, history can be a snare and not a help.

Read/download the complete GMO Letter below:

Copyright © GMO LLC