by William Smead, Smead Capital Management

A great deal has been written about how lower gasoline prices could stimulate discretionary purchases in the United States. RBOB gasoline futures peaked on June 20, 2014 at $3.12 per gallon and closed on November the 14th at $2.04. Those in the bearish camp like Randall Forsyth at Barron’s argue that lower oil and gas prices will negate and ruin the economic benefit of the oil boom. Here is how he facetiously states the bullish argument which he challenges:

According to the conventional wisdom, this ought to be the most salubrious of situations. To use the cliché, the drop in prices at the gasoline pump translates into a tax cut for the consumer. (The identity of this single, solitary consumer is a closely guarded secret, although pundits apparently have access to his or her mind-set and motivations.) In a piece emblazoned with the headline “THE BARREL STIMULUS,” in all caps, in case you might have missed it, last Friday’s New York Times quotes a corporate chieftain who declares “if oil prices stay between $75 and $95 a barrel, we would see the kind of stimulus package that the Federal Reserve or Congress could never do.”

We at Smead Capital Management believe that most stock picking organizations are underestimating future economic growth and earnings growth in consumer discretionary stocks. In this missive, we will address how lower oil prices will positively affect today’s U.S. economy both financially and psychologically. We will look at $2.50 per gallon gasoline as a catalyzing force which could light the consumer fires and ignite escape velocity in the economy. Lastly, we will look at past stock market cycles and see where consumer discretionary stocks lost the tailwinds of economic recovery.

Is an Oil Boom Better than Cheap Gasoline?

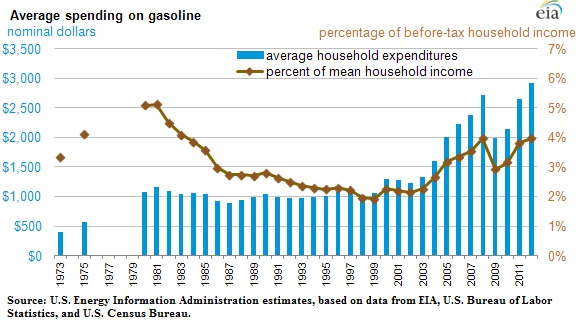

Let’s start with a chart which shows how important gasoline is to consumer spending. It is estimated that only 20% of monthly consumer spending is discretionary and the chart below shows that gasoline has been using 20% of that 20%:

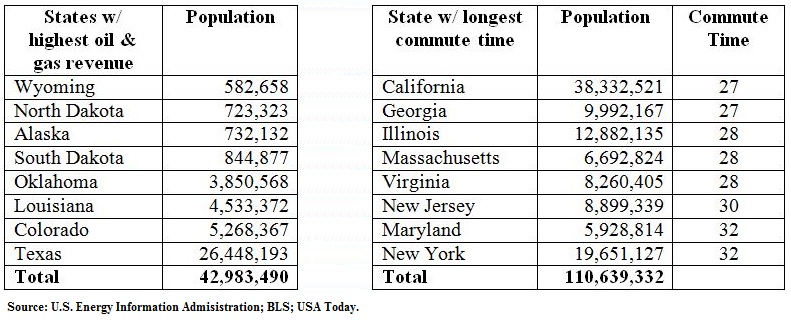

Now we will examine how many people live in the main oil and gas-producing states and compare that to the number of people who live in the states with the longest workday auto commutes. Here is the population of the states where the oil and gas industry is the most meaningful to the state economy and the population of the eight states with the longest commutes:

By a factor of 2.5 to 1, lower oil prices are the winner. We would add to this chart the fact that another 150 million Americans live in states which gain very little benefit from the domestic energy boom. Therefore, 15% of the population seems to benefit from high oil and gas prices and 85% benefit from $2.50 gasoline.

Will $2.50 gasoline catalyze consumer spending?

We believe that consumer spending is on the cusp of a decade long expansion which has positive implications for stock pickers. As a group, U.S. households are saving 5.6% of their gross income each month, sporting the lowest household debt service ratio of the last 35 years and have the most favorable demographics since yours truly graduated from college in 1980. Eighty-six million Americans are 19-38 years old and are on average 28-years old. This is the age at which the average American marries for the first time.

Housing is very affordable from a historical standpoint and is a big driver of economic growth. We believe low gasoline prices could and should spur numerous echo-boomers to buy a house which extends their commute! The huge drop in gas prices saves the long commutes the most money. If you drive 20,000 miles per year at 20 mpg you buy 1000 gallons of gasoline per year. You just got nearly $1100 per year put into your pocket by the drop in oil and gasoline prices.

Can an Economic Recovery End Before it starts?

The combination of the deep recession of 2007-2012 and the change in the age of marriage of the largest population group has caused most stock pickers to wonder if echo-boomers will marry, have kids and buy houses outside of the core of large metropolitan cities. What many experts are missing is that every deep recession stunts household formation for a few years and few of the recessions of the last 50 years have ever had as big a break in residential real estate prices as this one had. Thanks to the break in residential real estate prices, many experts question whether first-time home buying statistics will ever show the kind of jump which a huge population group like echo-boomers could create.

There were 179 million people in the 1960 U.S. Census and the deepest recession of the 1960’s showed that the U.S. had over one million housing starts. In 2014, this anemic economic recovery is only seeing housing starts of 957,000 with a 315 million population! When you pile a housing depression and $4.00 gasoline on at the same time, is it any wonder that the consumer is mortified and hunkered down? Now that gasoline is around $2.50 and ready to serve as a catalyst, we are in Warren Buffett’s camp. He said recently, “Hormones take over at some point and you get tired of your in-laws!” We say hormones, extra buying power and more affordable commuting could be the combination we are looking for.

Consumer discretionary stocks have led the stock market in prior economic recoveries. Recently, Ned Davis put out research showing that the consumer discretionary sector of the S&P 500 Index was the best performing sector three months before market tops over the last five decades. Consumer discretionary stocks have underperformed the S&P 500 since January 2014. Since the housing depression has prevented the economic recovery from blossoming and we are just getting decent gasoline prices into the pockets of 86 million echo-boomers, we like our over-weighting of what we call our addicted-customer-base consumer stocks.

For direct access to housing, we like NVR (NVR), the maker of Ryan Homes (a builder in states with some of the longest commutes). We like Berkshire Hathaway (BRK.B) for everything from residential real estate brokerage to paint to furniture to carpet, etc. We think Nordstrom (JWN), Cabela’s (CAB) and Home Depot will enjoy more confident consumers and blue-collar workers who see huge pay increases as housing rebounds. Lastly, we like Comcast (CMCSK) and Disney (DIS) and Gannett (GCI), who will entertain echo-boomers trapped at home in the evenings with newly-minted children. Did we mention that they’ll live farther from downtown thanks to $2.50 gasoline?

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management