by Ben Carlson, A Wealth of Common Sense

Long-term government bonds have been on an absolute tear this year. The 20+ Year Treaury ETF (TLT) is up almost 20% on the year as interest rates have continued to drop.

Over the long-term stocks are supposed to earn a risk premium over bonds because of the way they’re structured and the risk involved in each type of security. This has been the case historically, as stocks have earned a 5-6% premium over high quality bonds going back a hundred years or so.

But that relationship has been tested over the life of this bond bull market that saw double digit interest rates fall over the past 30+ years, boosting the performance of long-term bonds. The incredible performance in bonds has transformed the risk premium over this period.

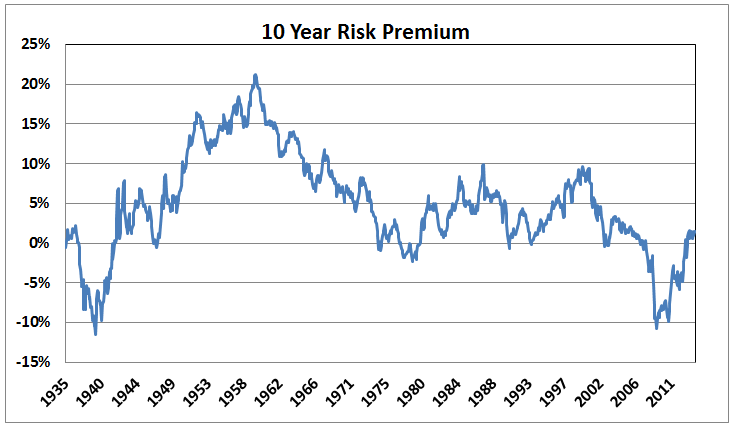

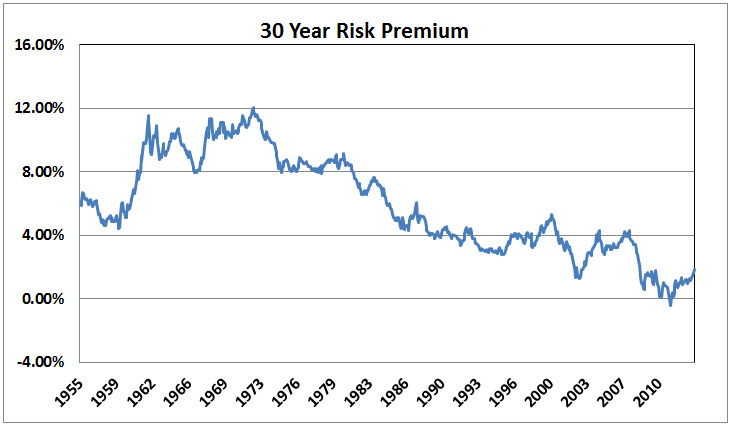

These are the risk premiums over 10, 20 and 30 year time frames based on the annual returns for the total U.S. stock market (represented by the CRSP Total Market Index) and 20 Year Treasuries going back to 1926:

Any time the line goes below zero that means bonds have outperformed stocks over that period of time. It’s rare, but not out of the question, especially when double digit starting interest rates are combined with an ending date that falls close to a severe financial crisis. Anything is possible.

The further out you extend the time horizon, the more consistent the advantage of owning stocks over bonds becomes, but even the thirty year risk premium is all over the place depending on the start and end dates.

This data goes through year-end 2013, when the risk premiums for stocks over long-term bonds in the most recent 10, 20 and 30 year periods were 1.5%, 2.4% and 1.8%, respectively. These were all well below the long-term averages of 4.8%, 5.6% and 5.9% for each of the designated time frames.

It would be easy look at this data and say that stocks aren’t worth the risk, but I think that misses the point. This is really more about the unbelievable bond bull market than anything. Long-term bonds are up almost 9.5% a year over the past 30 years, an amazing run of performance (stocks are at 11.2% annually).

Eventually the bond bull market that began in the early 1980s is going to come to an end and long-term bonds will get crushed (and good luck figuring out when that happens), but sometimes it’s worthwhile to step back and appreciate a bull market of this magnitude. It’s been an amazing run for bonds.

It’s also makes sense to look back at the historical data to see what happens when bonds aren’t in a near-continuous falling interest rate environment. For the 50 years from 1932 to 1981, long-term treasury bonds returned 2.95% per year, which was almost a full percent below the inflation rate of 3.8%. The tail-end of this period saw rapidly rising inflation and interest rates, but it’s worth noting that the risk premium hasn’t always been quite so narrow (stocks were up 10.5% per year in that time).

I don’t know exactly what’s going to happen, but simple math based on the current level of interest rates leads me to believe that these risk premiums will be much wider in the future over longer time frames than they’ve been in the recent past.

This doesn’t even mean that stock returns have to be as high as they’ve been in the past. But it looks like a high probability bet that the spread between the returns on stocks and bonds should be wider in the future than it has been for the past three decades or so.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense