by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday November 11th

U.S. equity index futures were higher this morning. S&P 500 futures were up 2 points in pre-opening trade.

Volume on U.S. and Canadian equity markets is expected to be lower than normal today. Bond markets are closed in commemoration of Veterans Day in the U.S. and Remembrance Day in Canada.

Time Warner added $1.32 to $78.65 after Goldman Sachs upgraded the stock from Neutral to Conviction Buy.

Alibaba (BABA $116.94) is expected to open higher after Oppenheimer initiated coverage with an Outperform rating. Target is $133.

Archer Daniel Midland added $0.05 to $50.82 after Bank of America/Merrill reinstated the stock with a Buy rating. Target is $58.

JP Morgan slipped $0.15 to $61.78 after Keefe Bruyette downgraded the stock from Outperform to Market Perform.

Interesting Charts

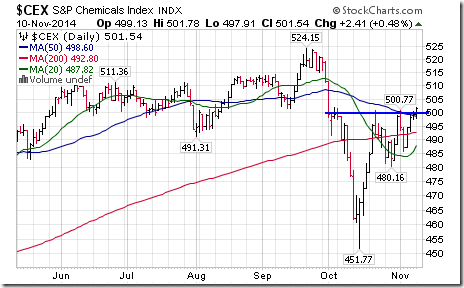

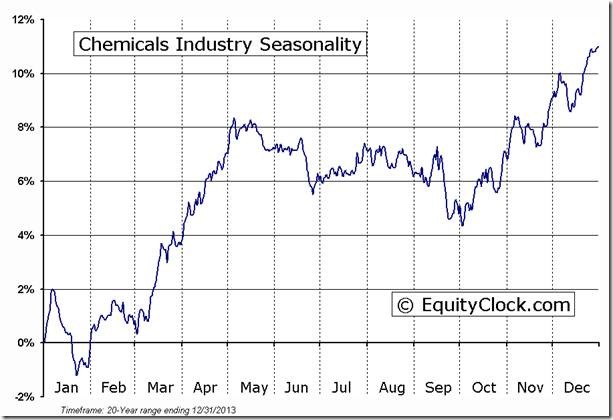

S&P Chemicals Index (subsector to the Materials sector with an 80% weight) has lagged the S&P 500 Index, but is showing catch up signs. The Index completed a base building pattern yesterday on a move above 500.77.

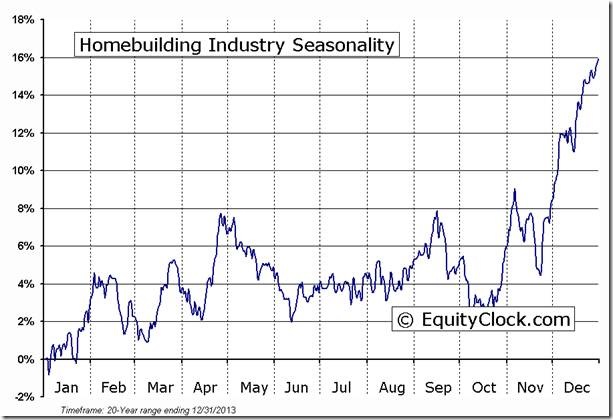

‘Tis the season for strength by the sector!

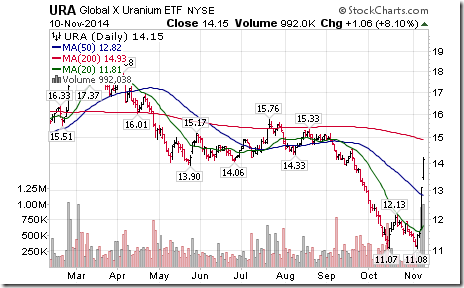

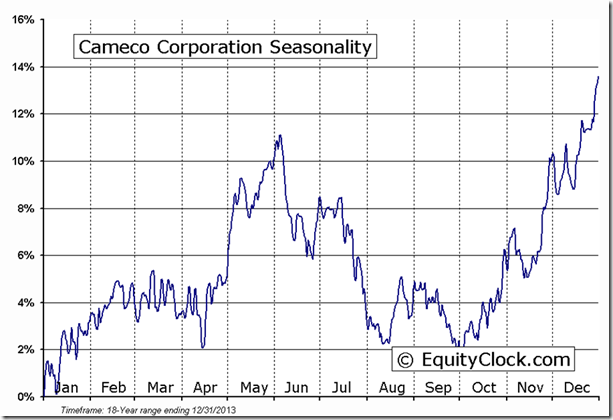

Uranium stocks and related ETFs entered into a momentum spurt on Friday after Japan confirmed plans to re-activate two nuclear power plants. Two analysts quickly released reports that predicted higher uranium prices. Following is a link to a BNN interview on Friday where the analyst predicted a US$30 per ton price increase.

http://www.bnn.ca/Video/player.aspx?vid=486828

Spot prices rose 5% over the weekend. See http://www.uxc.com/review/UxCPrices.aspx for spot prices (to be updated later today). Higher spot prices quickly were translated into the price of Uranium Participation Units

Uranium stocks and related ETFs broke above base building patterns on higher than average volume. ‘Tis the season for strength in the sector!

StockTwits Released Yesterday

Quiet bullish technical action by S&P 500 stocks to 10:45. Breakouts: $YUM, $WMT, $SWK. No breakdowns.

The breakout by $WMT above $79.37 is an encouraging sign for Christmas sales this year.

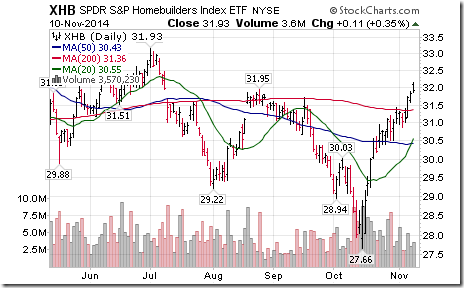

Nice breakout by $XHB above $31.95. Helped by positive report by $TOL. ‘Tis the season for Home Builders!

Technical Action by Individual Equities Yesterday

Two more S&P 500 stocks broke above resistance after 10:45: Dollar General and Harris Corp.

One TSX 60 stock broke resistance: Blackberry.

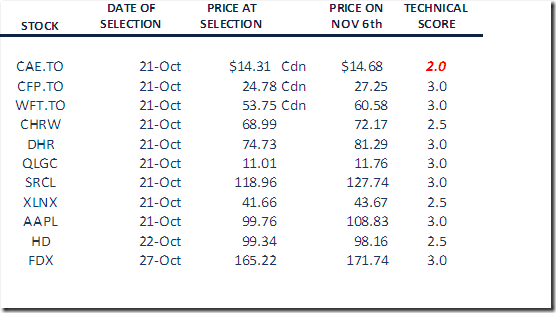

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Tech Talk/Horizons Weekly Seasonal/Technical Sector Report

Report was released yesterday morning. Following is a link:

Special Free Services available through www.equityclock.com

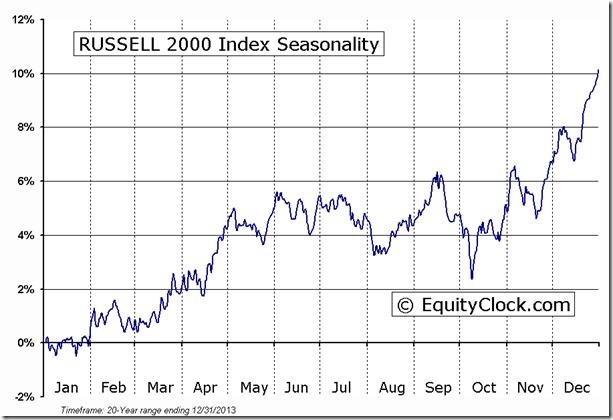

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

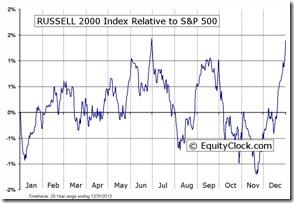

^RUT Relative to the S&P 500 |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC November 10th 2014

Copyright © EquityClock.com