by Ben Carlson, A Wealth of Common Sense

“It [precious metals stocks] has bone-crushing volatility.” – William Bernstein

If there’s been a worse place to be as an investor over the past few years than precious metals stocks then I haven’t found it. This year a diversified basket of these metals and mining companies is down around 16% but over the past three years the losses are closer to 65%. In that same time the S&P 500 is up nearly 75%, an enormous difference in performance.

In an interview with Morningstar this past week, author and investor William Bernstein said that precious metals stocks are starting to pique his interest and that now wouldn’t be a bad time to add them to your portfolio. Bernstein said he’s been following precious metals stocks for 25-30 years, so he understands the risks and how they generally work in a portfolio. Here are a few points he made on these stocks as an investable asset class:

- They typically have much lower returns than the overall stock market.

- They are extremely volatile, much more so than the market.

- They tend to zig when the market zags, providing a diversification benefit.

- They perform very well during periods of high inflation (one of the biggest reasons they’ve gotten killed lately).

- Even though they’re so volatile, they can actually add to a portfolio’s return, assuming a regular rebalance, and decrease overall portfolio volatility.

Bernstein was skeptical a few years ago when everyone was so sure that commodities were the place to be, so it’s interesting to see that he’s intrigued by the space now. He’s mentioned a smallish 5-10% allocation to precious metals stocks in most of the books he’s written so I thought it would make sense to take a look at the historical numbers to get a better sense of how they tend to act.

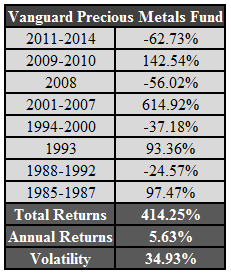

He wasn’t kidding about the bone-crushing volatility in these stocks. Take a look at how cyclical precious metals stocks are based on the Vanguard Precious Metals Fund since 1985:

Volatility is roughly double that of the S&P 500 over this same time frame while the S&P 500 gained almost exactly double the annual returns, 11.20% per year to be exact. So precious metals stocks gave you half the return at double the volatility.

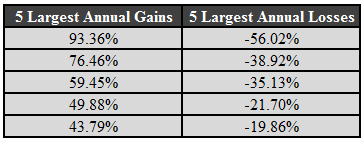

You can get a sense of this volatility by looking at the 5 largest annual gains and losses in the fund:

It’s basically feast or famine.

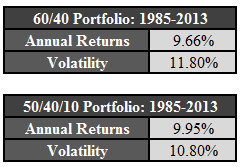

I also looked at two portfolios to see how precious metals stocks would have worked in the past to verify Bernstein’s claims that they decrease volatility and increase returns. This actually has been true in the past, but the differences are minimal.

The first portfolio I looked at was a simple 60/40 portfolio of the total U.S. stock market and the total U.S. bond market. The second portfolio was made up of 50% in stocks, 40% in bonds and 10% in precious metals stocks (so the same 60/40 overall stock/bond ratio). Here are the results from 1985-2013:

Adding a 10% allocation to precious metals stocks did slightly increase the performance and lead to a decrease in volatility. This is most likely a rebalancing and diversification bonus (I assumed an annual rebalance). The correlation between the S&P 500 and the Vanguard Precious Metals Fund was only 0.14, signalling a weak relationship between the two asset classes.

The question investors have to ask themselves is this: Is the ridiculous volatility worth it for the chance to potentially outperform by a slim margin and barely reduce the volatility characteristics of a portfolio? Most investors have a hard enough time dealing with the swings in the stock market. For many investors, the higher the volatility, the higher the chance for making dumb mistakes.

Plus there’s the possibility that these stocks could continue to drop. To go from a 65% loss to a 75% loss would mean another 25% fall from here. Things can always get cheaper before they finally turn around. And there’s nothing that says these stocks have to follow the same path they’ve taken in the past. The 2001-2007 period made up the majority of the gains in these stocks. Who knows if we’ll ever see that kind of outperformance in the commodities space again.

You have to be a very brave investor to add precious metals stocks as a long-term allocation to a portfolio because you could be waiting a long time for them to prove their worth. They are sure to test your patience. Yet I’m sure they also look extremely tempting to many investors after such a huge fall.

Decisions, decisions.

Watch the William Bernstein interview with Christine Benz from Morningstar for more:

Bernstein: Retirement Allocations for 3 Age Bands (Morningstar)

Further Reading:

Are commodities for trading or investing?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense