by Don Vialoux, EquityClock.com

Pre-opening Comments for Monday November 3rd

U.S. equity index futures were lower this morning. S&P 500 futures slipped 2 points in pre-opening trade. Index futures responded to a slightly downbeat report from China’s Purchasing Managers reports. The Official report and the HSBC report for October released last night indicated growth, but a slightly slower rate.

Facebook added $0.48 to $75.47 after Tigress Financial upgraded the stock from Neutral to Buy.

Blackrock (BLK $341.11) is expected to open higher after Citigroup upgraded the stock from Neutral to Buy. Target is $385.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/02/stock-market-outlook-for-november-3-2014/

Note comments on the Nikkei Average

Economic News This Week

October ISM to be released at 10:00 AM EST on Monday is expected to dip to 56.2 from 56.6 in September

September Construction Spending to be released at 10:00 AM EST on Monday is expected to increase 0.7% versus a 0.8% decline in August

September U.S. Trade Deficit to be released at 8:30 AM EST on Tuesday is expected to be unchanged at $40.1 billion in August.

Canadian September Merchandise Trade Balance to be released at 8:30 AM EST on Tuesday is expected to be a deficit of $700 million versus a deficit of $600 million in August.

September Factory Orders to be released at 10:00 AM EST on Tuesday are expected to decline 0.7% versus a 10.1% decline in August

October ADP private employment report to be released at 8:15 AM EST on Wednesday is expected to fall to 220,000 from 213,000 in September.

October ISM Services to be released at 10:00 AM EST on Wednesday is expected to dip to 58.0 from 58.6 in September

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to dip to 285,000 from 287,000 last week.

Third quarter Productivity to be released at 8:30 AM EST on Thursday is expected to fall to 1.4% from 2.3% in the third quarter.

October Non-farm Payrolls to be released at 8:30 AM EST on Friday are expected to slip to 235,000 from 248,000 in September. October Private Non-farm Payrolls are expected to ease to 228,000 from 236,000 in September. October Unemployment Rate is expected to remain unchanged at 6.8%. October Hourly Earnings are expected to increase 0.2% versus no change in September

October Canadian Employment to be released at 8:30 AM EST on Friday is expected to decline 7,500 versus a gain of 74,100 in September. October Unemployment Rate is expected to remain unchanged at 6.8%

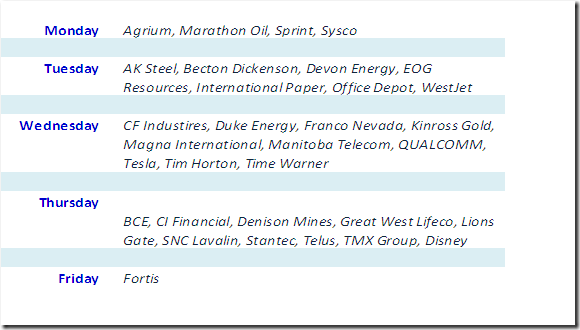

Earnings News This Week

TechTalk/Globe and Mail Column Released on Friday

Headline reads, “The Halloween effect: No tricks, just treats”. Following is a link:

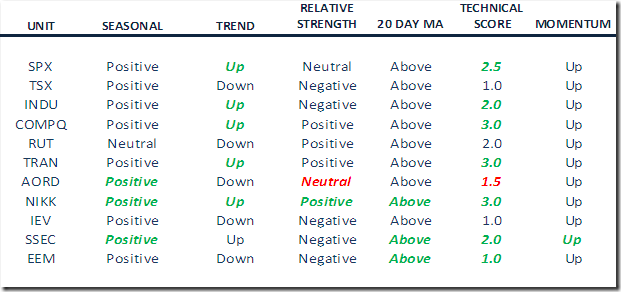

Summary of Weekly Seasonal/Technical Parameters for Equity Indices/ETFs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Green: Upgrade

Red: Downgrade

The S&P 500 Index gained 53.47 points (2.72%) last week. Intermediate trend changed to up from neutral when the Index closed at an all–time high and just below its all-time inter-day high at 2019.26. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index are trending up, but are overbought.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 74.80% from 53.00%. Percent is intermediate overbought, but has yet to show signs of peaking.

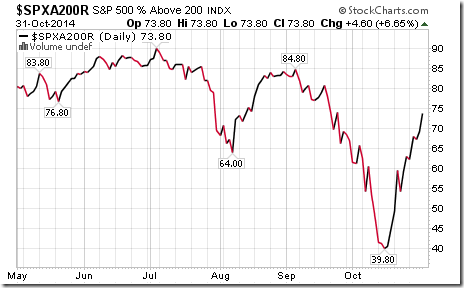

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 73.80% from 63.00%. Percent is intermediate overbought, but has yet to show signs of peaking.

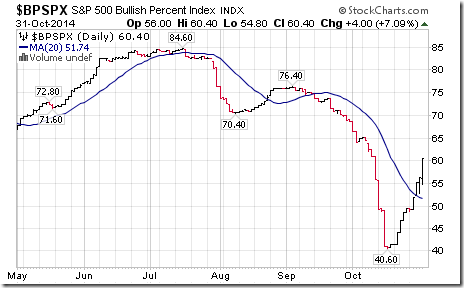

Bullish Percent Index for S&P 500 stocks increased last week to 60.40% from 49.60% and moved above its 20 day moving average. The Index is intermediate overbought, but has yet to show signs of peaking.

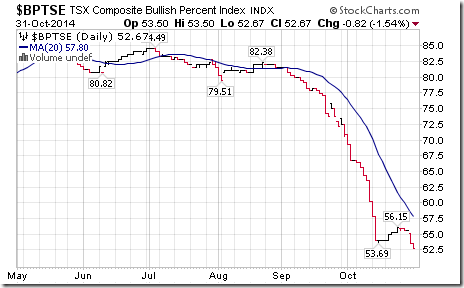

Bullish Percent Index for TSX Composite stocks fell last week to 52.67% from 56.15% and remained below its 20 day moving average. The Index remains in an intermediate downtrend.

The TSX Composite Index added 69.50 points (0.48%) last week. Intermediate trend remains down (Score: 0.0). The Index remains above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index remains negative (Score: 0.0). Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending up.

Percent of TSX stocks trading above their 50 day moving average increased last week to 36.63% from 30.04%. Percent is in an intermediate uptrend.

Percent of TSX stocks trading above their 200 day moving average was unchanged last week at 46.09%.

The Dow Jones Industrial Average gained 585.11 points (3.48%) last week. Intermediate trend changed to up from down on a move on Friday above 17,350.64 to an all-time high. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from negative. Technical score improved to 2.5 from 1.0 out of 3.0. Short term momentum indicators are trending up and are overbought, but have yet to show signs of peaking.

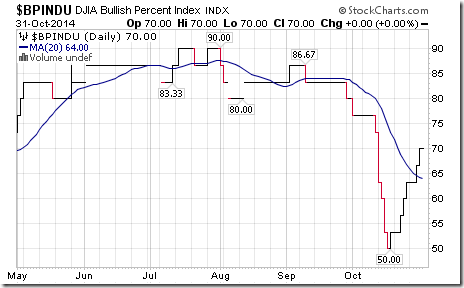

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 70.00% from 63.33%.and moved above its 20 day moving average. The Index is in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

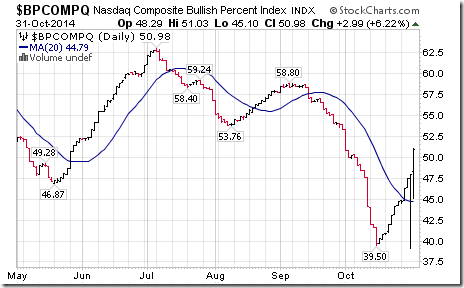

Bullish Percent Index for NASDAQ Composite stocks increased last week to 50.98% from 44.59% and moved above its 20 day moving average. The Index is trending higher.

NASDAQ Composite Index gained 147.03 points (3.28%) last week. Intermediate trend changed to up from neutral on Friday on a move above 4,610.57 to a 13 year high. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Russell 2000 Index gained 54.59 points (4.88%) last week. Intermediate trend is down. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up and are overbought.

The Dow Jones Transportation Average gained 186.53 points (2.18%) last week. Intermediate trend changed to up from neutral on a move above 8,714.94 to an all-time high. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up and are overbought

The Australia All Ordinaries Composite Index added 139.20 points (2.65%) last week. Intermediate trend remains down. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending up and are overbought.

The Nikkei Average jumped 759.13 points (7.34%) last week. Intermediate trend changed to up from neutral on a move above 16,374.14 to a 4 year high. The Average moved above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from negative. Technical score improved to 3.0 from 0.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

iShares Europe 350 added $1.33 (2.68%) last week. Intermediate trend remains down. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending up.

The Shanghai Composite Index added 111.90 points (5.12%) last week. Intermediate uptrend was confirmed on a move above 2,391.35. Units moved above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 2.0 from 1.0 out of 3.0. Short term momentum indicators are trending up and are overbought.

iShares Emerging Markets increased $1.13 (2.75%) last week. Intermediate trend remains down. Units moved above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 1.0 from 0.0 out of 3.0. Short term momentum indicators are trending up.

Currencies

The U.S. Dollar gained 1.18 (1.38%) last week. Intermediate uptrend was confirmed on Friday on a move above 86.87. The Dollar remains above its 20 day moving average. Short term momentum indicators are trending up.

The Euro fell 1.37 (1.08%) last week. Intermediate downtrend was confirmed on Friday on a move below 125.01. The Euro remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold.

The Canadian Dollar fell US 0.31 cents (0.35%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are mixed.

The Japanese Yen plunged 3.40 (4.68%) last week following announcement of an economic stimulus program. Intermediate downtrend was confirmed on Friday when the Yen fell below 90.93. The Yen remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold.

Commodities

The CRB Index added 1.74 points (0.64%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0.

Gasoline added $0.01 per gallon (0.47%) last week. Intermediate trend remains down. Gasoline remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0.

Crude Oil slipped another $0.47 per barrel (0.58%) last week. Intermediate trend remains down. Oil remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are oversold and showing early signs of recovery.

Natural Gas gained $0.25 per MBtu (6.91%) last week. Intermediate trend remains down. Gas moved above its 20 day moving average. Strength relative to the S&P 500 Index improved to neutral from negative. Technical score improved to 1.5 from 0.0 out of 3.0. Short term momentum indicators are trending up.

The S&P Energy Index added 13.09 points (2.08%) last week. Intermediate trend remains down. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 1.0 from 3.0 out of 3.0. Short term momentum indicators are trending up.

The Philadelphia Oil Services Index added 3.60 points (1.47%) last week. Intermediate trend remains down. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 1.0 from 0.0 out of 3.0. Short term momentum indicators are trending up.

Gold plunged $60.20 per ounce (4.89%) last week. Intermediate downtrend was confirmed on Friday on a move below $1,183.30. Gold fell below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score fell to 0.0 from 1.5 out of 3.0. Short term momentum indicators are trending down and are oversold.

Silver plunged $1.07 per ounce (6.23%) last week. Intermediate downtrend was confirmed when Silver fell below $16.64 per ounce. Silver remains below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score fell to 0.0 from 0.5 out of 3.0. Short term momentum indicators are trending down and are oversold. Strength relative to Gold remains negative.

The Gold Bug Index plunged 28.17 points (15.28%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down and are oversold. Strength relative to Gold remains negative.

Platinum fell $15.70 per ounce (1.26%) last week. Trend remains down. PLAT remains below its 20 day MA. Strength relative to the S&P 500 remains negative. Turned positive to Gold.

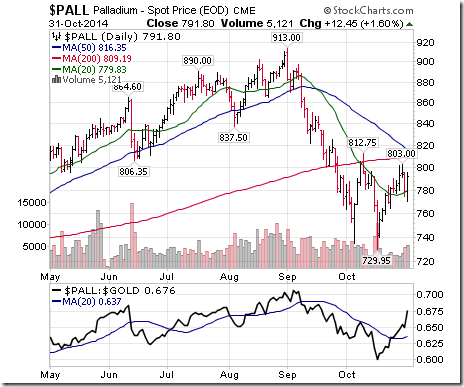

Palladium gained $10.90 per oz. (1.40%) last week. Intermediate trend is down. PALL remains above its 20 day MA. Strength relative to S&P goes to negative from neutral. Strength relative to Gold changed to positive from neutral. Technical score changed to 1.0 from 1.5.

Copper added 0.007 cents per lb (0.23%) last week. Intermediate trend remains down. Copper remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score eased to 1.0 from 1.5 out of 3.0.Short term momentum indicators are trending up.

The TSX Metals and Mining Index fell another 9.44 points (1.35%) last week. Intermediate downtrend was confirmed on a move below 670.39. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators have bottomed and are trending up.

Lumber dropped $12.50 (3.71%) last week. Trend changed to down from neutral on a move below $325.30. Lumber remains below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score fell to 0.0 out of 1.0 out of 3.0.

The Grain ETN added $1.98 (5.51%) last week. Trend remains down. Units remain above their 20 day MA. Strength relative to the S&P 500 Index remains positive. Score remains at 2.0.

The Agriculture ETF gained $1.25 (2.39%) last week. Intermediate trend remains down. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending up and are overbought.

Interest Rates

Yield on 10 year Treasuries increase 6.2 basis points (2.73%) last week. Intermediate trend remains down. Yield moved above its 20 day moving average. Short term momentum indicators are trending up.

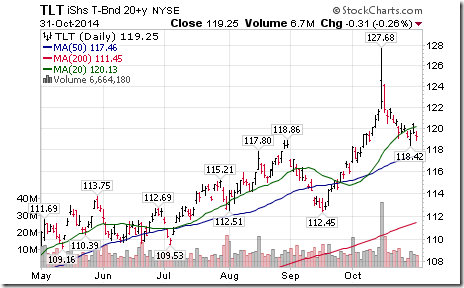

Conversely, price of the long term Treasury ETF fell $0.47 (0.39%) last week. Intermediate trend remains up. Price fell below its 20 day moving average.

Other Issues

The VIX Index dropped another 2.08 (12.92%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average.

Third quarter earnings reports by S&P 500 stocks have passed their peak (about 75% reported) and Canadian reports are gearing up. Revenues and earnings generally have been slightly higher than consensus.

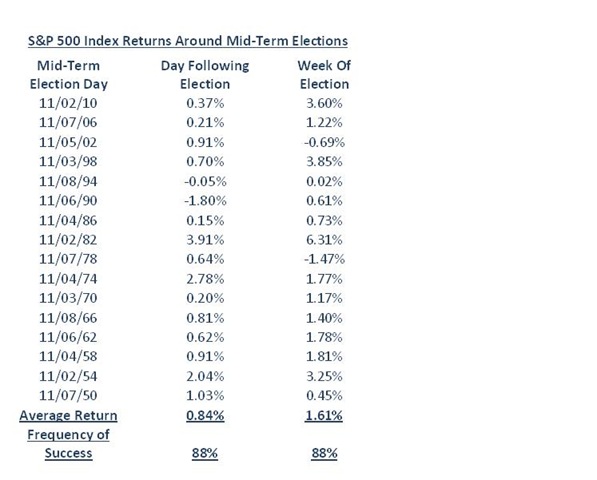

Political focus this week is results from the U.S. mid-term election on Tuesday evening. Final results could be delayed until as late as December. Key focus is on control over the Senate. A gain of 6 seats will give control to the Republicans. Current polls suggest that the Republicans will win 6-8 seats. Control of Congress by the Republicans suggests a turn to the political right given that the Republicans will control the Senate’s agenda, an encouraging event for equity markets. History shows that the S&P 500 Index moves higher on the day after and the week after the event. Following is a recent study completed by EquityClock that provides the data:

Economic focus is on the October Employment Report on Friday. Most economic data released this week in Canada and the U.S. is expected to confirm recovery at a slowing pace.

Short and intermediate technical indicators for broadly base equity indices around the world and most sectors (exceptions: precious and base metal stocks and energy stocks) generally are overbought, but have yet to show signs of peaking.

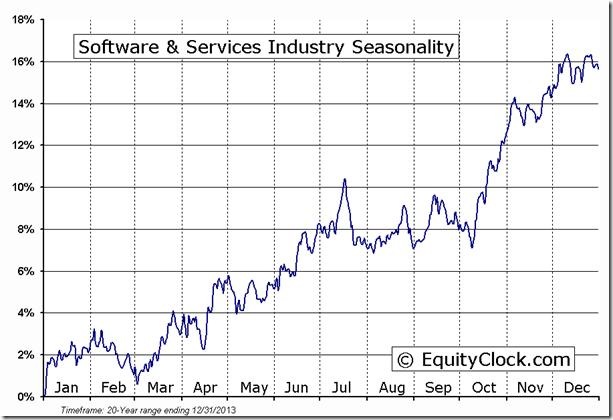

Seasonal influences for equity markets in the month of November are positive. Thackray’s 2014 Investor’s Guide notes that November is the third best performing month of the year during the past 63 years for the Dow Jones Industrial Average, S&P 500 Index and NASDAQ Composite Index. Not as positive for the TSX Composite Index! November was the eighth best performing month during the past 27 years. During the past 10 years, the Dow Jones Industrial Average gained an average of 0.5% per period, the S&P 500 Index gained an average of 0.3% and the TSX Composite Index gained an average of 0.4%. Best performing sectors during the past 22 years were Information Technology, Consumer Discretionary and Healthcare. Best performing sub-sectors were Agriculture, Retail and Semi-conductors.

International events remain a quiet concern including the Ebola fright, “lone wolf” attacks by terrorist and simmering conflicts in Ukraine, Palestine, Iraq and Syria.

The Bottom Line

Caution! Intermediate lows (and probably the 4 year Presidential Cycle lows) were set by North American equity markets on October 15th. However, the 10% fall by the S&P 500 Index and the 11.3% fall by the Dow Jones Industrial Average from their highs in early September to their lows in mid-October already have been recovered fully. U.S. equity markets already are intermediate term overbought. Accordingly, preferred strategy is to hold current equity positions (particularly with likely strength early this week) and to add to seasonally attractive equities and sectors on weakness. Preferred sectors include economic sensitive sectors including Technology, Consumer Discretionary, Industrials and Materials (read Chemicals).

U.S. equity investments are preferred over Canadian equity investments. ’Tis the season for U.S. equities over Canadian equities until early December!

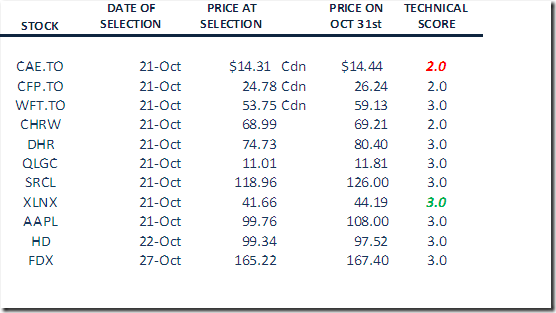

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

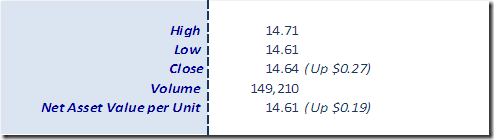

Horizons Seasonal Rotation ETF HAC October 31st 2014

Copyright © EquityClock.com