Round Numbers

prepared by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

August 29, 2014

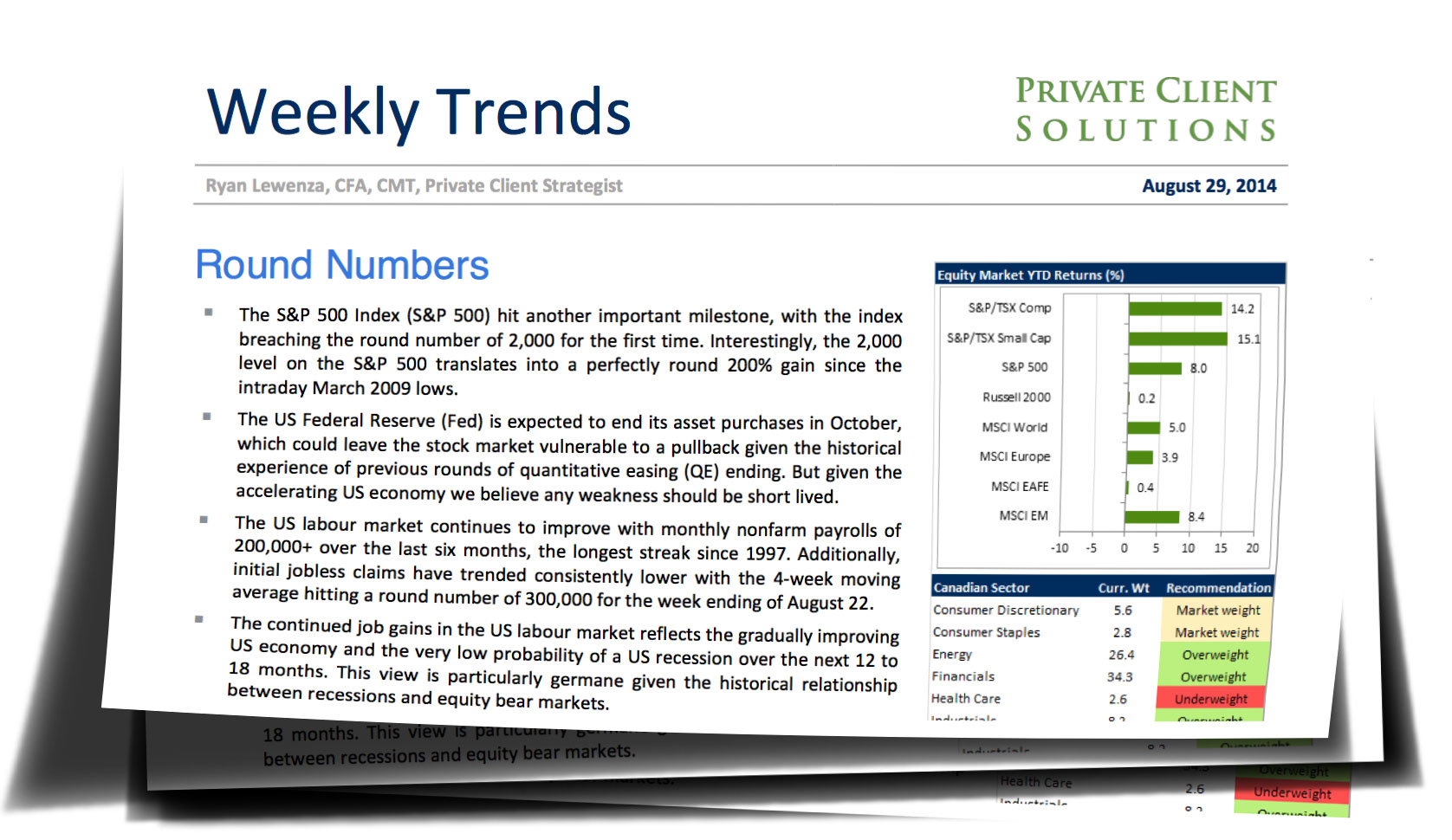

• The S&P 500 Index (S&P 500) hit another important milestone, with the index breaching the round number of 2,000 for the first time. Interestingly, the 2,000 level on the S&P 500 translates into a perfectly round 200% gain since the intraday March 2009 lows.

• The US Federal Reserve (Fed) is expected to end its asset purchases in October, which could leave the stock market vulnerable to a pullback given the historical experience of previous rounds of quantitative easing (QE) ending. But given the accelerating US economy we believe any weakness should be short lived.

• The US labour market continues to improve with monthly nonfarm payrolls of 200,000+ over the last six months, the longest streak since 1997. Additionally, initial jobless claims have trended consistently lower with the 4-week moving average hitting a round number of 300,000 for the week ending of August 22.

• The continued job gains in the US labour market reflects the gradually improving US economy and the very low probability of a US recession over the next 12 to 18 months. This view is particularly germane given the historical relationship between recessions and equity bear markets.

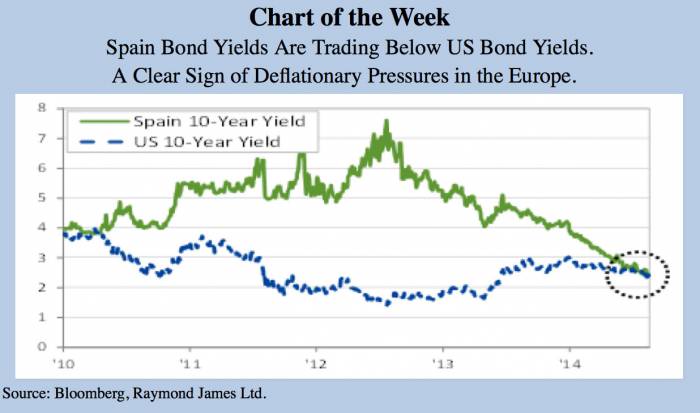

• The European economy seems to be going the other way, with economic growth stalling in Q2/14. With deflationary pressures mounting, officials are likely to implement QE in the coming months, keeping the liquidity spigot open.

Source: Bloomberg, Raymond James Ltd.

Copyright © Raymond James