by Claude Erb, via SSRN

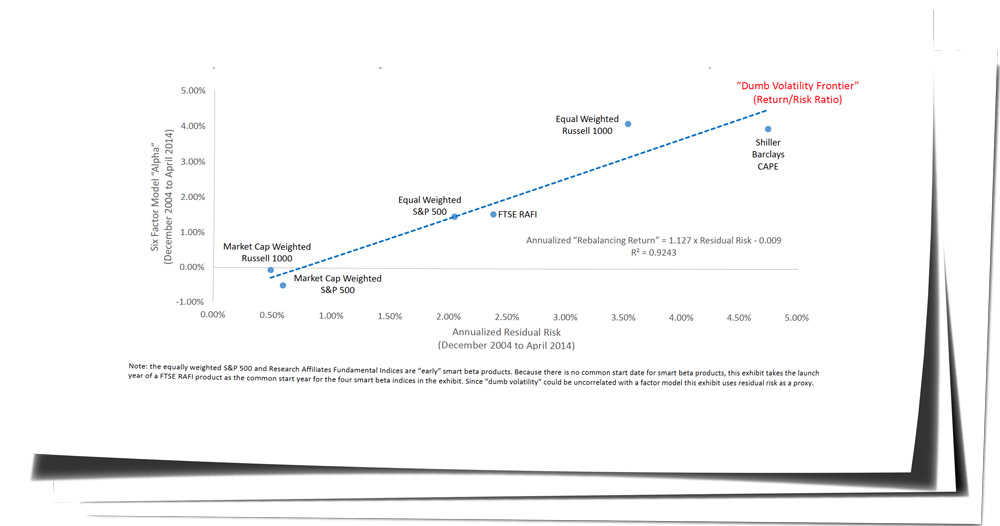

It is possible that some investors make the "dumb mistake" of "buying high and selling low". This may create "dumb volatility" which might allow some smart beta strategies to exploit the "behavior gap" by "buying low and selling high". "Live data" suggests 1) the value-added from exploiting dumb volatility has been about 2-4% per year, 2) dumb volatility strategy risk-adjusted-returns have been similar, 3) there could be a "dumb volatility return frontier" offering more "return from dumb volatility" in exchange for more "dumb volatility" and 4) some dumb volatility strategies have achieved Warren Buffett-like "value-added". A six factor model shows no evidence that traditional factors, such as "size" and "value", drove the dumb volatility return. Going forward, the ability of a strategy to absorb capital will be an important economic moat.

Copyright © SSRN