by William Smead, Smead Capital Management

As someone who came into the investment business in 1980, I was immediately enamored by the logic of Sir John Templeton. He was the founder and portfolio manager during the first 40 years of the Templeton Growth Fund. During his tenure the fund beat the S&P 500 Index by 2% per year, net of annual expenses. We believe his best concept as a contrarian investor was his idea of buying common stocks at “the point of maximum pessimism.” In other words, he looked for meritorious common stocks among those that are contentious. He also took contentiousness one step further when he said, “If you wait to see the light at the end of the tunnel, you have already missed the bottom.”

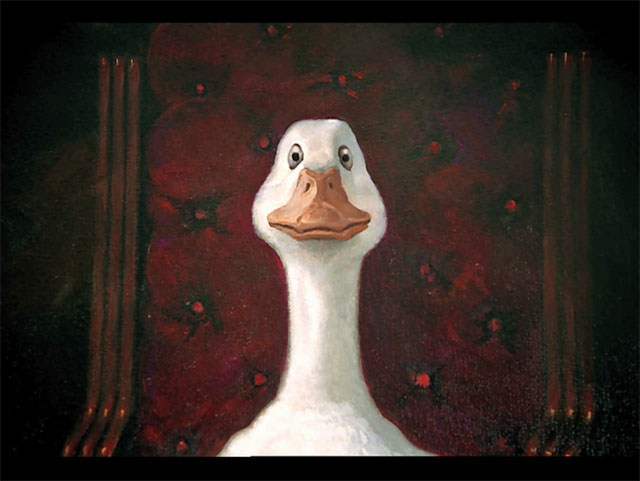

Aflac (AFL) is largest seller and underwriter of supplemental health insurance. It is also the leading issuer of individual insurance policies in Japan. Additionally, Aflac sells life, health, Medicare supplement, accident and long-term convalescent care policies. The price of common shares plummeted in the financial crisis of 2007-09 to $11.49 per share and now hovers around $59 per share. The shares then took a beating in the European debt crisis of 2011 as Aflac had a small but meaningful position in their bond portfolio among the nations called PIGS (Portugal, Ireland, Greece and Spain). The losses taken on those bonds led Aflac’s stock to fall in price to $31.46 per share. After recovering in 2012, the shares have been by-passed by the U.S. market’s performance in recent years, despite the fact that is has increased in price from $0.49 to around $59 per share over the last 30 years. This seems very cheap to us when you consider they have a consensus earnings estimate for 2014 of $6.24 per share.

There are three difficult business factors associated with Aflac which lead it to have a P/E ratio below 10 on consensus 2014 earnings. First, the Japanese yen has weakened in the last couple of years from 80 per dollar to about 102. The Japanese government has made it very clear that they would like to see the weakness continue. Since Aflac earns 74% of its profit from Japan, currency weakness reduces profitability. Second, the implementation of the Affordable Care Act in the U.S. has made small to medium size businesses both leery and distracted, which has made sales comps difficult. Aflac has also had a difficult time translating their fantastic branding into strong growth in the U.S. Lastly, Aflac owns a huge investment portfolio which is heavily invested in bonds designed to match maturities with future insurance liabilities.

In their recent Q2 2014 earnings call, the top executives of Aflac gave no indication that they can see the light at the end of the tunnel on yen weakness relative to the U.S. dollar. We at Smead Capital believe that the U.S. dollar is massively undervalued in relation to other currencies of developed economies, as the yen was before 2013. The Japanese leaders have been one of the first countries to realize and deal with this fact.

Aflac executives have consistently been frustrated by their inability to translate fantastic, wide-moat branding in the U.S. into increased sales of their supplemental health insurance in the U.S. They said on the earnings call that second half earnings will be negatively impacted by the expense of gearing up U.S. sales efforts (no light at the end of that initiative’s tunnel). In a world of low interest rates, international turmoil and potential default of countries like Argentina, risks abound in the bond market. Aflac hired Eric Kirsch from Goldman Sachs in 2011 to oversee the investment portfolio and every indication is that it is no longer an area of grief for the company. However, low interest rates overall make it harder to make money on the float created by premiums.

Here is how Smead Capital puts all of these circumstances together: Aflac has a great history of profitability, consistently gorgeous free cash flow and has generated huge wealth for the public shareholders. Still, current business negatives, which successful solutions are unknowable and unseen, cause most investors to avoid shares of the company. To us, this sounds like a prescription which Sir John Templeton might be attracted to if he were still investing.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com