by Patrick O'Shaughnessy, Millenial Invest

The best investing super-power would be perfect foresight. Imagine if every year you knew which 25 stocks (from a large, liquid universe just to keep things reasonable[i]) would be the best performers over the next year? This foresight would translate into outrageous annual returns over the past 50 years of 80% per year[ii]! Wouldn’t it be great if you could know about these stocks ahead of time? Even just one or two?

Last year’s “perfect portfolio” would have included Facebook, Tesla, Delta Airlines, Netflix, Orange (formerly France Telecom), and Alcoa. These companies came from all different corners of the market, and many would have doubled your money in just one year.

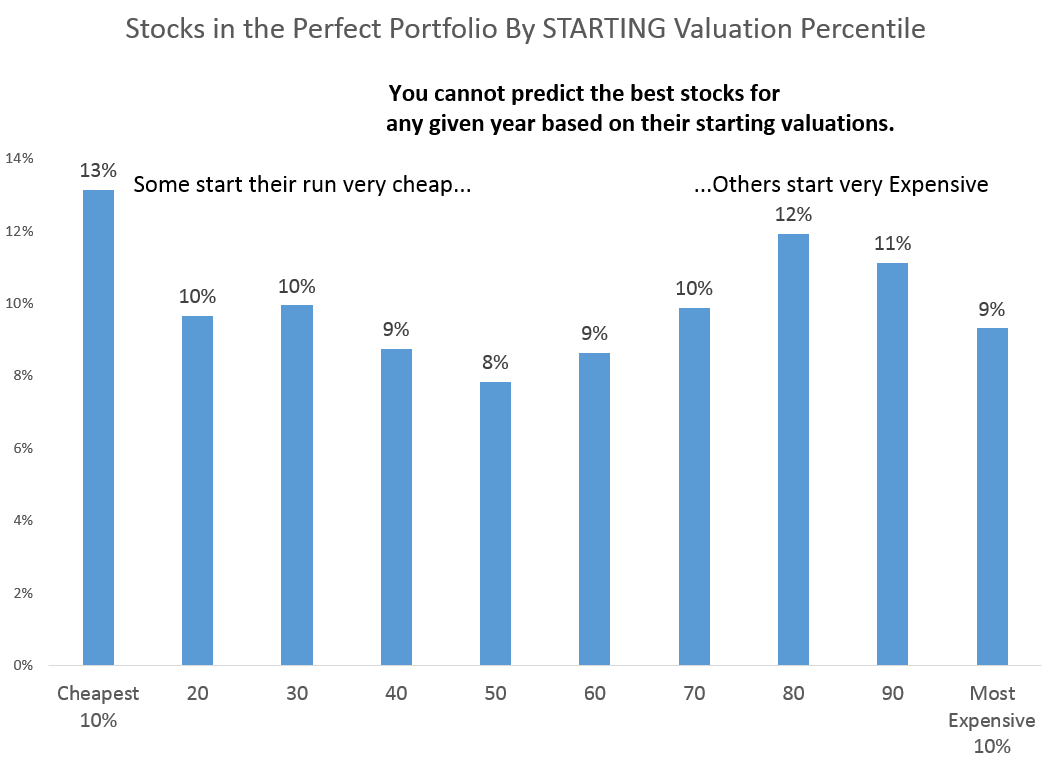

As exciting as these returns are, the important thing about these companies is that there is no rhyme or reason to how they look at the beginning of their run. I ran a profile of all “perfect portfolio” stocks since 1963, hoping to find traits or factors which these stocks had in common. Maybe they were often super-cheap to start the year, or had huge recent price momentum, or were stocks of outstanding quality. But none of these hopes proved true.

Let’s look at their starting valuations, for example. It is well established that cheap stocks outperform expensive stocks over time. But perfect portfolio stocks came from across the valuation spectrum. They were almost evenly distributed across starting valuation percentiles (where percentiles were calculated based on simple measures like price-to-earnings and price-to-sales).

The same story was true for momentum and quality (two other proven ways to select outperformers): there were no common traits among the best performing stocks.

The sad fact is that headline-making high flying stocks are impossible to identify ahead of time with any degree of consistency. Of course, investors will never stop trying to find this market equivalent of the Holy Grail. Sadly for investors, this grail quest will result in high costs and frustration, not 80% returns.

[i] Large defined as any stock with a market cap larger than the entire universe’s average market cap. Today would have a market cap floor of $7.3 billion

[ii] Of course, these returns are impossible in the real world. If you started with $1,000,000 and earned 80% annual returns, you’d own the entire global stock market (all $70 trillion of it) by your 27th year. You’d also end up owning entire companies early on and be unable to trade and earn the 80% returns for long.

Copyright © Millenial Invest