by Rick Ferri

I tilt. Do you tilt? It’s OK to tilt. Many people tilt. I’m not talking about posture or politics – I’m talking about portfolio design.

A portfolio “tilt” is industry slang for an investment strategy that overweighs a particular investment style. An example would be tilting to small-cap stocks or value stocks that have historically delivered higher returns than the stock market. Overweighing to a style is always done with the expectation of achieving a higher return or higher risk-adjusted return than the market.

The research behind a small-cap and value tilting is based in part on studies by Nobel Laureate Eugene Fama from the University of Chicago Booth School of Business and Kenneth French from Dartmouth University. Their widely cited Three-Factor Model explains the risk and return of diversified equity portfolios across three risk dimensions: market risk, size risk and value risk.

Investors who employ a Fama-French tilt in their portfolio believe that overweighing small-cap stocks and value stocks provides a different return path than holding only the capitalization-weighted market itself. Fama and French view any excess return from tilting is a payoff for taking additional risk. In contrast, some practitioners claim this method is a more efficient way to invest in that it provides a free lunch, i.e., higher returns without higher risk.

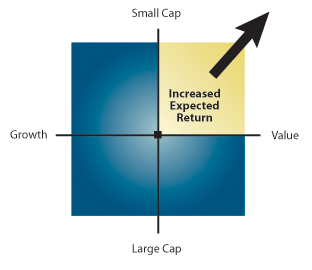

Figure 1 illustrates the Fama-French Three-Factor Model. The total stock market is in the center of the figure. The horizontal axis depicts portfolios tilted to growth stocks (left) and value stocks (right). The vertical access depicts portfolios tilted to large stocks (bottom) and small stocks (top). The gold area represents increased expected risk and return over the total market when a portfolio overweighs to value and small-cap stocks.

Figure 1: Combining small-cap and value stocks using the Fama-French Three-Factor Model

Source: Fama-French diagram as illustrated on the Portfolio Solutions website.

There are thousands of ways to create a Fama-French three-factor portfolio. My preferred method is to begin with a total stock market index fund and add exposure to a small-cap value index fund. Here’s how to build this portfolio:

1) Start with the investible stock market in its totality – nearly 4,000companies according to CRSP’s June 2014 Factsheet for their U.S. Total Market Cap Index. You can invest in a fund that tracks this index using the Vanguard Total Market Index Fund (ticker: VTSMX) or ETF (ticker: VTI). There are several other low-cost index funds that track similar total market indexes.

2) Select a small-cap value index fund to complement the total market fund. There are a variety of small-cap value index products available. I recommend a low-cost fund that is well-diversified and has a heavy concentration in small-value stocks. This way you get the most “bang” for your buck. The fund I currently use in client portfolios is the iShare S&P Small-Cap 600 Value ETF (ticker: IJS). Another fund I like is the PowerShares Fundamental Pure Small Value Portfolio (ticker: PXSV).

3) Set your tilt amount. Decide what percentage of your equity portfolio to allocate in the total market index fund and how much to allocate to a small-cap value index fund. It’s important to pick the allocation you can stick with through thick and thin because discipline is important.

Allocating between a total market index fund and a small-cap value index fund can be a tricky decision. The more tilt in a portfolio, the more “tracking error” it will have against the total stock market. That’s a good thing when small-cap value stocks are outperforming, and it’s a bad thing when large-cap growth stocks are seizing the day, the year or the decade as they did in the 1990s.

Also, know that it’s more expensive to invest in small-cap value stock index funds than a total stock market index fund. The expense ratio can be five times higher or more. Fees have an impact on expected return. The more you pay in total portfolio costs, the greater the gross index return needs to be just to cover those costs, and the less likelihood you’ll outperform net of cost.

Behavior is another issue. A tilted portfolio can underperform for many years (see Expect Years of Pain before Market Gain for details). A prolonged underperformance period makes tilting risky from a behavioral perspective. Some people are impatient and will jump out of a strategy after a few bad years. This is exactly what investors should not do because it locks in a lower long-term return. The strategy has to be diligently maintained in order for it to be successful. Tilting is a life-long investment ideal.

This brings us back to the allocation decision. My preference is 75 percent to a total market index fund and 25 percent allocation to a small-value index fund. This allocation provides some exposure to riskier assets without a lot of tracking error or meaningfully higher cost. A portfolio mix should be rebalanced each year back to its target allocation.

Tilting a portfolio is a decades old concept that has gotten a face-lift in recent years. Today, we hear about them as “smart-beta” strategies. Articles on smart-beta appear in the media every week.

Don’t let the hype of smart-beta confuse you. Wall Street loves to repack old concepts with snappy new titles because it helps sell products to less educated investors. Smart-beta is tilting in a pretty new wrapper.

I’m not for the smart-beta hype because it leads to short-sighted investment decisions. This is a complex strategy that needs contemplation and consideration. I don’t recommend it for people who don’t fully understand that potential higher returns cannot be achieved without taking higher risk. See Smart Beta and Tourist Investors for details.

Tilting is for investors who are knowledgeable, understanding, willing to accept higher risk and pay higher fees, and most important, are extremely disciplined in implementation and maintenance. If this is you, choose your funds wisely and keep your costs as low as you can. This will give you the highest probability for long-term success.

Copyright © Rick Ferri