by Vadim Zlotnikov, AllianceBernstein

Small-cap stocks have lagged large-cap stocks by a substantial margin over the past few months, but a close look at the causes makes us think they could be in for a reversal of fortune.

It hasn’t been a banner few months for US small-cap stocks. From March through the end of May, the Russell 2000 Index of small-caps declined by 3.8%. Large-cap stocks, in contrast, delivered a positive 4% return, based on the S&P 500 Index. The relative performance gap of 7.7% represented one of the worst three-month stretches for small-caps in decades.

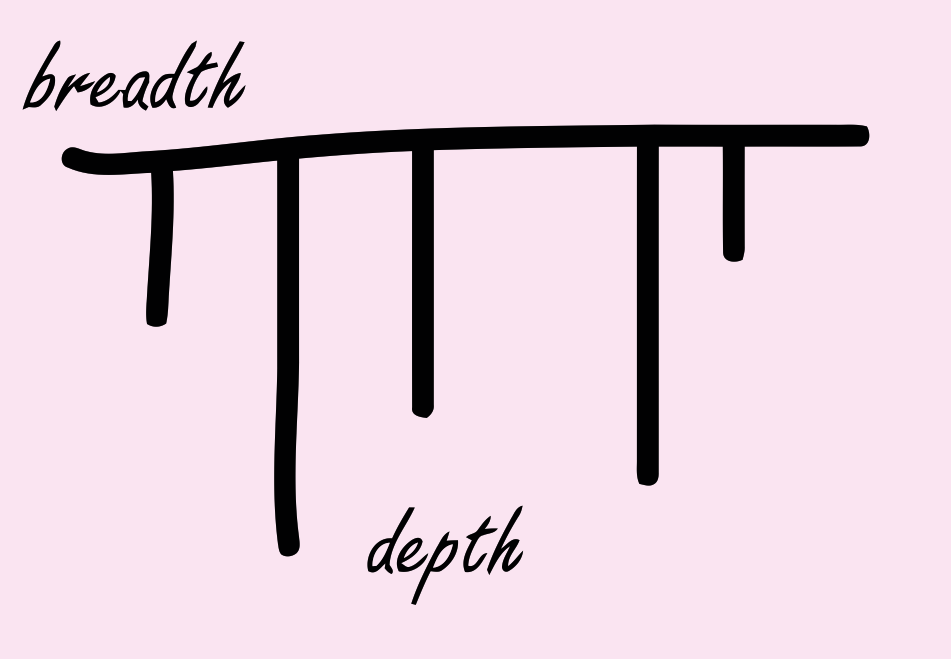

The underperformance was global in scope, but it appeared to be most extreme in the US. If we look back to 1979—a period spanning 35 years of performance history—small-caps fared worse versus large-caps in only about 5% of the observed three-month periods (Display).

One Culprit: Index Composition

We drilled down into the underperformance to look at the causes. As it turns out, differences in the way small-cap and large-cap stock indices are composed had a hand in the recent shortfall for small-caps. The biases and exposures of cap-weighted indices tend to fluctuate over time, and the profile of the Russell 2000 didn’t do it any favors in recent months. It had relatively high exposure to certain factors that did poorly and underweight in some that did well.

For example, relative to the S&P 500, the Russell 2000 had a greater concentration of high-beta, low-profitability stocks and financial-sector stocks—neither of which was in favor. At the same time, it was relatively underexposed to energy stocks, which enjoyed strong relative performance.

We’ve looked at similar periods of underperformance historically. In the three months after these shortfalls, small-caps tended to perform in line with large-caps. Over the ensuing six- to 12-month period, small-caps outgained large-caps by 2% to 4%. It’s also interesting that if we exclude the massive underperformance by small-caps during the tech bubble, the 12-month outperformance increases to almost 10% versus large-caps.

What Could Drive a Performance Reversal?

We think there’s a reasonably good chance of a reversal in the relative underperformance of small-cap stocks versus large-caps as we move forward.

One development that could help smaller-cap stocks is a pickup in merger & acquisition activity. Smaller companies tend to be the most common targets of this activity, and acquiring companies often pay a premium in the process. Growing evidence of an economic rebound might also help, because smaller-cap stocks tend to be more responsive to economic conditions. A stronger US dollar could also contribute by making exports to other nations more expensive. Since the business models of smaller companies tend to be more domestically oriented, they tend to be less vulnerable to the headwinds of higher export prices than larger firms are.

We think there’s a good chance that small-cap stocks will reverse their recent performance deficit versus large-cap stocks, but investors should be measured in their exposure: small-cap valuations range from neutral to unattractive. We do see an opportunity ahead for this market segment. Of course, as with any investment strategy, the specific stocks you choose make a big difference in the results you achieve.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist and Co-Head of Multi-Asset Solutions at AllianceBernstein (NYSE: AB).

Copyright © AllianceBernstein