by Mawer Investment Management, via The Art of Boring Blog

The date was November 9, 1989. George Bush Sr. sat in the oval office, a host of senior intelligence officers before him. These officers were in the midst of explaining to the President why the Berlin Wall was most certainly not going to fall in the near future. As the group discussed their analyses, a messenger came into the room and quietly turned on the TV. The conversation was immediately interrupted by the sound and images of people tearing down a massive, concrete wall: the Berlin Wall was coming down right before their eyes.

As this botched intelligence investigation illustrates, the “truth” is often subjective. The objective reality in any situation is generally not easy to ascertain, especially if it involves: a) the future, and b) uncertainty. Part of the difficulty is that, we, as humans, are gifted in our capacity to delude ourselves. We are cognitively and emotionally biased against seeing the world with true objectivity. One example of this is when individuals fall prey to a phenomenon we call engrained truths.

An engrained truth is an assumption that, held long enough, starts to feel like a permanent fixture of reality; it is an idea that becomes so deeply embedded into the psyche of the masses that it starts to affect behaviour and becomes self-reinforcing. For example, in the weeks before the Berlin Wall fell, intelligence officials believed firmly that Germany was in no way ready for reunification as this simply did not fit into the mental model that the “experts” had developed over time. Likewise, the mantra that “housing prices only ever go up” is an engrained truth that seems to recur every housing cycle.

Engrained truths are pernicious and can be particularly problematic for investors. Here are some of the engrained truths we observe in the current environment:

- Central banks are fully capable of getting economies back in shape and will be able to normalize rates effectively. Except, what if they don’t? The tactics employed by central banks around the world and scale at which they have intervened, represents one giant experiment.

- Property prices always go up. Our American counterparts were recently burned on this one, but Canadians and Australians have yet to be reminded of the cycle of, and leverage inherent in, real estate.

- The USD is always the safe haven of choice and US Treasuries are risk-free. It would have been inconceivable in the early 20th century to think that the Sterling would lose its reserve status to the USD, yet the transition did occur. Even if improbable, it is not impossible for the U.S. to overburden itself with debt and fall into a nasty debt cycle, the consequence of which could be a selloff of the Dollar and Treasuries.

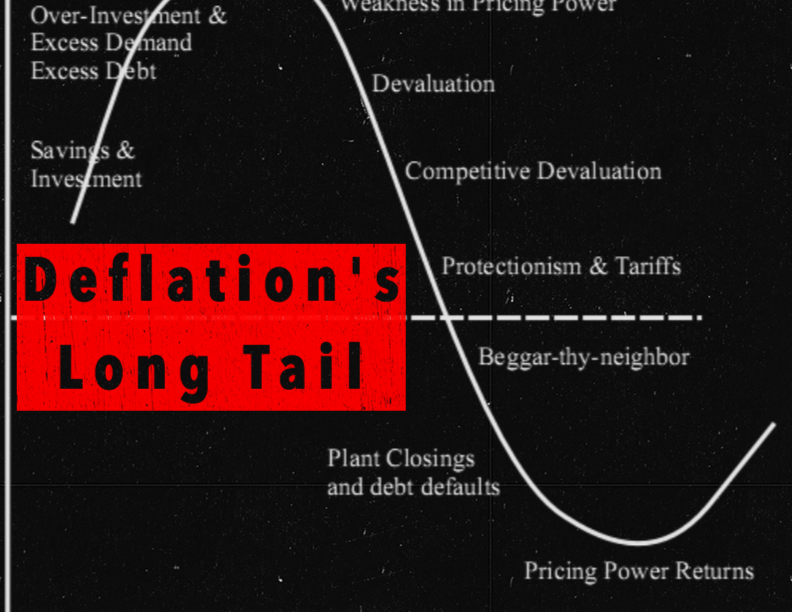

- Interest rates are definitely going up. Investors in the market currently seem to assume that interest rates will normalize in the next year, yet there could be a myriad of reasons why this doesn’t turn out to be the case. Among them: structural overcapacity in the world, a financial crisis in China, significant deflation in Europe, or weak commodity prices (for the Canadian economy).

- Mean reversion always occurs and correlations between asset classes that existed previously will continue into the future. What if some fundamentals shift and certain asset prices go discrete?

- Canada has resources the world needs. The typical argument for the Canadian economy is that Canada is blessed with natural resources that the world needs: oil, gas, and other commodities. Would this still be the case in 10 years if no big pipelines were built, the price of solar energy continued to drop at its current rate, and/or cheaper oil was able to beat expensive Canadian oil to market?

- Emerging markets are bound to have structural growth. Although we often find ourselves in this camp, there is no certainty that this region will grow at previously achieved rates.

It is important to recognize engrained truths as the perception of risk can become dangerously distorted when an investor’s assumptions turn into an embedded reality. Therefore, it is beneficial for an investor to escape the views of the masses when they become myopic. While this may not always be easy to do, we find that a questioning, skeptical mindset is a good starting point. This type of thinking can help uncover unique investment opportunities and also help limit one’s negative exposures.

Certainly, engrained truths extend beyond investing. Just as President Bush and his team of advisors were certain the Berlin Wall would not fall, it is clear that many other accepted “truths” in life are not so. They are simply temporary conditions that have the potential to be completely undermined by discrete events or shifting paradigms. Just because a notion becomes accepted as prevailing wisdom does not make it wise.

This post was originally published at Mawer Investment Management