by Don Vialoux, Timing the Market

Economic News This Week

March Retail Sales to be released at 8:30 AM EDT on

Monday are expected to increase 1.0% versus a gain of 0.3% in

February. Excluding Auto Sales March Retail Sales are

expected to increase 0.5% versus a gain of 0.3% in February.

February Business Inventories to be released at 10:00 AM

EDT on Monday are expected to increase 0.6% versus a gain of

0.4% in January

March Consumer Prices to be released at 8:30 AM EDT on

Tuesday are expected to increase 0.1% versus a gain of 0.1% in

February. Excluding Food and Energy, March Consumer

Prices are expected to increase 0.1% versus a gain of 0.1% in

February.

The April Empire Manufacturing Index to be released at

8:30 AM EDT on Tuesday is expected to increase to 7.5 from 5.6

in March

March Housing Starts to be released at 8:30 AM EDT on

Wednesday are expected to increase to 955,000 from 907,000 in

February.

March Canadian Consumer Prices to be released at 8:30 AM

EDT on Wednesday are expected to increase 0.4% versus a gain of

0.8% in February.

March Industrial Production to be released at 9:15 AM

EDT on Wednesday is expected to increase 0.5% versus a gain of

0.6% in February. March Capacity Utilization is expected

to improve to 78.8 from 78.4 in February.

The Fed Beige Book for April is released at 2:00 PM EDT

on Wednesday.

Weekly Initial Jobless Claims to be released at 8:30 AM

EDT on Thursday are expected to increase to 312,000 from

300,000 last week.

The April Philly Fed Manufacturing Index to be released

at 10:00 AM EDT on Thursday is expected to decrease to 8.6 from

9.0 in February.

Earnings Reports This Week

Equity Trends

The S&P 500 Index plunged 49.40 points (2.65%) last

week. Trend changed from up to neutral when the Index fell

below the 1,839.57. The Index remains below its 20 day moving

average and fell below its 50 day moving average. Short term

momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day

moving average plunged to 39.20% from 74.60% last week.

Percent remains in intermediate downtrend.

Percent of S&P 500 stocks trading above their 200 day

moving average plunged last week to 73.00% from 85.20%.

Percent is overbought and trending down.

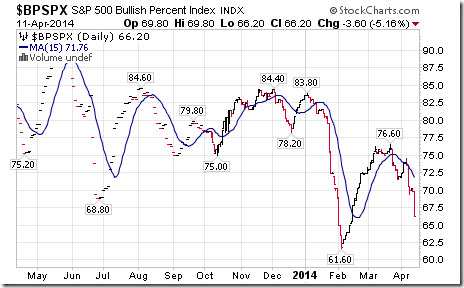

Bullish Percent Index for S&P 500 stocks fell last week

to 66.20% from 73.80% and moved below its 15 day moving

average. The Index is overbought and trending down.

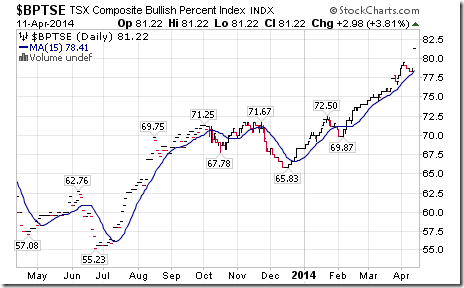

Bullish Percent Index for TSX Composite stocks increased

last week to 81.22% from 78.66% and remained above its 15

day moving average. The Index remains overbought and above its

15 day moving average.

The TSX Composite Index fell 135.41 points (0.94%) last

week. Intermediate trend remains up (Score: 1.0). The Index

fell below its 20 day moving average (Score: 0.0). Strength

relative to the S&P 500 Index changed to positive from

neutral (Score: 1.0). Technical score based on the above

technical indicators slipped to 2.0 from 2.5 out of 3.0. Short

term momentum indicators are trending down.

Percent of TSX stocks trading above their 50 day moving

average fell last week to 56.97% from 67.09%. Percent

remains intermediate overbought and trending down.

Percent of TSX stocks trading above their 200 day moving

average slipped last week to 77.87% from 78.90%.

The Dow Jones Industrial Average fell 385.96 points (2.35%)

last week. Trend changed from up to neutral (Score: 0.5) on

a move below 16,046.99 on Friday. The Average fell below its 20

and 50 day moving averages (Score: 0.0). Strength relative to

the S&P 500 Index remained positive. Technical score fell

to 1.5 from 3.0 out of 3.0. Short term momentum indicators are

trending down.

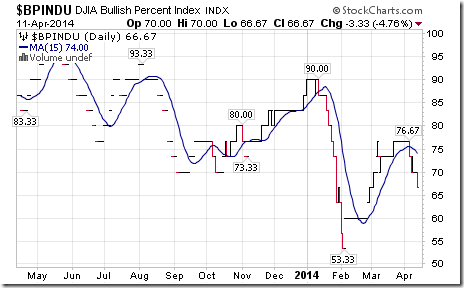

Bullish Percent Index for Dow Jones Industrial Average

stocks fell last week to 66.67% from 73.33% and remained

below its 15 day moving average. The Index remains intermediate

overbought and trending down.

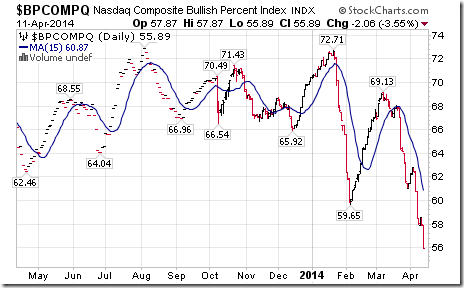

Bullish Percent Index for NASDAQ Composite Index plunged to

55.89% from 60.74% and remained below its 15 day moving

average. The Index remains overbought and trending down.

The NASDAQ Composite Index plunged 128.00 points (3.10%)

last week. Intermediate trend remains down. The Index

remains below its 20 and 50 day moving averages. Strength

relative to the S&P 500 Index remains negative. Technical

score remains at 0.0 out of 3.0. Short term momentum indicators

are oversold, but have yet to show signs of bottoming.

The Russell 2000 Index plunged 41.94 points (3.64%) last

week. Intermediate trend remains down. The Index remains

below its 20 and 50 day moving averages. Strength relative to

the S&P 500 Index remains negative. Technical score remains

at 0.0 out of 3.0. Short term momentum indicators are oversold,

but have yet to show signs of bottoming.

The Dow Jones Transportation Average fell 208.37 points

(2.75%) last week. Trend changed on Friday from up to

neutral on a move below 7, 375.59. The Average fell below its

20 and 50 day moving averages. Strength relative to the S&P

500 Index changed from positive to neutral. Technical score

fell to 1.0 from 3.0 out of 3.0. Short term momentum indicators

are trending down.

The Australia All Ordinaries Composite Index slipped 5.00

points (0.09%) last week. Intermediate uptrend was

confirmed on a move above 5,477.30. The Index remains above its

20 and 50 day moving averages. Strength relative to the S&P

500 Index improved to positive to neutral. Technical score

improved to 3.0 from 2.5 out of 3.0. Short term momentum

indicators are overbought.

The Nikkei Average plunged 1,103.72 points (7.33%) last

week. Intermediate downtrend was confirmed on a move below

13,995.86. The Average fell below its 20, 50 and 200 day moving

averages. Strength relative to the S&P 500 Index changed

from positive to negative. Technical score dropped to 0.0 from

2.0 out of 3.0. Short term momentum indicators are oversold,

but have yet to show signs of bottoming.

iShares Europe 350 units fell $0.61 (1.26%) last week.

An intermediate uptrend was confirmed on a move above $48.89.

Units fell below their 20 day moving average on Friday.

Strength relative to the S&P 500 Index remained positive.

Technical score remains at 3.0 out of 3.0. Short term momentum

indicators are overbought and showing signs of rolling over.

The Shanghai Composite Index added 71.71 points (3.48%) last

week. Intermediate trend changed from down to up on a move

above 2,079.55. The Index remained above its 20 day moving

average and moved above its 50 and 200 day moving averages.

Strength relative to the S&P 500 Index improved to positive

from neutral. Technical score improved to 3.0 from 1.5 out of

3.0. Short term momentum indicators are overbought, but have

yet to show signs of peaking.

iShares Emerging Markets added $0.53 (1.28%) last week.

Intermediate trend remained up. Units remain above their 20, 50

and 200 day moving averages. Strength relative to the S&P

500 Index remained positive. Technical score remained at 3.0

out of 3.0. Short term momentum indicators are overbought and

showing early signs of peaking.

Currencies

The U.S. Dollar Index plunged 0.99 (1.23%) last week.

Intermediate trend remains neutral. The Index fell below its 20

and 50 day moving averages. Short term momentum indicators are

trending down.

The Euro gained 1.83 (1.34%) last week. Intermediate

trend remains up. The Euro moved above its 20 and 50 day moving

averages. Short term momentum indicators are trending up.

The Canadian Dollar was unchanged last week. Trend

changed from down to neutral on a move above 91.41. The Canuck

Buck remains above its 20 and 50 day moving averages. Short

term momentum indicators are overbought.

The Japanese Yen gained 1.57 (1.62%) last week.

Intermediate trend remains down. The Yen moved above its 20 and

50 day moving averages. Short term momentum indicators are

trending up.

Commodities

The CRB Index added 4.45 points (1.46%) last week.

Intermediate uptrend was confirmed on a move above 308.38. The

Index remains above its 20, 50 and 200 day moving averages.

Strength relative to the S&P 500 changed from neutral to

positive. Technical score improved to 3.0 from 2.5 out of 3.0.

Gasoline jumped $0.08 per gallon (2.73%) last week.

Intermediate trend remains up. Gasoline remains above its 20

day moving average. Strength relative to the S&P 500 Index

changed from neutral to positive. Technical score improved to

3.0 from 2.5 out of 3.0.

Crude Oil gained another $2.68 per barrel (2.65%) last

week. Intermediate trend remains neutral. Crude remains

above its 20 day moving average. Strength relative to the

S&P 500 Index changed from neutral to positive. Technical

score improved to 3.0 from 2.5 out of 3.0. Short term momentum

indicators are trending up.

Natural Gas gained $0.20 per MBtu (4.52%) last week.

Intermediate trend remains negative. Gas moved above its 20 day

moving average. Strength relative to the S&P 500 Index

changed from neutral to positive. Technical score improved to

2.0 from 0.5 out of 3.0. Short term momentum indicators are

trending up.

The S&P Energy Index fell 10.70 points (1.62%) last

week. Intermediate trend remains up. The Index remains

above its 20, 50 and 200 day moving averages. Strength relative

to the S&P 500 Index remains positive. Technical score

remains at 3.0 out of 3.0. Short term momentum indicators have

rolled over from overbought levels.

The Philadelphia Oil Services Index fell 7.63 points (2.62%)

last week. Intermediate trend remains up. The Index moved

below its 20 day moving average. Strength relative to the

S&P 500 Index remains positive. Technical score slipped to

2.0 from 3.0 out of 3.0. Short term momentum indicators are

trending down.

Gold gained $16.70 per ounce (1.28%) last week.

Intermediate trend remains up. Gold moved above its 20 and 50

day moving averages. Strength relative to the S&P 500 Index

changed from negative to positive. Technical score improved to

3.0 from 1.0 out of 3.0. Short term momentum indicators are

trending up.

Silver was unchanged last week. Intermediate trend

remains up. Silver remains below its 20, 50 and 200 day moving

averages. Strength relative to the S&P 500 Index changed

from negative to neutral. Technical score improved to 1.5 from

1.0 out of 3.0. Short term momentum indicators are trending up.

Strength relative to Gold remains negative.

The AMEX Gold Bug Index slipped 0.84 points (0.37%) last

week. Intermediate trend remains neutral. The Index remains

below its 20, 50 and 200 day moving averages. Strength relative

to the S&P 500 Index changed to neutral from negative.

Technical score improved to 1.0 from 0.5 out of 3.0. Short term

momentum indicators are trending up. Strength relative to Gold

changed from neutral to negative.

Platinum gained $14.00 per ounce (0.97%) last week.

Trend remains up. Platinum remains above its 20 day MA.

Strength relative to the S&P 500 Index remained positive.

Technical score remains at 3.0. Strength relative to Gold

remains positive. ‘Tis the season for strength!

Palladium added $16.00 per ounce (2.02%). Nice breakout

on Friday. Platinum remains above its 20 day MA. Strength

relative to the S&P 500 Index and Gold remains positive.

Score: 3.0

Copper added $0.01 per lb.(0.33%) last week.

Intermediate trend remains down. Copper remains above its 20

day moving average. Strength relative to the S&P 500 Index

changed from neutral to positive. Technical score improved to

2.0 from 1.5 out of 3.0. Short term momentum indicators are

trending up.

The TSX Metals & Mining Index added 12.55 points (1.56%)

last week. Intermediate trend remains down. The Index

remains above its 20 day moving average. Strength relative to

the S&P 500 Index improved to positive from neutral.

Technical score improved to 2.0 from 1.5 out of 3.0. Short term

momentum indicators are trending up.

Lumber added $0.60 (0.18%) last week. Trend remains

down. Lumber remains below its 20 day moving average. Strength

relative to the S&P 500 changed from negative to neutral.

The Grain ETN slipped $0.62 (1.24%) last week. Trend

remains up. Units fell below their 20 day moving average on

Friday. Strength relative to the S&P 500 Index remains

positive. Technical score fell to 2.0 from 3.0 out of 3.0.

The Agriculture ETF fell $0.64 (1.19%) last week.

Intermediate trend remains up. Units fell below their 20 day

moving average on Friday. Strength relative to the S&P 500

Index remains positive. Technical score slipped to 2.0 from 3.0

out of 3.0. Short term momentum indicators are trending down.

Interest Rates

The yield on 10 year Treasuries dropped 10.7 basis points

(3.93%) last week. Intermediate trend remains up. Yield

remains below its 20 day moving average. Short term momentum

indicators are trending down.

Conversely, price of the long term Treasury ETF added $2.27

(2.09%) last week. Intermediate trend remains up. Units

remain above their 20 day moving average.

Other Issues

The VIX Index spiked 3.07 (21.99%) last week. The Index

moved above its 20, 50 and 200 day moving averages.

Technical action by individual equities in the S&P 500

was bearish last week. On Friday, 48 S&P 500 stocks

broke intermediate support levels. Look for more stocks

breaking support than stocks breaking resistance this week.

Technical action by individual equities in the TSX Composite

Index was neutral. Energy stocks dominated the list of

stocks breaking resistance. Seasonal influences in the sector

remain positive until early May.

Major breakdowns by broadly based U.S. equity indices last

week imply that an intermediate correction has started.

Short and intermediate technical indicators for U.S. indices

and sectors generally are trending down from overbought levels.

Economic news this week is expected to confirm a rebound in

the U.S. economy from depressed December/early March

weather-depressed levels.

First quarter reports start to pour in this week. Main

focus is on the Financial Services sector. Technology also is

in focus. The market is anticipating a “difficult” comparison

for earnings and revenues on a year-over-year basis. Consensus

for S&P 500 companies on average is no change from last

year. However, most first quarter reports are released at

annual meetings where stock splits, dividend increases and

share buy backs frequently are announced.

Historically during U.S. Midterm Presidential Election

years, U.S. equity indices have reached an intermediate high

near the middle of April followed by a correction that lasts

until early October. Technical action last week suggests

that the correction this year already has started. We are not

alone with this call. Following is a link to a MarketWatch.com

call published on Friday with a headline reading, “A bigger

10%-15% correction is coming this autumn: Bank of

America/Merrill Lynch”.

International focus this week is on China’s first quarter

GDP to be released on Wednesday. Consensus is for a

slowdown to 7.3% from 7.7% in the fourth quarter. Other

international focuses include developments in Ukraine,

Venezuela and Iran.

Trading activity is expected to diminish during the week as

the Good Friday holiday approaches.

Weakness in the U.S. Dollar continues to impact equity

markets, particularly the Materials and Energy sectors.

Equity markets outside of the U.S. continue to show positive

returns on a real and relative basis.

The Bottom Line

Strength in mid-week last week is expected to prove to be

the last chance to take profits in a variety of seasonal trades

that were approaching their average exit dates. Intermediate

downside risk remains. Any short term strength will provide an

opportunity to reduce positions.

Special Free Services available

through www.equityclock.com

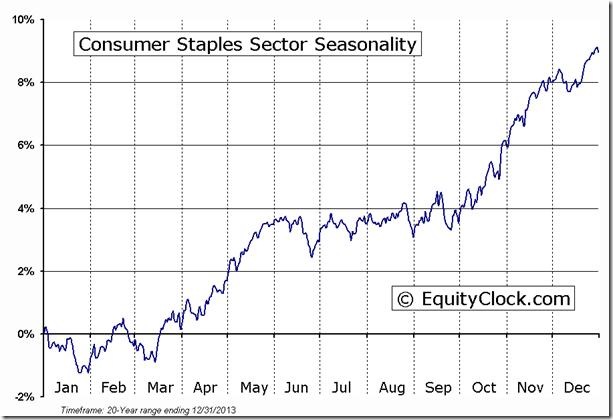

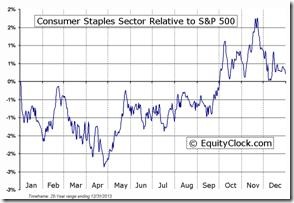

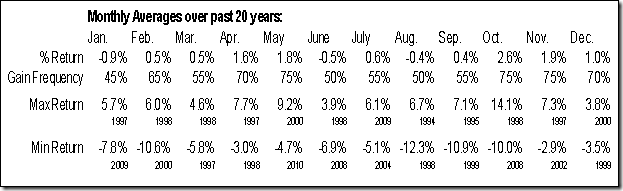

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

It’s time to celebrate!

== = = = = = = = = = = = = = = = = =

=

Tech Talk celebrated its

11th anniversary of service on April

12th

== = = = = = = = = = = = = = = = = =

=

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada)

Inc. All of the views expressed herein are the personal

views of the authors and are not necessarily the views of

Horizons ETFs Investment Management (Canada) Inc., although any

of the recommendations found herein may be reflected in

positions or transactions in the various client portfolios

managed by Horizons ETFs Investment Management (Canada)

Inc.

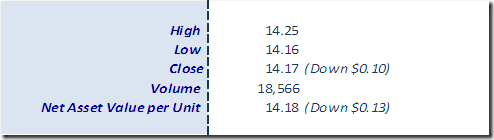

Horizons Seasonal Rotation ETF HAC April

11th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2019/08/359dfa3edfd20ce50fb0c93dd471b3ba.png)