You Raised All This Money, Now What Do You Do?

By Brian Livingston, General Manager of SIACharts

If you are like most advisors, you have spent the beginning of the year rushing from meeting to meeting, gathering assets as clients both new and old tried to get money in before the RRSP deadline. What is likely happening now is that the money is being transferred into your accounts and you need to start making some informed decisions for these clients. Now what do you do? Do you have an actual defined investment strategy that you adhere to? Is this strategy consistent and based on anything other than your gut instinct? Do you have a system in place to protect your client against potential market downside losses like back in 2008, and take advantage of upside moves in the markets like we are currently experiencing now? If you can’t answer yes to all of these questions, then you owe it to your clients and to yourself to read on.

I was talking with someone last week, who said that he really did not feel confidence that his advisor had a strategy to deal with changing market conditions. Does this statement ring true of you as well? If we boil right down to it, as an advisor, you will make more money if you spend more time with your clients, and less time sitting behind a computer in an attempt to decipher what is going on with the overall macro direction of the markets, and then trying to figure what to do with individual investment selections. Should you be in the U.S. or Canadian Equity markets right now, or maybe you should be in Cash? How much time is wasted trying to do all the analysis by yourself? Spending all this time on analyzing securities minimizes your revenue generating opportunities. A recent study conducted by a research group concluded that advisors who spend in excess of 60% of their time in client facing activity earned 3 to 5 times more income than those that did not.

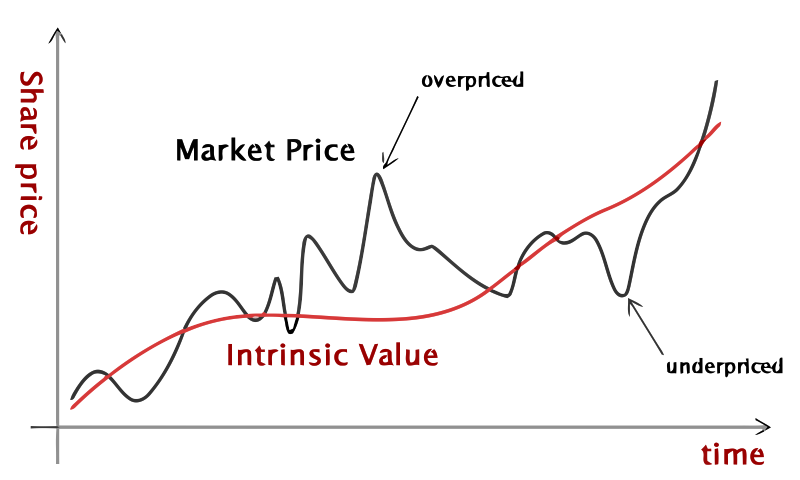

Potential clients, as well as current ones, are looking for something different and better. The days of Buy and Hold are gone as a strategy, as clients don’t want to hear that we may lose a decade or two of returns. There is a large group of investors, with huge sums of money moving ever closer to retirement, and they cannot afford to have 2008 happen again. They want to know that you have a systematic solution for these issues, not just a buy and hope strategy. Those advisors who recognize this change in the client landscape will have the greatest opportunity to prosper, while others will be left behind trying to figure out what happened.

How do you decide where to put this money that you just received? Maybe you should be in Commodities right now, Emerging Markets, Bonds, or Currencies? What is the rules based approach that you follow every time to help fully serve your clients? Growing your book is very difficult if not almost impossible without a systematic approach to help streamline your business.

Investment advisors using SIACharts take advantage of being able to have a macro to micro approach to markets, one that is consistent, easy to follow, and easy to explain to prospects and clients. In a few minutes a day, advisors can identify, track, and report their various strategies, so they easily know where to be placing all of their client’s assets. This strict approach to risk management has been able to help our clients reduce their risk significantly, while helping them stay in the markets for longer periods of time during bull markets improving their performance. And just as important, saving you time from rigorous in-depth analysis thus giving you more time to spend face to face with your clients and more opportunity to increase your book of assets.

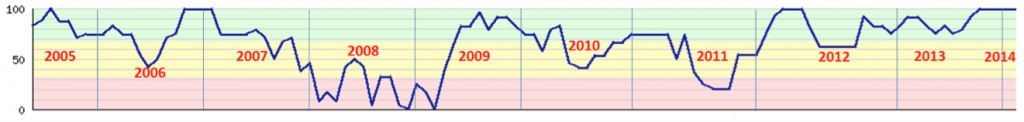

So, how do we go about doing this? Our first step is an overall call on how we should be approaching the Equity markets for risk management, referred to as the SIA Equity Action CallTM. Depending upon where the call currently resides within 1 of 3 zones, our clients change their approach towards their purchases, to the point that they may not be making any equity purchases at all.

Once we have established how (and if) we are going to make an equity purchase, we then need to know more specifically which asset class and which equity market to purchase with the lowest risk. SIA provides this information to the Investment Advisor. What is stronger right now: US, International, or Canadian Equity? How do we know when to get defensive and go more into Cash and/or Fixed Income if needed? Using the SIACharts Asset Class Ranking SystemTM, we can again narrow down the purchase by selecting the strongest asset classes and then the strongest sectors within that asset class.

Staying in the strongest asset classes has done 2 things for our clients. First, it has helped minimize the amount of time spent on analysis giving advisors more time to market, prospect, and meet with their current clients. Second, it has also helped to minimize risk and increase their returns by keeping them out of the weakest asset classes. Knowing what asset classes currently present the highest risk is one of the most important elements to help eliminate possible drawdowns in their portfolio. Minimizing drawdowns is as important as generating returns, especially for your clients nearing retirement.

Now, we need to take that final step in sharpening the pencil and decide what the positions are that we need to invest in. Once again, we employ our relative strength system for our advisors to narrow down the selection process even further. Whether you are looking at Stocks, ETFs, or Mutual Funds, the SIA system again ranks the holdings from strongest to weakest to show you what to buy and also what to avoid or sell.

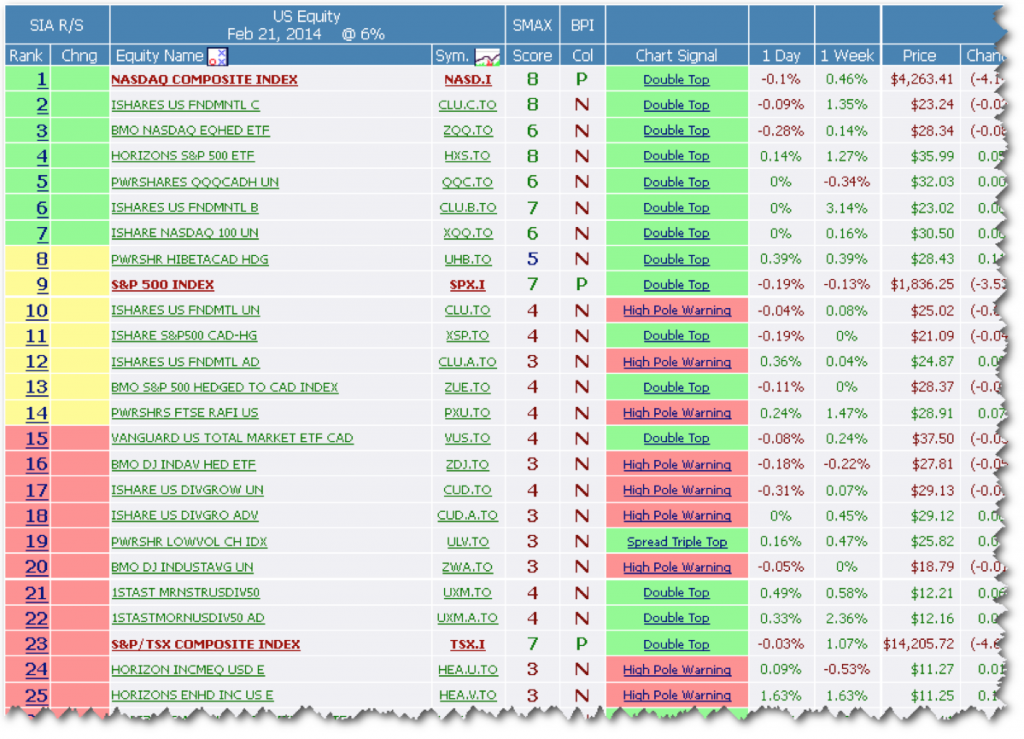

In the example below, we are going to look at ETFs using our US Equity ETF Report as US Equity is the top ranked asset class currently in SIACharts.

The report is broken down into 3 different color-coded zones to help minimize the number of selections you need to analyze, as we only make purchases in the Favored Green Zone. Staying out of the other zones helps to yet again minimize the risk profile for your clients.

By taking this rules based, macro to micro approach, advisors using SIACharts know exactly how to approach their purchases and exactly what and when to buy and sell. We have heard from advisors using our service that last year was their best year ever, in terms of gathering assets and also in terms of returns. Some made over 50% returns for the clients in their growth models with very few transactions, and most importantly very little time spent behind the computer.

So, what are you going to do with all that new money you just brought in? Do the same thing that you have always done in hopes that something different happens this year? Or, would you rather develop investment management strategy that is successfully helping to minimize losses and maximize returns for hundreds of advisors across North America in minutes a day? Put that hard earned money to work with confidence in the markets with a rules based strategy today!

Want to see strategies that have been returning 13% to 25% annually for the last 6 years, regardless if you are using Stocks, ETFs, or Mutual Funds? Sign up now for a no obligation, FREE two week trial by clicking here and someone from our office will contact you right away about setting up a time to give you a free demonstration how to use the site to yours and your client’s best advantage.