Merrill Lynch Fund Manager Survey

Chart 1: Fund managers remain heavily exposed to global equities

Source: Short Side of Long

Last months Merrill Lynch Fund Manager Survey showed extreme exposure towards global equities, with managers being 60% overweight. The recent October data shows a slight pullback towards 49% overweight and still remaining quite close to the 1 standard deviation above a decade long mean. The reading stood at -12% underweight in December 2011, just as the rally was taking off.

Chart 2: Eurozone is the most preferred equity region for global managers

Source: Short Side of Long

Regional exposure within the stocks is also changing. Eurozone equites are now the most favour area for global fund managers, being 46% overweight. This is a huge increase from only 3% overweight in July of this year. Japanese equities come in as the second most loved region in the survey, at 30% overweight. Interestingly, US equities, which have been favoured so many times since the 2009 bull market began, currently find themselves at neutral levels (0% exposure). It seems that trend followers and sheep herding managers have been scared by the Debt Ceiling issues and have rotated out of US into EU.

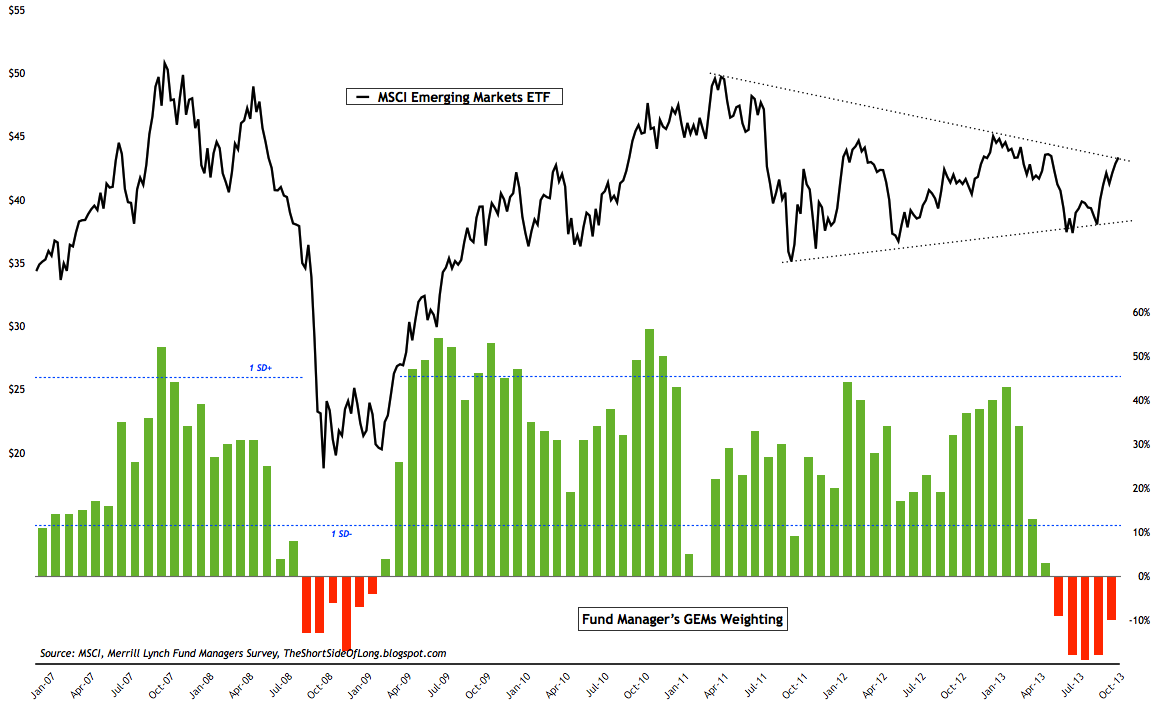

Chart 3: However, exposure towards emerging markets remains bearish

Source: Short Side of Long

However, equities are not loved everywhere. On average, emerging markets still remain out of favour by global fund managers, with exposure remaining below 1 standard deviation from the decade long mean for the 6th month running. Current reading of exposure currently stand at -10% underweight and was as high as 43% overweight in February of this year.

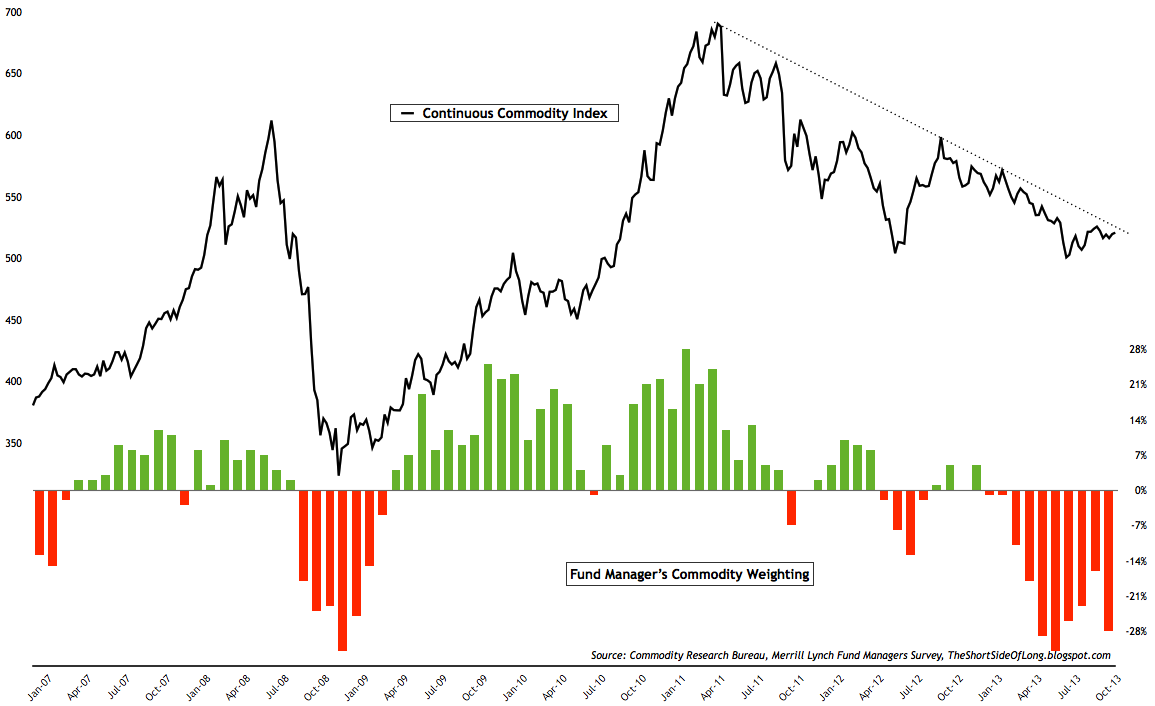

Chart 4: Commodities continue to be very disliked and under owned

Source: Short Side of Long

Emerging market equities aren't the only disliked asset class in the world right now. Commodities exposure remains extremely bearish and at some of the lowest levels in the surveys history. Commodities did reach a record underweight of -32% in June of this year, and despite slight improvements, this months survey has brought us back to super bearish levels where managers are holding -28% underweight position (4th worst on record in surveys history).

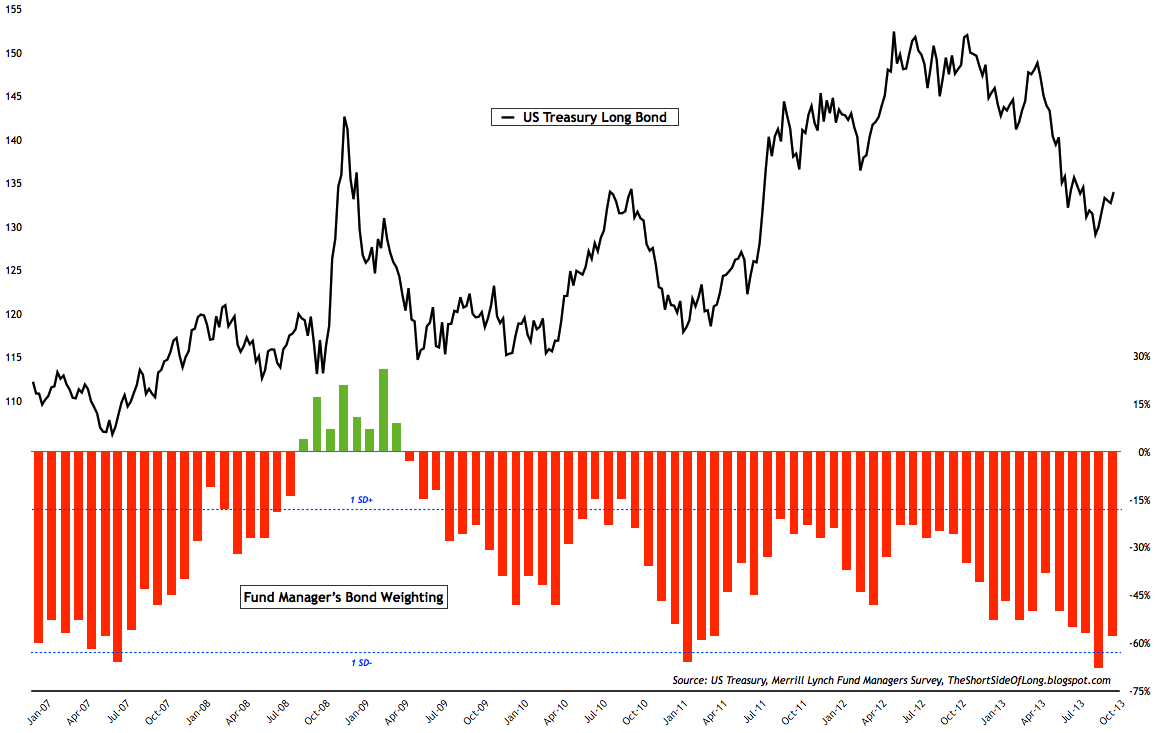

Chart 5: Fund manager exposure to bonds improved only slightly

Source: Short Side of Long

Bonds are also very much disliked, and find themselves in a similar position to emerging markets and commodities. The current level of under weight exposure stands at -58%, which is only a slight improvement from last months super bearish levels of -68% under weight (2nd worst on record in surveys history).

Chart 6: Cash levels remain neutral despite stocks rising rather sharply

Source: Short Side of Long

Cash levels remain at 4.4% and have lingered around similar levels for months now. Usually a drop below 3.5% is a warning signal of a potential sell off while a rise above 5% is an indication of a potential buying opportunity. The question is... why are cash levels elevated when equities have been rising rather sharply?

When we look at the overall exposure to various asset classes, we can conclude that fund managers around the world really favour Developed Market stocks and dislike emerging markets, commodities and bonds. Therefore, one way we can explain above average cash levels is due to the fact that just about every asset class apart from DM stocks is currently under performing. While managers are making money in one area of their portfolio, other areas are declining and forcing them reduce exposure and rise cash.

Copyright © The Short Side of Long