The long and short of things: Performance trends continued to shift last month.

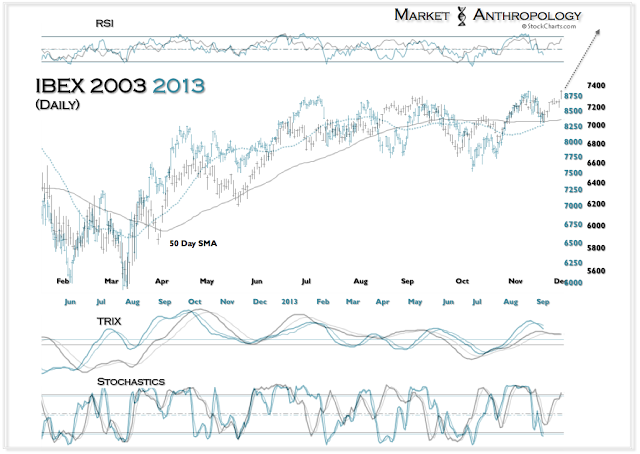

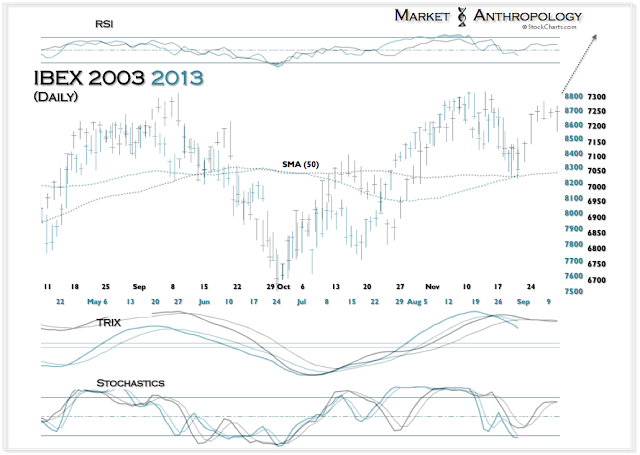

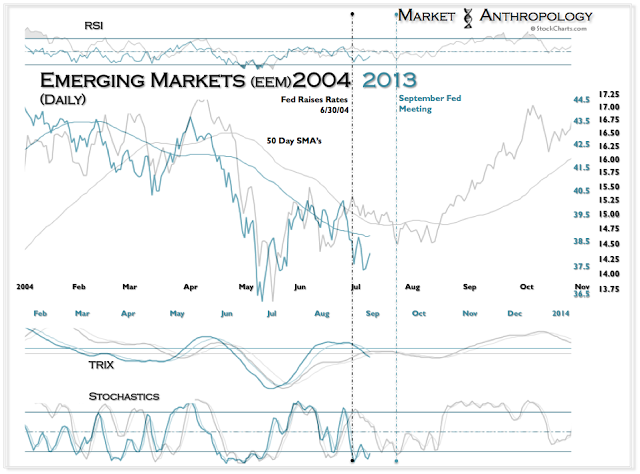

- The baton was passed in the equity markets in August with the S&P 500 stumbling (~ -3%), Europe outperforming (VGK ~ -1.5%) and China rallying (SSEC ~ +5%). Although we continue to see risk towards the upside, we expect equities ex-US to extend their outperformance in September.

Click to enlarge images

For recent context - see Here.

For recent context - see Here.

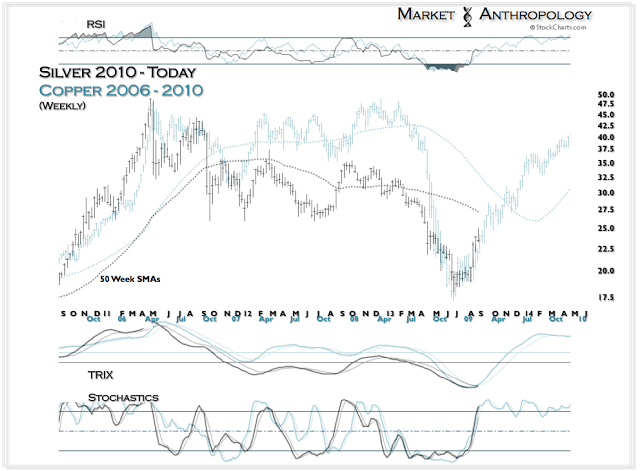

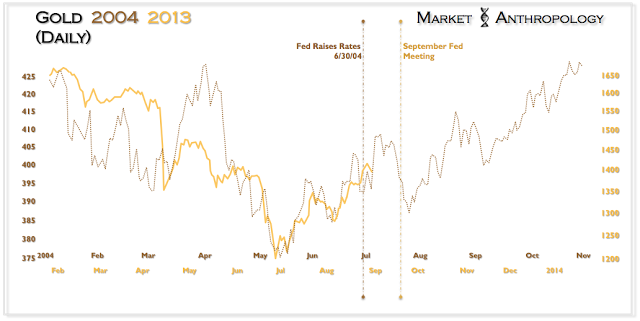

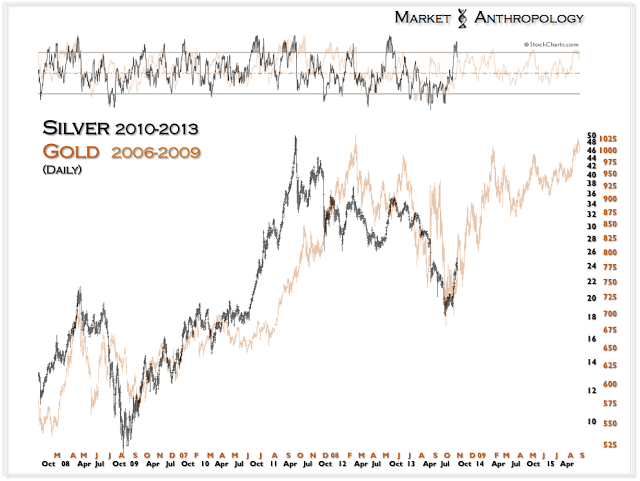

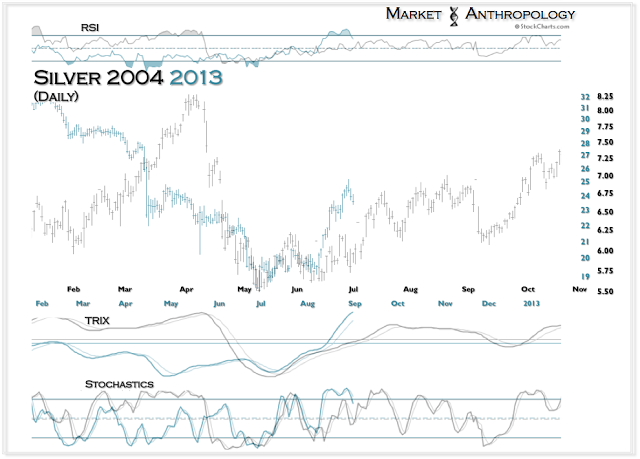

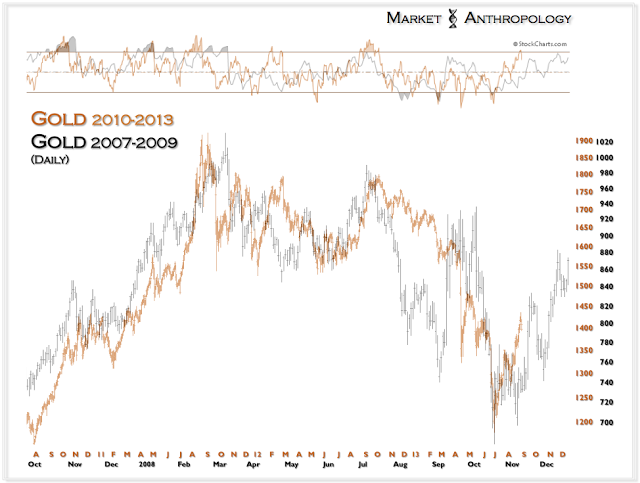

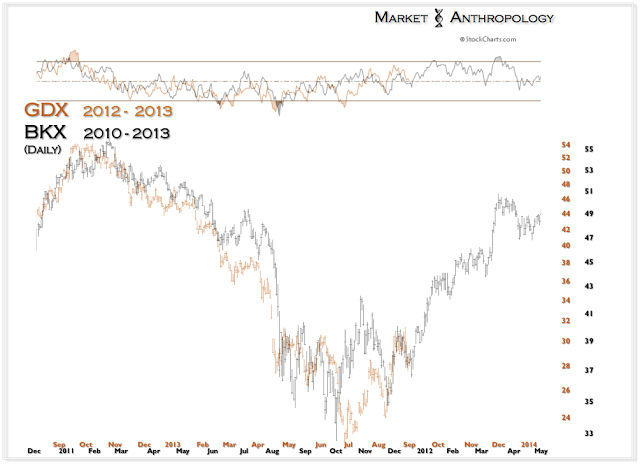

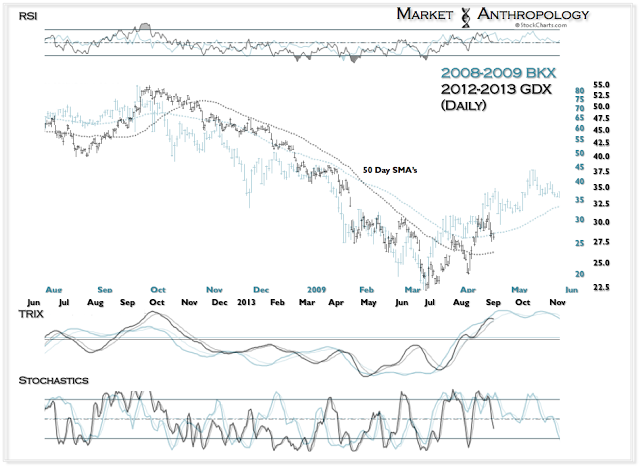

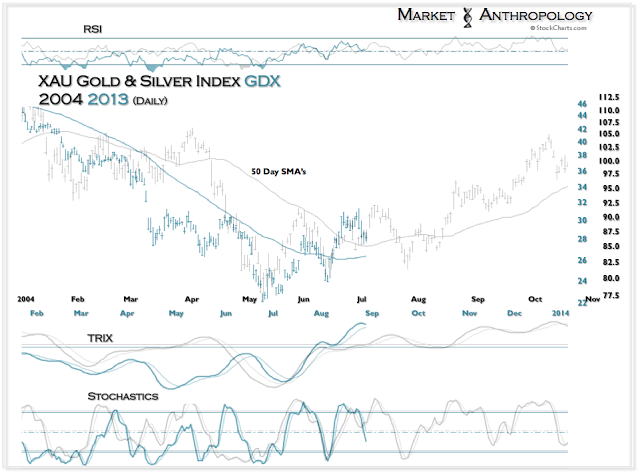

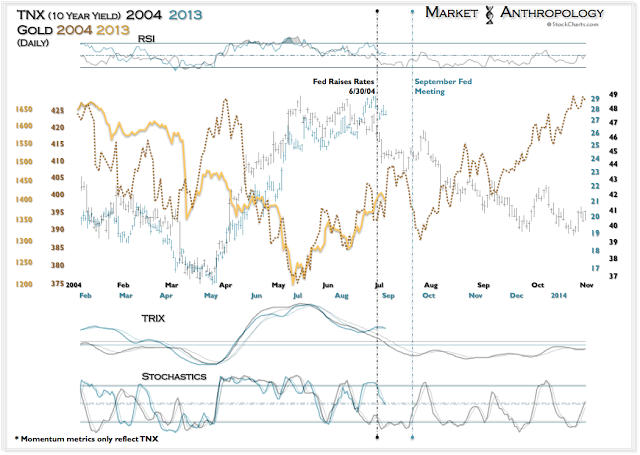

- Lighting a long fuse and strongly outperforming equities, hard commodities - led by silver, gold and their respective miners had a banner August. We continue to favor the precious metals sector.

For recent context - see Here.

For recent context - see Here.

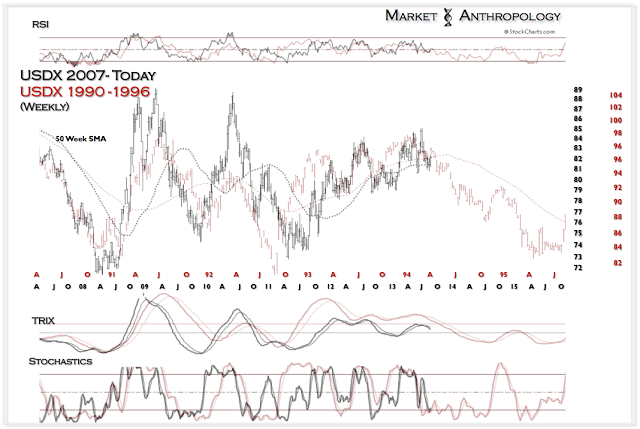

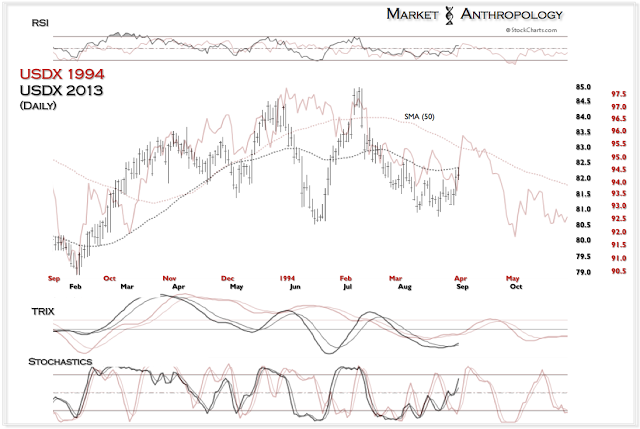

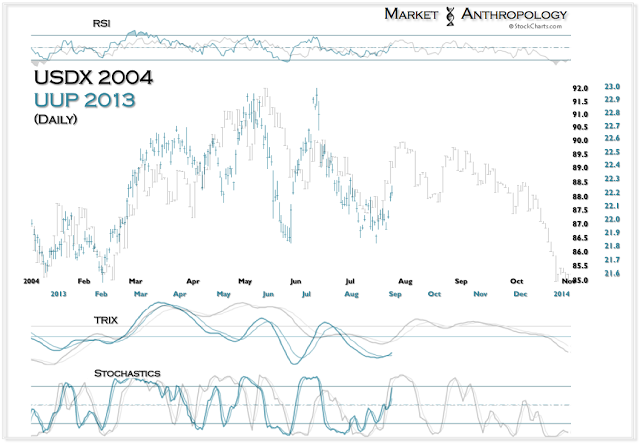

- While over the short-term the dollar likely has more room to run, we see the USDX rolling over into 2014 along the lines of 1994 and 2004.

For recent context - see Here.

For recent context - see Here.

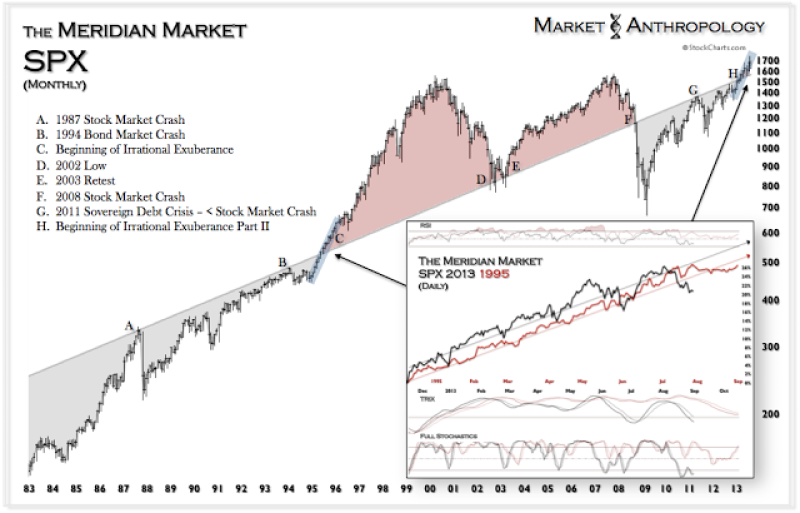

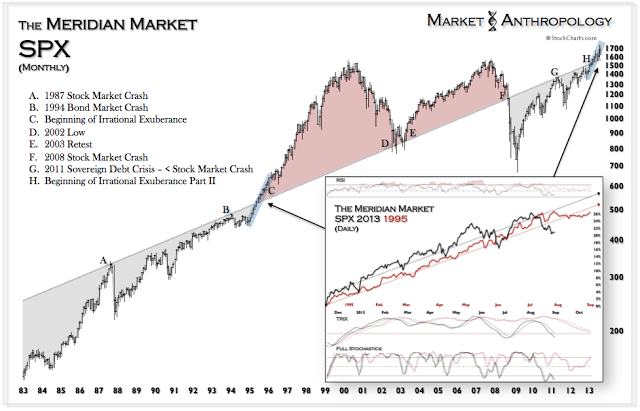

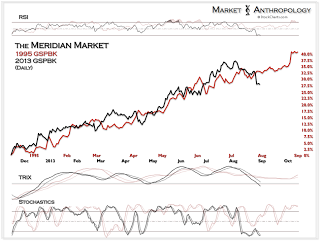

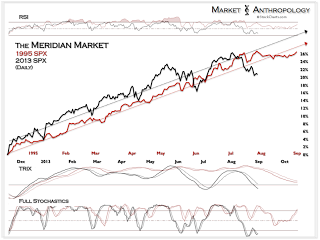

- Until the SPX breaks below the Meridian on a monthly basis (for September it's ~ 1570) - we expect momentum to remain with the bulls.

For recent context - see Here.

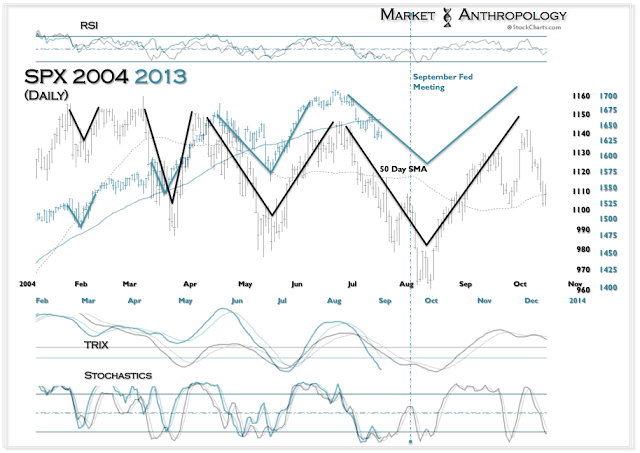

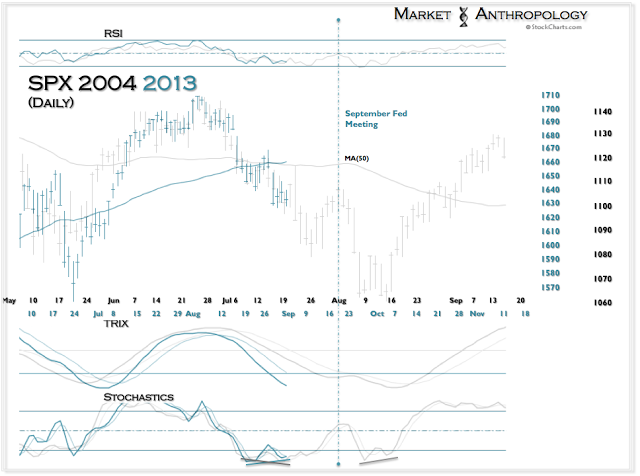

Although the year-to-date trend profile has run across the grain - the 2004 SPX momentum comparative, which illustrates four (4) successively longer and deeper corrections, has been useful for short-term positioning and contrasts as the Fed transitions the market to less accommodative monetary policies.

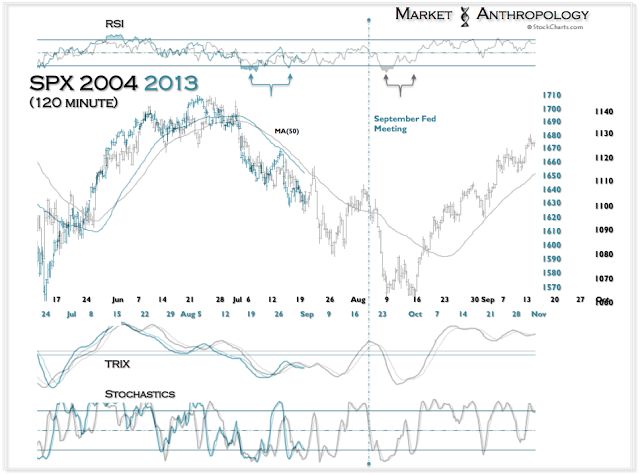

We loosened the scale on the 120 minute comparative to align with the daily chart above. Should the equity markets continue to follow this structure - the bid in futures Monday will be sold hard in the back half of this week.

Those concerns are somewhat mitigated by the positive momentum and strength divergences (annotated on both charts) which depict a more resilient structure, such as the August 2004 low.

For further context - see Here.

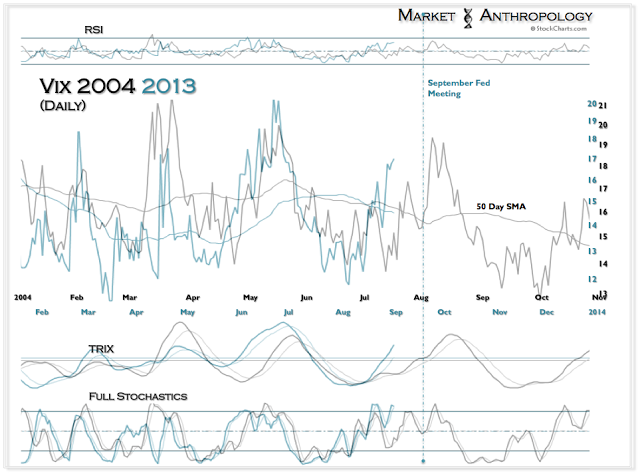

From the bulls perspective, the VIX also appears more representative of exhaustion - than continuation.

For recent context - see Here.

Copyright © Market Anthropology