by David Templeton, Horan Capital Advisors

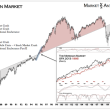

As noted in the below chart of the S&P 500 Index, the market technicals for the S&P are less stretched this year versus the same time last year. Last year the S&P 500 moved higher by 2.0% in August and an additional 2.4% in September all prior to the election, the fiscal cliff and sequestration. Fast forward to August this year and we have seen the market pullback 4.5% in August. At the same time some technical market measures that indicated an overbought setup last year now indicate an oversold position for the market as we begin trading in September.

In the below chart, the Relative Strength Index and the Money Flow Index, a couple of technical indicators, are at levels indicative of a situation where selling pressure could subside as we move into the last four trading months of the year. Certainly external shocks can upset the market, Syria is top of mind in addition to a few other market moving news events, however, the market is in a different technical place this year than at the same time last year. The last word of caution is respect the trend.

Copyright © Horan Capital Advisors