by Scott Krisiloff, Avondale Asset Management

$TSLA is the short squeeze du jour, but its recent run brings to mind four other short squeezes of this bull market: $NFLX, $GMCR, $CMG and $MNST. Just like Tesla, all four of those stocks saw huge increases powered by intense interest from both retail investors and scrambling short sellers despite extreme valuations. Each stock eventually hit a wall too and saw a decline of 40% plus (and each has seen a subsequent recovery).

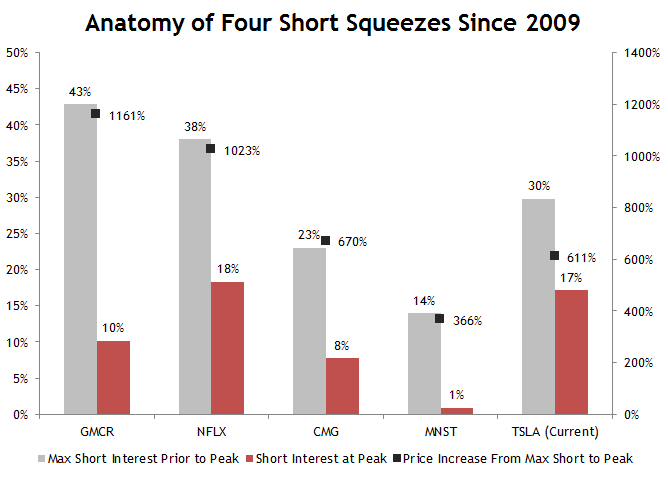

Below is some data on how short interest fell over the course of these stocks’ bull runs. On average, the four squeezes that were cracked saw short interest fall by 20 percentage points (as a percent of shares outstanding) before the short squeeze lost its oomph. The average gain was an astounding 805% from peak short interest to peak price. By comparison, Tesla has seen a 13 percentage point decrease in short interest and a 611% increase in share price since short interest peaked.

Tesla’s short squeeze appears to be reaching towards the limits of these past short squeezes, but it hasn’t eclipsed them yet. If the short squeeze continues, gains could continue to be eye popping. Consistent with intuition, there does appear to be some correlation between short interest contraction and price increase–GMCR saw the largest contraction in short interest and also the largest increase in price, while the opposite was true for MNST.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.