by William Smead, Smead Capital Management

On a recent trip to Europe we participated in a forum in Milan of five stock picking organizations. Two were from Brazil, one was from Malaysia and one was picking stocks inside China via the Shanghai Stock Exchange. We believe what they said was an enticement to investors for the purpose of getting them excited about stocks in their country. To us, this reveals a great deal about where prices in emerging stock markets and commodities are headed over the next five to seven years.

We were allowed ten minutes to make an introductory presentation to a group of 80 to 100 institutional investors and institutional sales professionals. Our firm was fifth out of the five to present. Each of the other four explained all the wonderful business-friendly things that the governments of Brazil, Malaysia and China were going to do to make robust economic growth. They then extrapolated how this robust growth would equate to attractive returns from owning common stocks in the three countries going forward.

Here is what we think we know about economic growth and common stock investing based on anticipating the effects of government policies: when Democrats are in power, Republicans tend to believe that the government is ruining the economy; and when the Republicans are in power, the Democrats usually believe that the Republicans are ruining our economy. So, over a twenty-year time frame, this means that almost everyone in the US spends a great deal of time thinking that government is ruining the US economy. In case you are wondering, we as a firm remain politically agnostic and believe that the Federal government is somewhere between a negative factor to a neutral one as it pertains to economic growth.

Why would we bring this up? First, we think an amazingly large part of asset allocation in portfolios in the US, both institutionally and for high net worth individuals, seems dependent on the ongoing success of the Chinese economy. They seem to have had uninterrupted growth for over 30 years and their “red capitalism,” with a high degree of central control appears to have outperformed “free-market” developed countries like the US.

Second, an enormous amount of capital is tied up in multiple asset classes under the same thesis. Since 2002, it seems like American investors have been interested in taking advantage of the growth in China through countries like Australia, Canada, Brazil, Malaysia, Indonesia and Russia. These countries had become rock stars in the investment world due to the glow they received from feeding China’s boom. In our view, the reason these emerging/commodity producing nations became so popular was that China has perpetuated their growth by massively over-building their infrastructure. We think the debt associated with the $2.5 trillion of infrastructure spending from 2008-2011, which the China government executed via its four largest government-owned banks, kept the demand up for commodities for three years longer than un-manipulated fundamentals would have indicated.

Third, we think the list of asset classes infected by this secular trend is long, including emerging stock markets, emerging bond markets, commodities in general, oil, gold, currencies of emerging market and commodity-producing nations and companies in developed nations which cater to China. As we wrote in a previous missive, the “well known fact” of uninterrupted growth in China still controls more capital in the US than the S&P 500 index does. Remember, one year ago the gold ETF (GLD) had more money in it than the S&P 500 index ETF (SPY).

Last—and Milton Friedman is rolling over in his grave—why do Americans of both parties have very little confidence in their central government and Federal Reserve Board of Governors and enormous financial confidence in a bunch of inexperienced and older Chinese gentlemen who were educated at major US colleges? We think it is the “out of sight, out of mind” factor. We aren’t the ones who live in China where freedom is limited and we aren’t on the ground working in their factories. We don’t get detailed 24/7 news on their banks and don’t get transparency in China on any minimum level. It is why we like to send our kids to college in another town. Whatever stupid things they do, we won’t see or hear about them.

About once a month, we get snippets of the reality on the ground in China. This last week, David Barboza, from the New York Times, wrote a piece about the immense graft in China called, “Coin of Realm in China Graft: Phony Receipts”. Here is a part of his story:

To begin to comprehend China’s vast underground economy, one need only visit this city’s major transportation depots and watch as peddlers openly hawk fake receipts…

…Buyers use them to evade taxes and defraud employers. And in a country rife with corruption, they are the grease for schemes to bribe officials and business partners. Making them and using them is illegal in China. Some people have been executed for the crime. But demand is so strong that a surprising amount of deal-making takes place out in public.

Barboza went on, describing the toll which corruption takes on a centrally-controlled society:

Detecting fake or doctored receipts is a challenge for tax collectors, small businesses and China’s state-run enterprises. While there are no reliable estimates of how much money is involved in the trade, as China’s economy has mushroomed and grown more sophisticated, so has the ability to falsify receipts.

These snippets come at the expense of a great deal of personal risk to the writer and from the international embarrassment which comes by hiding information from the New York Times or Wall Street Journal. As we have said many times, “An economy is like an oven. If you don’t clean it regularly, your baking starts to taste like garlic and onions!” In our opinion, if regular recessions and occasional depressions don’t occur in a long-term stretch of very high economic growth in a country, the economy becomes loaded with bad investments, bad loans, huge fraud and immense graft. We think the Chinese economy smells like garlic and onions.

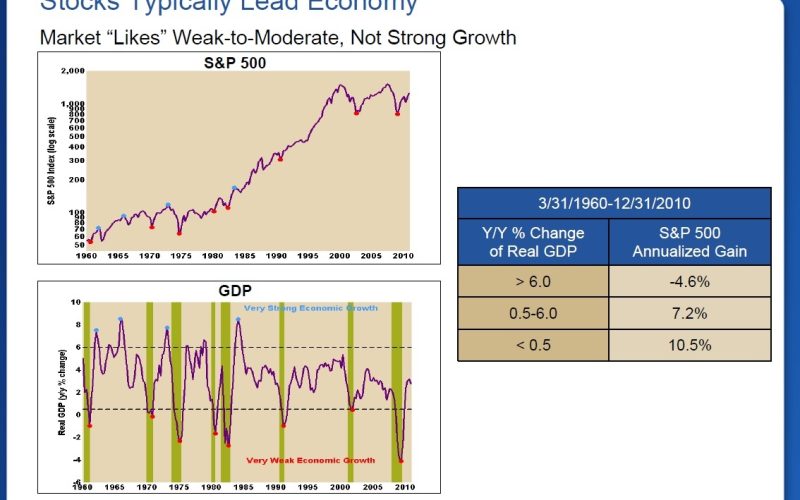

This is all called a “boom/bust cycle” for a reason. Our experience has taught us to that booms like this end in busts. Many times in the past, phases like this go on for a number of years longer than one would expect. Don’t let these circumstances fool you. The confidence these portfolio managers have in their government’s ability to promote economic growth seems genuine and many believe that there is a connection between high rates of economic growth and stock market returns. Thanks to Liz Ann Sonders and her research team at Charles Schwab, here is the history of stock market returns and economic growth:

High growth rates run consistently with poor equity returns and periods of slow to middling economic growth and very slow to negative growth lead to much higher returns. Therefore, we conclude that our cohorts are erroneous in their hope that governments in Brazil, Malaysia and China can keep the boom alive. Friedman and Smead Capital Management would argue that they are erroneous for thinking that governments cause economic growth in the first place.

Best Wishes

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management