Emerging Markets Radar (May 21, 2013)

Strengths

- Dividends paid by Latin American equities have been crucial in cushioning the 14.9 percent fall in the MSCI Latin America index over the past five years. Earnings weakness, multiple contraction, and foreign exchange losses have weighed heavily on the region’s equities. However, the reliability of dividend payments by local companies has returned a cumulative 18.3 percent since 2007, effectively easing the region’s recent weakness.

- Moody’s upgraded Turkey’s credit rating from Baa3 to Ba1 with a stable outlook. The move brings about the long awaited second investment grade rating, following Fitch’s upgrade in November 2012. The agency highlighted the recent and expected improvements in finance metrics, as well as noticeable progress on structural and institutional reforms. In addition, Turkey’s central bank cut rates by 50 basis points, exceeding analyst expectations as it seeks to contain currency appreciation. The lira has been strengthening as capital inflows seeking to benefit from the country’s promising economic growth remain strong.

- Indian inflation declined to a 41-month low in April. The wholesale-price index rose by 4.98 percent year-over-year, compared to initial analyst estimates for a 5.45 percent increase. The measure gives the central bank room to extend its monetary easing program and support growth in Asia’s third largest economy. The news was welcome by foreign investors who were net buyers of Indian equities.

- China April power consumption was up 6.8 percent versus 1.9 percent in March, indicating better economic activities and contributing to a stable Li Keqiang Index. April power generation was up 6.2 percent versus 2.1 percent in March.

- April data were roughly in line with market expectations, and showed only modest improvement from March. Industrial production improved rising 9.3 percent from 8.9 percent in March. April retail sales growth recovered modestly to 12.8 percent from 12.6 percent in March.

- April property investment in China was up 23.1 percent, which helped fixed asset investments increase by 20.6 percent.

- China smartphone volume grew 39 percent in the first quarter this year, showing strong domestic demand.

- Korea’s jobless rate declined further to 3.1 percent in April from 3.2 percent in March.

- Vice Premier Zhang Gaoli says China won’t approve new steel, cement, aluminum smelters, ship-building projects.

Weaknesses

- Not only has the Peruvian stock market been held hostage to falling metals prices, due to its heavy weighting in mining stocks, the country’s economy has also suffered a blow to its exports that resulted in significantly slower than expected economic growth. In March, economic activity grew at a pace of 3 percent, a far cry from the 4.5 percent median forecast. In addition, the country’s stock market has lost nearly a fourth of its value year to date, significantly underperforming its emerging market peers. However, the domestic fundamentals remain strong and the central bank has room to cut rates if the export slowdown becomes broad based.

- Despite some analyst optimism with respect to the situation in the eurozone, new GDP growth estimates from Brussels continue to paint a gloomy picture for 2014. The chart below shows that, although all shown countries are expected to have positive GDP growth in 2014, the vast majority will grow at rates below 2 percent. Similarly, the eurozone is expected to grow only a meager 1.2 percent. However, it is worth noticing that the countries leading the return to growth and restarting the European Union are located in Eastern Europe.

- China April fixed asset investment growth was 20.6 percent versus market expectation 20.9 percent, with infrastructure and manufacturing investments slowing to 22.7 and 17.9 percent, respectively.

- Investment banks are revising down China GDP forecast for 2013 after April economic data release. Bank of America Merrill Lynch downgraded China 2013 GDP to 7.6 percent from 8 percent previously, while JP Morgan cut to 7.6 percent from 7.8 percent.

- China April FDI was up 0.4 percent for April versus consensus 6.2 percent.

- Malaysia first quarter GDP slowed to 4.1 percent, below consensus 5.5 percent. Exports were weak declining 0.6 percent, while domestic consumption was strong rising 8.2 percent.

- China Premier Li Keqiang indicated policy makers are reluctant to stimulate growth.

- The Beijing Daily reported that only 28.2 percent of the 229,000 college graduates in the Beijing area had secured a job this year. When meeting with college graduates and unemployed people in Tianjin this week, President Xi Jinping stressed the need for growth.

- Singapore retail sales declined 7.4 percent in April after declining 3 percent in March, worse than market expectation of -2.5 percent.

Opportunities

- Following this week’s widely publicized $11 billion debt offering by Petrobras, the largest ever for an emerging markets’ issuer, the Brazilian Development Bank, known as BNDES, announced it is ready to seek a bond sale to boost its lending program. For reference, BNDES lent or invested $77 billion last year; that is twice as much as the World Bank. The bank plays a vital role in stimulating economic expansion in the country through investments in companies of all sizes, which are focused on innovation, and sustainable development. The additional funds could be help Brazil break out of the slowing growth cycle of the last few years and keep pace with its Latin American and BRIC peers.

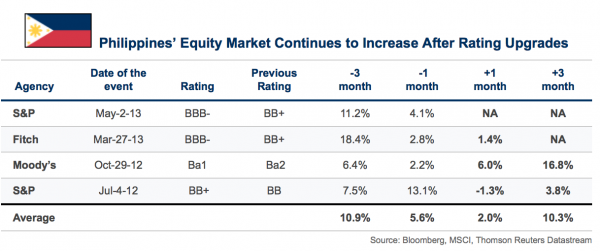

- The recent credit rating upgrade and central bank rate cuts in Turkey may have some investors thinking the milestones have been reached and it may be a good to time to sell Turkish equities. This is certainly not the case in our opinion. Turkey stands among the strongest countries to benefit from current global easing; internally, inflation is well under control, and domestic consumption is unabated. Furthermore, the country’s stock market continues to trade on a cheaper price to earnings valuation when compared to countries like Mexico, Malaysia, and Thailand. Lastly, HSBC published a Flashnote showing how credit rating upgrades do not limit future performance. To illustrate, the chart shows the performance of the Philippines’ equity market following recent credit upgrades; as is evident, the Philippines equity market returned 10.3 percent on average in the three months after its upgrade. Hence, there is ample reason to believe the Turkish equity market should continue to outperform.

- As shown in the graph below, an increasing number of mobile users also adopt mobile internet. This offers smartphone business opportunities for online shopping, online games, online search, online advertisements, and many other internet applications. The recent merger and acquisition activities and alliance in internet space indicates vast mobile internet opportunities and profits.

Threats

- Some delays and uncertainty are looming in the Mexican construction sector as firms await President Pena Nieto’s announcement of the infrastructure plans contained in the so-called National Development Plan. As with any new president, investors expect multiple ambitious projects to be announced, especially following the numerous campaign promises made by Pena Nieto. However, fear of a break up of the coalition in congress, which pushed back some of the important announcements, in addition to the apparent shift in housing policies to be pursued by the President, are destabilizing the already fragile homebuilders.

- Russia’s inability to cut benchmark interest rates as it tries to contain inflation led President Putin to announce last month that banks would have to bear the burden of rate cuts. As expected, Sberbank, Russia’s largest bank, announced reductions on the rates it charges on corporate loans by 0.4 to 1.4 percent, effective May 15. Analysts expect the bank to mitigate the squeeze in net interest margins by altering its asset mix.

- Indonesia current account deficits continued in the first quarter, though improved from prior quarter and better than the market consensus. Stubborn current account deficits may force the central bank to tighten demand to stabilize the currency rupiah. Otherwise, the Bank of Indonesia will continue to deploy foreign currency reserve to buy rupiah.